The market is estimated to reach a value of more than USD 850 million by 2027.

The COVID-19 pandemic positively impacted the Middle East and Africa Dipeptide Peptidase 4 (DPP-4) Inhibitors Market. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people.

Dipeptidyl peptidase 4 (DPP-4) inhibitors are a class of medicine that lower high blood glucose levels and are used in the treatment of type 2 diabetes. DPP4 inhibitors increase insulin and GLP-1 secretion and are commonly prescribed for people suffering from type 2 diabetes. The use of DPP4 inhibitors in patients with COVID-19 with or even without type 2 diabetes offers a simple way to reduce the virus entry and replication into the airways and to hamper the sustained cytokine storm and inflammation within the lung in patients diagnosed with COVID-19 infection.

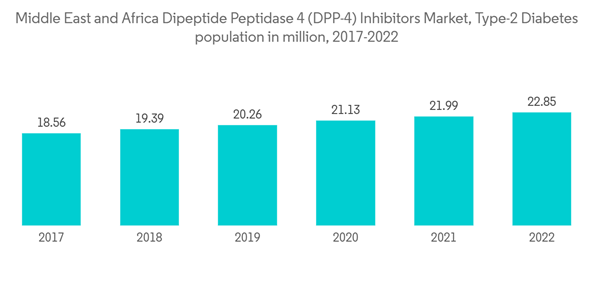

The diabetic prevalence is high in countries in the Middle East and African region. The gradually growing obesity rate, combined with the genetic predisposition for Type-2 diabetes, acted as a prominent driver for the increase in the Type-2 diabetic population over the last 40 years. Currently, nearly 10% of the population is living with diabetes. Diabetic patients in the Middle East and African region mainly suffer from Type-2 diabetes, accounting for nearly 90% of the total diabetic population in 2021.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Middle East and Africa Dipeptide Peptidase 4 (DPP-4) Inhibitors Market Trends

The Tradjenta segment is expected to witness the highest CAGR in the Middle East and Africa Dipeptide Peptidase 4 (DDP-4) Inhibitors Market over the forecast period

The Tradjenta segment is expected to register the highest CAGR of about 7.6% in the Middle East and Africa dipeptide peptidase 4 (DDP-4) inhibitors market over the forecast period.Tradjenta is a prescription drug that helps improve blood glucose control in adults with type-2 diabetes and is considered an adjunct treatment to diet and exercise. It is also used as an add-on therapy to insulin. Tradjenta should not be used in patients with type-1 diabetes or for the treatment of diabetic ketoacidosis. The persistence of oral antidiabetic treatment for type-2 diabetes is characterized by drug class, patient characteristics, and severity of renal impairment. Unlike older classes of glucose-lowering drugs such as sulfonylureas and insulin, DPP-4 inhibitors have an inherently low risk of causing hypoglycemia due to their glucose-dependent insulinotropic mechanism of action mediated via the incretin hormone glucagon-like peptide-1.

73 million adults were living with diabetes in the IDF MENA Region in 2021. This figure is estimated to increase to 95 million by 2030. 48 million adults in the IDF MENA Region live with impaired glucose tolerance, which places them at increased risk of developing type-2 diabetes. Governments in the ME have identified the threat of diabetes and started to respond with various policies, initiatives, and programs. Six out of 15 countries in this region still do not have a national operational action policy for diabetes. Many countries still do not have a national strategy to reduce overweight, obesity, and physical inactivity, which are important risk factors for diabetes. Most counties have fully implemented national diabetes treatment guidelines. However, constant measures are being taken to minimize diabetic complications.

Owing to the rising rate of obesity, the growing genetic factors for type-2 diabetes, the increasing prevalence, and the aforementioned factors, the market is likely to grow.

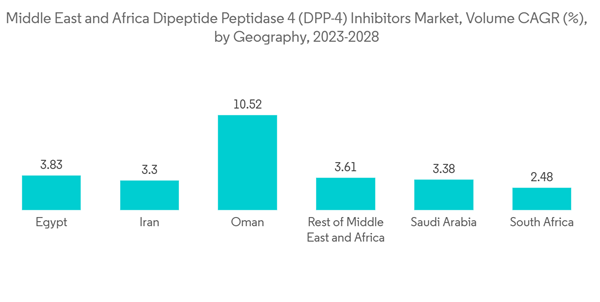

Saudi Arabia holds the highest market share in the Middle East and African Dipeptide Peptidase 4 (DPP-4) Inhibitors Market in the current year

Saudi Arabia holds the highest market share in the Middle East and Africa dipeptide peptidase 4 (DPP-4) inhibitors market in the current year and is expected to register a CAGR of around 3.1% over the forecast period.More than one in ten people in Saudi Arabia were living with diabetes, and the prevalence of the disease was expected to almost double by 2045, according to the IDF 2021 report. The IDF report also mentioned that 4.27 million people in Saudi Arabia, which has a population of about 34.8 million, have diabetes, while 1.86 million people have the disease but are yet to be diagnosed.

The growing incidence, prevalence, and progressive nature of the disease have encouraged the development of new drugs to provide additional treatment options for diabetic patients. Non-insulin treatments, used as first-line therapies for patients suffering from type 2 diabetes, currently capture more than half the sales in the anti-diabetic market. Over the past decade, two important classes have entered this market: dipeptidyl peptidase-4 inhibitors (DPP-4) and sodium-glucose cotransporter-2 inhibitors (SGLT-2). Oral antidiabetic agents work in various ways to reduce blood sugar levels in people with type-2 diabetes; some stimulate insulin secretion by the pancreas, and others improve the responsiveness of cells to insulin or prevent glucose production by the liver. Others slow the absorption of glucose after meals.

In July 2022, the Saudi Government announced that Saudi Arabia saw growing demand for quality healthcare services, spurred by changes including an increasing and aging population and a growing prevalence of lifestyle diseases such as diabetes and obesity. The government and private sector are both involved in working on healthcare entities, certifications, and regulations. The government is taking steps to have 100 percent of Saudi citizens covered by insurance and is working towards ensuring affordability, access, and quality digital healthcare and primary care with cost-effectiveness.

Owing to the aforementioned factors, the market is expected to grow during the forecast period.

Middle East and Africa Dipeptide Peptidase 4 (DPP-4) Inhibitors Industry Overview

The Middle East and Africa dipeptide peptidase 4 (DPP-4) inhibitors market is consolidated, with a few major manufacturers like Eli Lilly, AstraZeneca, Merck, Boehringer Ingelheim, Novartis, etc., while the remaining market comprises other local or region-specific manufacturers.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Merck and Co.

- AstraZeneca

- Bristol Myers Squibb

- Novartis

- Takeda Pharmaceuticals

- Eli Lilly

- Boehringer Ingelheim