Key Highlights

- Consumers often prefer water enhancer products as they are convenient to use and carry. Additionally, they can turn normal drinking water into nutritious water by adding a small portion of the products. Consumers who avoid consuming processed and unhealthy beverages prefer these products to hydrate themselves with fortified water. They are fortified with nutrients and functional ingredients, and the consumption of water enhancers is increasing globally. Moreover, water enhancers replace functional beverages such as energy and sports drinks as they offer similar kinds of supplements to the consumer.

- With more consumers in the market focusing on health and fitness, preferring these products over energy drinks and sports drinks. Water enhancers infused with vitamins, minerals, and electrolytes that give an instant boost are preferred by consumers for their functional properties.

- People involved in sports and fitness tend to consume these products to boost their performance by hydrating with enhanced water. Moreover, water enhancers can be customized to consumers' preferences and tastes, positively influencing their overall sales.

- To cater to the demand, the players also offer flavored water enhancers to attract consumers in the market. In addition, leading players are introducing new and innovative flavors to broaden their existing consumer base.

- For instance, in August 2021, UpSpring LLC introduced the U.Siip range of water enhancers for pregnant and breastfeeding women. New U.Siip Water Enhancers combine four electrolytes into a refreshing drink mix to help with hydration. U.Siip comes in two plant-based flavors, Lemon Lime and Citrus Ginger. The company claims its products are vegan, dairy-free, gluten-free, and non-GMO, with no artificial colors, flavors, or sweeteners.

Water Enhancer Market Trends

Rising Demand for Non-carbonated Drinks

- Customers' increasing preference for flavored beverages over carbonated beverages high in sugars and additives propels the market growth. Consumers prefer flavored ones over non-flavored ones owing to the variety and enhanced taste with multiple health benefits. The demand for fortified beverages with essential nutrients such as amino acids, protein, vitamins, and minerals has increased.

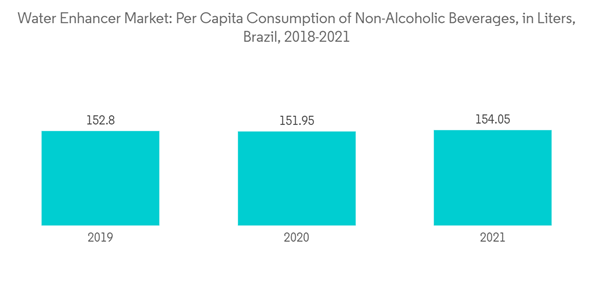

- Moreover, enhanced water is primarily consumed by people who live hectic lifestyles, are engaged in high-intensity workouts, and would like to prefer on-the-go products. They are available in portable packaging, which makes them easy to carry anywhere. The primary factors driving the growth of this market are rising concerns about digestive health due to lifestyle changes and increasing demand for healthy energy drinks or non-alcoholic beverages.

- In addition, manufacturers are offering their products with the claim of energizing or refreshing functionality through a blend of vitamins, minerals, and herbal additives, leading to the growing consumption of water enhancers. They may help meet the nutritional gap in consumers' diets without needing vitamin pills or mixing the powder in water.

- The wide range of flavor options has also promoted the consumption of water enhancers in the global market. For instance, in April 2022, Robinsons, a brand of Britvic PLC, launched new water enhancer benefit drops with added vitamins in four different flavors. Benefit drops are available in portable format for consumers on the go as they deliver great taste and additional vitamins in their water consumption.

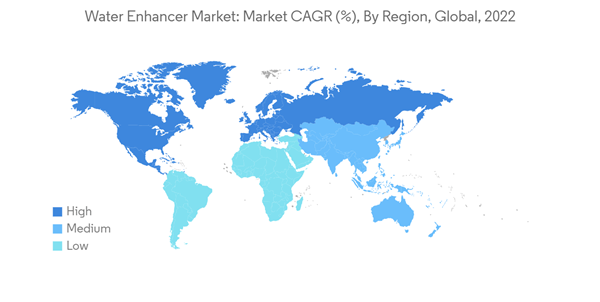

North America Dominates the Global Market

- The market for water enhancers has been increasing significantly, especially in developed or established markets like the United States, where consumers are well aware of product differentiation and have easy accessibility to growing product categories. Additionally, consumers have been looking for convenient products to stay hydrated and healthy during their regular chores.

- People opt for mini-bottles of water drops, concentrated flavor enhancers that instantly transform plain water into a value-added drink, as these drops claim to contain health-based ingredients. Moreover, the shift in consumer preference for nutrient-enabled functional beverages from soft drinks (SD) increases the potential demand for water enhancers.

- Additionally, rising consumer preferences for functional ingredients have led to increasing consumption of water enhancers among people seeking healthy drinking options. Consumer inclination toward herbal, natural, and plant-based or botanical extracted beverages has bolstered the growth of the water enhancer market. The rising demand for personalized beverage options is also shaping the market in the North American region.

Water Enhancer Industry Overview

The water enhancer market is highly consolidated and is dominated by players such as PepsiCo Inc., Nestle SA, The Coca-Cola Company, The Kraft Heinz Company, and Britvic PLC. Manufacturers now focus on broader platforms, such as online distribution channels, to market and brand their products to attract more customers. To attain a larger share in the market studied, manufacturers are revitalizing their product portfolios by presenting a premium-sized version of the product range through existing brands or new launches. The major companies aim to develop and introduce new package types and manufacturing processes to deliver product categories, such as soft drinks, waters, and organic, all-natural, and kosher beverages.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- PepsiCo Inc.

- Nestle S.A. (Nuun)

- The Coca-Cola Company

- The Kraft Heinz Company

- Jelsert (Starburst)

- Britvic plc

- Dyla LLC

- Wisdom Natural Brands

- Pharmavite LLC (MegaFood)

- DreamPak