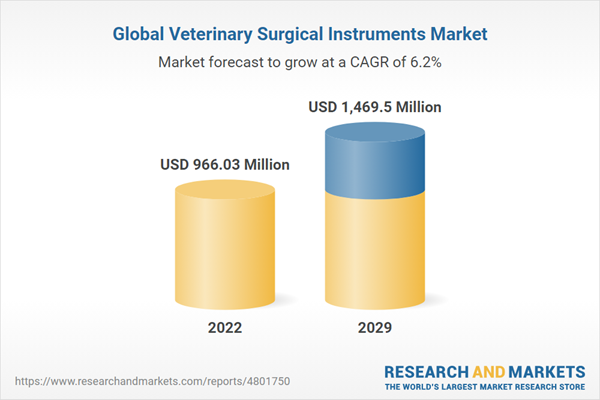

The Veterinary Surgical Instruments market is projected to rise at a compound annual growth rate (CAGR) of 6.18% to reach a market valuation of US$1,469.503 million by 2029, from US$966.031 million in 2022.

The veterinary surgical instruments market is propelled by a convergence of factors underscored by the escalating significance of pet health and the continual advancements in veterinary medicine. With global pet ownership rates on the rise, there is a corresponding surge in demand for veterinary services, including surgical interventions. This burgeoning demand necessitates a diverse array of veterinary surgical instruments to meet varied surgical needs.As pets are increasingly regarded as cherished family members, there is a heightened willingness among owners to invest in their healthcare, encompassing surgical procedures when deemed necessary. In parallel with human medicine, veterinary medicine is witnessing a trend towards specialization, resulting in a call for specialized surgical instruments tailored to specific procedures performed by veterinary surgeons.

Furthermore, the growing emphasis on minimally invasive surgical (MIS) techniques underscores the necessity for instruments designed for laparoscopic and endoscopic surgeries, aiming to minimize recovery times and complications for pets.

In response to evolving needs, there is a growing demand for instruments characterized by lighter and stronger construction, facilitating improved handling and manoeuvrability. Additionally, the market is witnessing a surge in the development of more ergonomic instruments, aiming to alleviate fatigue for veterinarians during surgical procedures. Enhanced features incorporated into instruments further contribute to greater surgical precision and efficiency.

The heightened awareness of animal welfare issues is fostering the adoption of advanced surgical techniques that prioritize minimizing pain and discomfort for pets. This, in turn, drives the demand for specialized instruments tailored to facilitate such procedures.

Moreover, the proliferation of veterinary clinics and speciality hospitals underscores the necessity for a broader range of surgical instruments to address diverse surgical requirements.

In conclusion, the veterinary surgical instruments market is propelled by the increasing significance of pet healthcare, ongoing advancements in veterinary medicine, and a steadfast focus on minimally invasive techniques and animal welfare. As these trends persist, the market is poised to experience sustained growth in the future.

Market Drivers:

Rise in Pet Ownership

The burgeoning trend of pet ownership is a pivotal driver propelling the veterinary surgical instruments market's growth. With an increasing number of households embracing pets, there's a corresponding uptick in veterinary visits, many of which entail surgical interventions. These procedures encompass a wide spectrum, ranging from spaying and neutering to orthopaedic surgeries, dental procedures, and treatments for various injuries or illnesses.According to CCTV media, statistics reveal a staggering figure of over 125 million one-person households in China, highlighting the growing prevalence of individuals seeking companionship through pet ownership. Notably, young people are drawn to pet ownership as a means to enhance their sense of relaxation and happiness, while some elderly individuals opt for pets for companionship and warmth.

The endearing nature of pets has also cultivated a vast fan base, leading to the emergence of a robust commercial market centred around them. Pet bloggers assert that viral pet videos have the potential to garner hundreds of millions of views, translating into substantial financial gains.

In parallel to advancements in human medicine, veterinary medicine is witnessing a surge in specialization. This trend encompasses the emergence of surgeons specializing in specific procedures, thereby fueling demand for specialized surgical instruments tailored to these procedures. Manufacturers are responding to this demand by innovating instruments designed explicitly for smaller or more delicate animals, thereby catering to the diverse needs of the pet population.

Growing animal healthcare

The veterinary surgical instruments market is predicted to grow at a steady rate, fueled by booming veterinary practices and investment in animal healthcare. In addition, the bolstering growth in pet ownership in major economies, namely China, the USA, and the EU region, coupled with investments in new surgical developments & innovations, have further caused an upward market trajectory.According to the European pet food industry, Europe is home to 127 million cats and 104 million dogs as household pets, with 91 million households owning a pet, constituting 46% of households. This surge in pet ownership is driving the development of innovative solutions in veterinary surgical instruments, ultimately improving surgical outcomes and enhancing animal well-being.

Furthermore, there is a noticeable rise in cases of cancer, orthopaedic issues, and dental problems in pets, which require surgical interventions. these factors collectively contribute to the steady veterinary surgical instruments market growth.

Market Restraint:

High cost, lack of awareness, and lack of disposable instruments.

The cost of veterinary surgical instruments, particularly for specialized procedures, can be prohibitive, posing a challenge for certain veterinary practices, particularly smaller clinics or those located in resource-constrained areas. Although reusable instruments are typically the norm, disposable alternatives present advantages in terms of convenience and potentially lower risks associated with infection control.Nevertheless, disposable instruments may be less accessible and affordable than their reusable counterparts. In developing nations where the veterinary sector is expanding, there may be limited awareness and access to advanced veterinary surgical instruments.

Veterinary surgical instruments market by application into sterilization surgery, dental surgery, gynaecology & urology, soft-tissue surgery, and orthopedic surgery

The veterinary surgical instruments market is segmented by application into sterilization surgery, dental surgery, gynaecology & urology, soft-tissue surgery, and orthopaedic surgery. Sterilization Surgery is one of the most common procedures performed on companion animals. It involves the utilization of instruments such as scalpels, forceps, and retractors to ensure sterilization.

Dental Surgery is witnessing a surge in demand within the veterinary field, necessitating specialized instruments for procedures like tooth extractions, teeth cleaning, and scaling, and the utilization of specialized drills and saws for complex dental procedures. The Gynecology & Urology Surgery segment encompasses instruments tailored for procedures related to the female reproductive system and the urinary tract in pets.

Soft-tissue surgery encompasses a diverse range of surgical interventions involving soft tissues such as skin, muscles, and blood vessels. Orthopedic Surgery focuses on surgical procedures about the bones, joints, and ligaments of animals.

Each of these segments presents unique requirements and demands, driving the innovation and development of specialized surgical instruments.

North America is anticipated to hold a significant share of the veterinary surgical instruments market.

North America is poised to capture a substantial portion of the veterinary surgical instruments market. This region boasts numerous leading manufacturers specializing in veterinary surgical instruments. Furthermore, North America boasts a well-established veterinary healthcare infrastructure characterized by a plethora of veterinary clinics and speciality hospitals.Pet owners in North America exhibit a notable propensity to invest in advanced veterinary care, including surgical procedures, for their beloved pets. There is a discernible demand for specialized laparoscopic and endoscopic instruments aimed at minimizing tissue trauma and expediting animal recovery times. To meet this demand, manufacturers are diligently developing advanced instruments tailored to the requirements of veterinary surgeons across the region.

As pet ownership rates continue their upward trajectory in North America, the demand for veterinary surgical instruments is anticipated to correspondingly surge. Moreover, with an increasing population of older pets, there is a projected growth in the requirement for orthopedic and other specialized surgeries, further amplifying market demand.

North America's robust foundation in veterinary medicine, coupled with the presence of established industry players and a steadfast focus on advanced technologies, is poised to consolidate its position as a key player in the veterinary surgical instruments market.

Market Segmentation:

By Animal Type

- Canines

- Felines

- Equines

- Others

By Application

- Sterilization surgery

- Dental surgery

- Gynecology & Urology

- Soft-tissue surgery

- Orthopedic surgery

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

Table of Contents

Companies Mentioned

- Jorgensen Laboratories,

- Neogen Corporation

- B. Braun Vet Care GmbH

- Medtronic PLC

- Surgical Holdings

- Avante Animal Health

- IM3 Inc.

- Sklar Surgical Instruments

- Steris Corporation

- Germed USA, Inc.

- Ethicon Inc. (Johnson & Johnson)

- Antibe Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | March 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 966.03 Million |

| Forecasted Market Value ( USD | $ 1469.5 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |