Available in water-based, solvent-based, and other formulations, pigment dispersions are vital to various industries where appearance and function matter. The growth of the pigment dispersion market is driven by several key factors. Rapid urbanization and infrastructure development, especially in Asia-Pacific, are increasing demand for paints and coatings, thereby boosting pigment dispersion use. The global shift toward sustainable solutions is speeding up the adoption of water-based dispersions due to stricter environmental regulations and rising awareness of VOC emissions.

Expanding end-use industries such as packaging, automotive, and textiles are also contributing to market growth, supported by growing consumer demand and industrial production. Furthermore, improvements in dispersion technologies have enhanced product quality and expanded application options, while supportive government policies, particularly in emerging economies, are creating favorable conditions for local manufacturing and innovation. Collectively, these factors position pigment dispersions as crucial components in both traditional and emerging industrial sectors.

Industrial paint & coating segment is the second fastest-growing segment in the pigment dispersion market during the forecast period.

Industrial paints and coatings are a key application area for pigment dispersions, serving industries such as automotive, machinery, marine, aerospace, and construction. These coatings are made for both aesthetic appeal and functional protection - resisting corrosion, chemicals, UV rays, and wear. Pigment dispersions are essential because they ensure consistent color, opacity, and stability, while also improving performance features like heat resistance and durability. As industries increasingly require high-performance, long-lasting coatings, pigment dispersions are evolving to meet stricter quality, environmental, and safety standards.The move toward eco-friendly, low-VOC formulations - particularly in developed regions like Europe and North America - is accelerating the adoption of advanced water-based dispersions. At the same time, rapid industrial growth in Asia-Pacific, especially in India, China, and Southeast Asia, is driving large-scale infrastructure and manufacturing projects, increasing demand for industrial coatings. Additionally, technological innovations such as nano-pigment dispersions and hybrid formulations are broadening application options in advanced sectors like aerospace and electronics.

The automotive segment is the second-largest in the pigment dispersion market.

The automotive industry is a major end-use sector driving demand for pigment dispersions, due to their vital role in vehicle coatings for both aesthetics and protection. Pigment dispersions are used in exterior body paints, interior components, and plastic trims to ensure vibrant color, UV stability, corrosion resistance, and long-lasting finishes. As consumer preference shifts toward visually appealing and durable vehicles, especially in vibrant and metallic shades, the demand for high-quality pigment dispersions continues to increase.Additionally, the global move toward electric vehicles (EVs) and lightweight materials further boosts the need for advanced coatings that improve energy efficiency and surface durability. Regions like Asia-Pacific, especially India and China, are experiencing strong growth in automotive production and sales, supported by rising disposable incomes, urbanization, and government incentives for EVs. This increase in automotive output directly leads to higher consumption of paints, coatings, and consequently, pigment dispersions.

The Asia Pacific region is projected to be the largest market for pigment dispersion during the forecast period.

Asia Pacific holds the largest share in the global pigment dispersion market, driven by rapid industrialization, urban expansion, and thriving end-use industries such as construction, automotive, packaging, and textiles. Countries like China, India, Japan, and South Korea are leading this growth due to strong manufacturing bases, rising consumer demand, and supportive government policies. China, as the world’s manufacturing hub, continues to dominate the paints, coatings, and plastics industries, resulting in significant consumption of pigment dispersions.India is experiencing unprecedented growth in construction and infrastructure, supported by initiatives like the Smart Cities Mission and increasing real estate development, which boost demand for decorative and industrial coatings. Additionally, India's expanding textile sector and growing packaging industry are further increasing the need for high-performance pigments.

Japan and South Korea contribute through advanced applications and technological progress. Japan’s focus on infrastructure renovation and smart city projects, along with large-scale construction efforts in South Korea - such as the Samsung semiconductor cluster and international finance center redevelopment - are driving demand for specialized coatings and dispersions. Overall, the region’s large population, growing middle class, rising automotive production, and rapid urbanization make Asia-Pacific the fastest-growing and most promising market for pigment dispersion manufacturers, offering ample opportunities for innovation and expansion.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

The study includes an in-depth competitive analysis of these players in the market, with their company profiles, recent developments, and key strategies.

Research Coverage

The market study covers the pigment dispersion market across various segments. It aims to estimate the market size and growth potential in different segments based on type, pigment type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, important observations about their products and offerings, recent developments, and key growth strategies they are using to enhance their position in the pigment dispersion market.Key Benefits of Buying the Report

The report aims to assist market leaders and new entrants in approximating the revenue figures of the overall pigment dispersion market and its segments. It is designed to help stakeholders understand the competitive landscape, gain insights to strengthen their business positions, and develop effective go-to-market strategies. Additionally, the report provides insights into the market's current pulse, including key drivers, restraints, challenges, and opportunities.The report provides insights into the following points:

- Analysis of key drivers (growing construction industry, expansion of plastic and packaging sectors), restraints (strict environmental regulations, fluctuations in raw material costs), opportunities (growth in emerging markets, increasing importance of aesthetics in packaging), challenges (disposal and waste management concerns)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the pigment dispersion market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in pigment dispersion market

- Competitive Assessment: In-depth assessment of market share, growth strategies, product and service offerings of leading players like BASF SE (Germany), DIC Corporation (Japan), Sudarshan Chemical (India), Vibrantz (US), Cabot Corporation (US), Heubach GmbH (Germany), Penn Colors (US), Pidilite (India), Lanxess (Germany), DyStar Industries (Singapore), Achitex Minerva S.p.A (Italy), Aralon Color GmbH (Germany), Chromatech Inc. (US), DCL Corporation (Canada), and AUM Farbenchem (India), among others, are the top manufacturers covered in the pigment dispersion market.

Table of Contents

Companies Mentioned

- BASF SE

- Dic Corporation

- Sudarshan Chemical Industries Limited

- Vibrantz

- Cabot Corporation

- Dystar Singapore Pte Ltd

- Lanxess

- Penn Color Inc.

- Pidilite Pigment

- Aralon Color GmbH

- Aum Farbenchem

- Achitex Minerva S.P.A

- Chromatech Incorporated

- Dcl Corporation

- Decorative Color & Chemical, Inc.

- Dcc Group Company Limited

- Kemiteks

- Manali Pigments Pvt. Ltd.

- Mikuni-Color Ltd.

- Rpm International Inc.

- Synthesia, A.S.

- Tiarco Chemicals

- Tennants Textile Colours Ltd.

- Vipul Organics Ltd.

- Quaker Color

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | August 2025 |

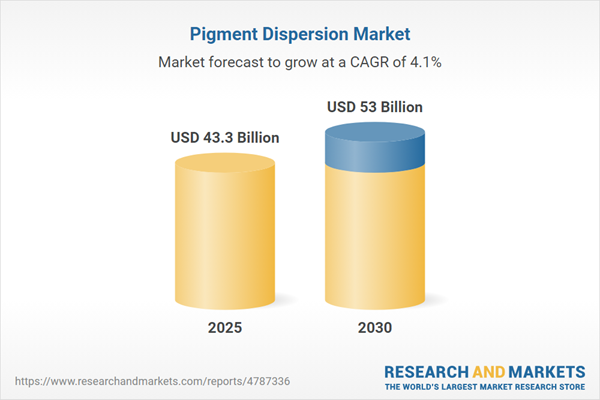

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 43.3 Billion |

| Forecasted Market Value ( USD | $ 53 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |