Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Industry 4.0 Adoption and Smart Manufacturing

The rapid adoption of Industry 4.0 practices and the widespread integration of smart manufacturing technologies are significant drivers propelling the Global Digital Twin Market. Industry 4.0 represents the fourth industrial revolution, characterized by the fusion of digital technologies with traditional manufacturing processes. Digital Twins, as virtual replicas of physical assets, play a pivotal role in this paradigm shift by enabling real-time monitoring, analysis, and optimization of industrial operations.As industries embrace automation, IoT (Internet of Things), and advanced analytics, the demand for Digital Twins grows exponentially. These digital replicas empower organizations to simulate and visualize their entire production processes, from design and prototyping to maintenance and performance monitoring. The ability to create a digital counterpart of a physical asset allows for comprehensive data-driven decision-making, predictive maintenance, and improved operational efficiency. As industries worldwide seek to enhance productivity and reduce downtime, the adoption of Digital Twins becomes a strategic imperative, driving the growth of the Global Digital Twin Market.

Rising Complexity in Product Design and Development

The increasing complexity of product design and development across various industries serves as another key driver for the Global Digital Twin Market. In sectors such as aerospace, automotive, healthcare, and architecture, products are becoming more intricate, incorporating advanced technologies and intricate systems. Traditional design and development processes struggle to cope with this complexity, leading to longer time-to-market and higher costs.Digital Twins address this challenge by providing a virtual platform for iterative design, testing, and refinement before physical prototypes are built. Engineers and designers can simulate different scenarios, assess the impact of changes, and optimize designs in the virtual realm, significantly reducing the time and resources required for product development. This ability to model and simulate complex systems accelerates innovation, enhances product quality, and ultimately drives the demand for Digital Twins across diverse industries.

Growing Focus on Sustainability and Environmental Impact

The Global Digital Twin Market is also fueled by the escalating emphasis on sustainability and the desire to minimize environmental impact. As companies strive to meet stringent environmental regulations and consumer expectations for eco-friendly practices, Digital Twins emerge as invaluable tools for sustainable business operations.Organizations can use Digital Twins to analyze and optimize resource utilization, energy consumption, and waste generation across their operations. By creating a virtual representation of their processes, companies can identify inefficiencies, implement eco-friendly practices, and reduce their carbon footprint. This sustainability-driven approach aligns with global initiatives for environmental conservation and resonates with consumers who prioritize green and socially responsible businesses. As the world moves towards a more sustainable future, the integration of Digital Twins into business operations becomes a key driver shaping the landscape of the Global Digital Twin Market.

Key Market Challenges

Interoperability and Standardization

One of the foremost challenges confronting the Global Digital Twin Market is the lack of interoperability and standardization across diverse industries. Digital Twins often involve the integration of complex systems, data sources, and technologies, and the absence of standardized protocols and interfaces hinders seamless communication and collaboration. As different industries adopt Digital Twins at varying paces and with distinct technology stacks, achieving interoperability becomes a significant hurdle.Without standardized frameworks, organizations face compatibility issues when integrating Digital Twins into their existing ecosystems. The diverse array of hardware, software, and communication protocols complicates data sharing and interoperability between different Digital Twin implementations. This challenge not only impedes the scalability of Digital Twin solutions but also limits their potential to deliver holistic insights across interconnected industries. Addressing this challenge requires concerted efforts from industry stakeholders to establish common standards, protocols, and data models that facilitate interoperability, ensuring a more cohesive and interconnected Digital Twin ecosystem.

Data Privacy and Security Concerns

Critical challenge facing the Global Digital Twin Market revolves around the protection of sensitive data and ensuring the security of digital replicas. Digital Twins inherently involve the collection, storage, and analysis of vast amounts of data, often including proprietary and confidential information about products, processes, and operations. The exposure of such data to unauthorized entities poses a significant risk to businesses, making data privacy and security paramount concerns.As the adoption of Digital Twins accelerates, the potential for cyber threats, data breaches, and intellectual property theft increases. Safeguarding digital replicas requires robust cybersecurity measures, encryption protocols, and secure data storage practices. Additionally, addressing the ethical implications of data ownership and usage is crucial. Striking a balance between data accessibility for collaboration and protecting sensitive information poses a challenge that necessitates continual advancements in cybersecurity technologies and the development of stringent regulations to govern data privacy within the Digital Twin ecosystem.

High Implementation Costs and Resource Intensity

The implementation of Digital Twins involves substantial upfront costs and resource investments, posing a significant challenge for organizations, particularly small and medium-sized enterprises (SMEs). Creating accurate digital replicas requires advanced technologies such as IoT sensors, high-performance computing, and sophisticated modeling software. These technologies come with significant associated costs, making it challenging for some businesses to justify the initial investment.The deployment of Digital Twins often necessitates a cultural shift within organizations, requiring personnel training and a reevaluation of traditional processes. The resource intensity extends beyond financial considerations to encompass time and human capital. The challenge lies in convincing businesses of the long-term benefits and return on investment (ROI) associated with Digital Twins, as well as providing accessible solutions and support to mitigate the initial barriers to entry. Addressing these challenges requires a comprehensive strategy that considers both the technological and organizational aspects of Digital Twin implementation.

Key Market Trends

Integration of artificial intelligence (AI) and machine learning (ML) technologies

A prominent trend shaping the Global Digital Twin Market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies. As organizations seek to extract more value from their Digital Twins, AI and ML are being harnessed to enhance predictive capabilities, optimize decision-making, and automate complex processes. The synergy between Digital Twins and AI/ML enables the development of intelligent systems that can learn and adapt based on real-time data.AI and ML bring predictive analytics to the forefront of Digital Twins, allowing businesses to anticipate potential issues, simulate various scenarios, and optimize performance. For example, in manufacturing, predictive maintenance powered by AI can analyze historical data and real-time sensor inputs to predict when equipment is likely to fail, enabling proactive maintenance to prevent costly downtime. In urban planning, AI-enhanced Digital Twins can simulate the impact of various infrastructure changes and optimize city layouts for efficiency and sustainability.

The integration of AI and ML into Digital Twins also facilitates continuous improvement. The systems can learn from ongoing operations, adapt to changing conditions, and optimize their models over time. This trend not only enhances the capabilities of Digital Twins but also paves the way for more autonomous and intelligent decision-making across industries, further driving the adoption of advanced digital replicas in the global market.

Emergence of Edge Computing for Real-Time Processing

An emerging trend in the Global Digital Twin Market is the widespread adoption of edge computing to enable real-time processing and analysis of data generated by Digital Twins. Traditional cloud computing models involve transmitting data from sensors to a centralized cloud server for processing and analysis. However, as the volume of data generated by IoT devices and Digital Twins increases, there is a growing need for faster and more efficient processing capabilities.Edge computing brings computational power closer to the data source, reducing latency and enabling real-time decision-making. In the context of Digital Twins, this trend is particularly relevant for applications that demand instantaneous responses, such as autonomous vehicles, smart cities, and critical infrastructure monitoring. By processing data at the edge, organizations can achieve lower latency, improved reliability, and reduced dependence on continuous high-bandwidth connectivity.

In manufacturing environments, edge computing allows for real-time analysis of sensor data from machinery, enabling instant adjustments to optimize production processes. In healthcare, edge computing enhances the capabilities of Digital Twins in patient monitoring and diagnostics, providing timely insights for healthcare professionals.

The adoption of edge computing in conjunction with Digital Twins not only addresses the challenges associated with data latency but also supports the scalability of these systems. As the trend continues to evolve, edge computing is likely to become an integral component of Digital Twin architectures, fostering a more responsive and agile digital ecosystem across various industries.

Segmental Insights

End-User Insights

The Automotive & Transportation segment held the largest share in 2023. The Automotive & Transportation segment is a pivotal component of the Global Digital Twin Market, demonstrating significant growth and innovation in recent years. Digital Twins in this sector have evolved beyond traditional product lifecycle management, encompassing applications ranging from design and manufacturing optimization to predictive maintenance and smart mobility solutions.The Automotive & Transportation sector has been quick to embrace Digital Twins as a means to address complex challenges associated with product development, manufacturing, and operational efficiency. The use of Digital Twins in the automotive industry extends from virtual prototyping and design validation to real-time monitoring of vehicles in operation. Transportation companies, including those in aviation and maritime sectors, are leveraging Digital Twins for predictive maintenance, fuel efficiency optimization, and route planning.

The rise of connected and autonomous vehicles is a transformative trend within the Automotive & Transportation segment. Digital Twins play a crucial role in the development and testing of CAVs, allowing manufacturers to simulate various driving scenarios, assess vehicle performance, and optimize autonomous systems. This trend is expected to accelerate as the automotive industry continues to invest in the development of self-driving vehicles.

Regional Insights

North America emerged as the dominating region in 2023, holding the largest market share. North America boasts a sophisticated technological infrastructure that facilitates the adoption and integration of Digital Twins across industries. The presence of high-speed internet connectivity, cloud computing resources, and a well-established network of data centers provides a solid foundation for the deployment of Digital Twins in diverse applications.The region is home to numerous innovation hubs, research centers, and technology clusters that actively contribute to the development and advancement of Digital Twin technologies. Collaboration between academic institutions, research organizations, and industry players fosters a culture of innovation, driving the continuous evolution of Digital Twins in North America.

The manufacturing sector in North America has embraced Digital Twins to enhance productivity, optimize supply chain management, and improve overall operational efficiency. The principles of Industry 4.0, including smart manufacturing and automation, are driving the adoption of Digital Twins in factories and production facilities.

Digital Twins are making significant inroads into the healthcare sector in North America. Virtual replicas of organs, patient data modeling, and drug discovery simulations are becoming commonplace, aiding medical professionals in diagnosis, treatment planning, and personalized medicine.

The aerospace and defense industries in North America leverage Digital Twins for designing, testing, and optimizing complex aircraft and defense systems. This application ensures enhanced safety, reduced development costs, and improved maintenance strategies.

Governments in North America recognize the strategic importance of digital technologies, including Digital Twins, in driving economic growth. Investments in digital infrastructure, broadband expansion, and support for research and development initiatives contribute to the region's leadership in the global Digital Twin Market.

Regulatory bodies in North America are actively working on establishing frameworks to address the ethical, legal, and security aspects of Digital Twins. Clear guidelines and standards are crucial to fostering responsible and secure adoption across industries.

North America is expected to remain a key driver of innovation and growth in the Global Digital Twin Market. The increasing collaboration between industry players, government support, and ongoing advancements in technology position the region at the forefront of shaping the future of Digital Twins across diverse sectors. As applications continue to expand, North America is likely to play a pivotal role in defining industry standards and best practices in the Digital Twin landscape.

Key Market Players

- ANSYS, Inc.

- Cal-Tek S.r.l

- Siemens AG

- General Electric Company

- IBM Corporation

- Lanner Group Limited

- Mevea Ltd.

- Microsoft Corporation

- Rescale Inc.

- SAP SE

Report Scope:

In this report, the Global Digital Twin Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Digital Twin Market, By Enterprise:

- Large Enterprises

- Small & Medium Enterprises

Digital Twin Market, By Application:

- Product Design & Development

- Predictive Maintenance

- Business Optimization

- Others

Digital Twin Market, By End-User:

- Automotive & Transportation

- Energy & Utilities

- Infrastructure

- Healthcare

- Others

Digital Twin Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Twin Market.Available Customizations:

Global Digital Twin Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ANSYS, Inc.

- Cal-Tek S.r.l

- Siemens AG

- General Electric Company

- IBM Corporation

- Lanner Group Limited

- Mevea Ltd.

- Microsoft Corporation

- Rescale Inc.

- SAP SE

Table Information

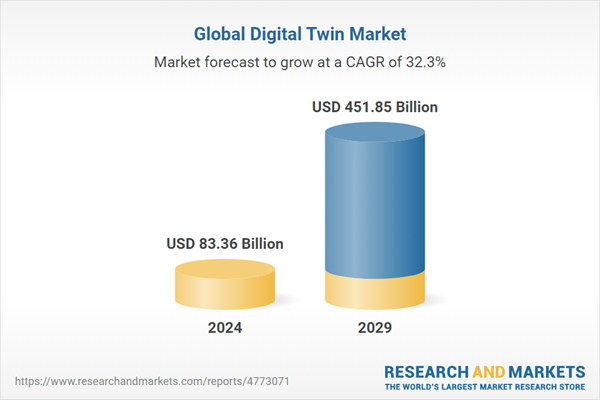

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | June 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 83.36 Billion |

| Forecasted Market Value ( USD | $ 451.85 Billion |

| Compound Annual Growth Rate | 32.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |