The COVID pandemic negatively affected the oil and gas industry, impacting North America's lubricants market. However, post-COVID, the rising demand from the oil and gas industry is expected to revive the market for oil & gas lubricants in the region.

Key Highlights

- The growing interest in unconventional reserves has been driving North America's oil and gas lubricants market.

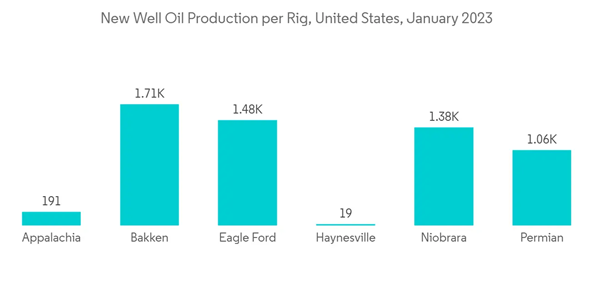

- Technological advancement leading to higher well production rates is expected to drive market demand during the forecast period.

- Volatile prices of crude oil are likely to hinder the market’s growth.

- Increasing offshore deepwater exploration is projected to act as an opportunity for the market in the future.

North America Oil & Gas Lubricants Market Trends

Offshore Exploration is Expected to Experience the Highest Growth

- Most of the North American land-based and shallow-water oil fields have reached their maturity, and there is little scope for new field discovery in these areas. However, prospects are bright for offshore deepwater oil field exploration and production.

- To meet the global demand for oil in the future, opportunities lie in the offshore deep seabed, where oil and gas operators continue to discover new reserves.

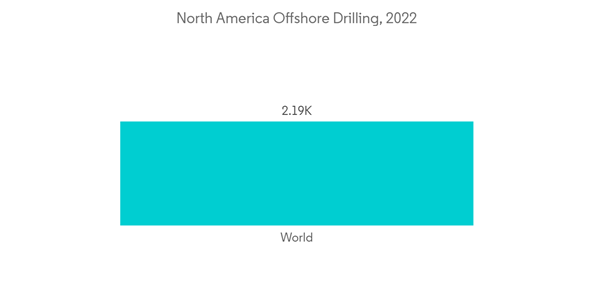

- According to World Oil's survey of international petroleum ministries and departments, offshore drilling in North America increased by 14% in 2022.

- The requirement for maintaining and boosting recovery rates from these subsea wells has increased and is expected to grow further, resulting in increased demand for lubricants.

- Governmental rules and regulation policies related to the usage of different types of lubricant technologies for subsea operations are getting more stringent day by day, which raises the need for better technological innovations in the lubricant business to increase the efficiency of production systems, and opens the doors for regional players to increase their market share.

- According to the Canadian Association of Petroleum Producers (CAPP), offshore investment in Newfoundland and Labrador was over USD 1.6 billion in 2022, up from USD 1.5 billion in 2021. Globally, the offshore sector is attracting significant new investment, with spending increase by 7% to approximately USD 195 billion in 2022. In comparison, the Gulf of Mexico is expected to increase investment by 21% this year to USD 13.1 billion. Offshore development in Canada provides some of the world's lowest emission oil. The natural gas and oil industries, as well as the provincial government, are attempting to collaborate with the federal government to improve the region's global competitiveness in order to help realize the value in Canada's offshore sector.

- With the increase of oil prices to a sustainable level, several offshore exploration and production projects are expected to be commissioned in the North American offshore waters, which in turn, present an excellent growth opportunity for companies involved in the lubricants business during the forecast period.

The United States is Expected to Aid Demand for Oil and Gas Lubricants

- In the United States, the exploration and production activities for unconventional resources, such as shale oil/gas and tight gas, are expected to remain high during the forecast period.

- As market conditions are improving significantly amid rising oil prices, coupled with the support of a new and favorable administration with pro-energy policies that understand the strategic importance of a healthy oil and gas industry, exploration and production activities are expected to increase further in the United States.

- The shale revolution in the North American region has led to unparalleled oil and gas production growth. Technological advancements in drilling and fracking technologies have unlocked vast reserves of gas and oil trapped in shale rock and redrawn the region's energy landscape.

- The International Energy Agency (IEA) expects a further increase in oil and gas production, with the United States emerging as a net oil exporter by 2027, the first time since 1953.

- According to CEDIGAZ data, the United States became the world's largest LNG exporter in the first half of 2022. According to EIA estimates, installed US LNG export capacity has increased by 1.9 Bcf/d nominal (2.1 Bcf/d peak) since November 2021.

- At every stage, from oil exploration and production to its transportation, storage, and processing, the industry faces critical issues and operates at extreme temperatures. Moreover, the equipment and machines used in the oil and gas industry are expensive, which creates the need for regular maintenance and lubricants, to ensure long life. This is expected to increase the demand for lubricants in the US oil and gas industry during the forecast period.

North America Oil & Gas Lubricants Market Competitor Analysis

The North American Oil and Gas Lubricants Market is fragmented in nature, with a large number of players operating in the market. A few key players (not in a particular order) include Exxon Mobil Corporation, Schlumberger Limited, LUKOIL, Lubrication Engineers Inc., and Chevron Corporation, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Interest towards Unconventional Reserves

4.1.2 Technological Advancement Leading to Higher Well Production Rates

4.2 Restraints

4.2.1 Volatile Prices of Crude Oil

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 Location

5.1.1 Onshore

5.1.2 Offshore

5.2 Product Type

5.2.1 Grease

5.2.2 Coolant/Anti-freezer

5.2.3 Engine Oils

5.2.4 Hydraulic Fluids

5.2.5 Other Product Types

5.3 Sector

5.3.1 Upstream

5.3.2 Midstream

5.3.3 Downstream

5.4 Geography

5.4.1 United States

5.4.2 Canada

5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/ Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 BP PLC

6.4.2 Chevron Corporation

6.4.3 Eni S.p.A

6.4.4 Exxon Mobil Corporation

6.4.5 Lubrication Engineers Inc.

6.4.6 LUKOIL

6.4.7 Petro-Canada Lubricants Inc.

6.4.8 Shell PLC

6.4.9 Schlumberger Limited

6.4.10 SKF

6.4.11 TotalEnergies SE

6.4.12 Valvoline Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Increasing Offshore Exploration

7.2 Favorable Government Policies

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BP PLC

- Chevron Corporation

- Eni S.p.A

- Exxon Mobil Corporation

- Lubrication Engineers Inc.

- LUKOIL

- Petro-Canada Lubricants Inc.

- Shell PLC

- Schlumberger Limited

- SKF

- TotalEnergies SE

- Valvoline Inc.