Global Connected Logistics Market - Key Trends and Drivers Summarized

How Is Connected Logistics Transforming Supply Chain Management?

Connected logistics is revolutionizing supply chain management by integrating advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), big data, and cloud computing into logistics operations. This technology enables real-time tracking, automation, and data-driven decision-making across various stages of the supply chain, providing businesses with unprecedented visibility into their logistics processes. For example, IoT sensors embedded in shipping containers or delivery vehicles provide continuous updates on the location, condition, and status of goods in transit. This allows companies to monitor temperature-sensitive products, track shipment delays, and optimize delivery routes on the fly. Additionally, connected logistics enhances warehouse operations through automation and robotics, enabling faster picking, packing, and inventory management. With predictive analytics powered by AI, logistics companies can forecast demand, prevent stockouts, and streamline operations for greater efficiency. The integration of these technologies transforms logistics from a reactive process to a proactive, data-driven function, helping businesses reduce costs, improve operational efficiency, and meet growing consumer expectations for faster and more reliable deliveries.What Role Does Real-Time Data Play in Enhancing Connected Logistics?

Real-time data is the backbone of connected logistics, providing the necessary information to make informed decisions, optimize operations, and respond swiftly to disruptions. The ability to capture and analyze vast amounts of data in real time enables companies to gain actionable insights into every aspect of their supply chain. For instance, connected vehicles equipped with GPS and telematics systems transmit real-time location data, which can be used to optimize delivery routes, reducing fuel consumption and improving on-time delivery rates. In addition to location tracking, real-time data allows for monitoring the conditions of goods, ensuring that perishable or sensitive items are transported under optimal conditions. For instance, temperature sensors in refrigerated trucks can alert logistics managers if the internal temperature deviates from safe levels, allowing for immediate corrective actions. Furthermore, real-time data sharing between stakeholders - such as suppliers, carriers, warehouses, and retailers - creates a more synchronized and transparent supply chain. This heightened level of visibility improves collaboration and reduces the likelihood of bottlenecks or miscommunications, ultimately resulting in a smoother and more efficient logistics process. As logistics companies continue to adopt more sophisticated data analytics tools, the use of real-time information will only grow, further enhancing the precision and agility of supply chains.How Are Emerging Technologies Shaping the Future of Connected Logistics?

Emerging technologies like blockchain, AI, and autonomous vehicles are playing a pivotal role in shaping the future of connected logistics. Blockchain technology, in particular, is gaining traction in the logistics industry due to its ability to offer secure and transparent data-sharing mechanisms. By creating an immutable ledger of transactions and shipments, blockchain ensures that all parties involved in a supply chain have access to reliable, real-time information, reducing the risks of fraud, delays, and disputes. This level of transparency enhances trust between suppliers, shippers, and customers. Meanwhile, AI is enabling predictive maintenance for vehicles and machinery, helping logistics companies minimize downtime and ensure smooth operations. AI-powered systems also improve demand forecasting, allowing businesses to adjust their inventory levels based on projected demand, reducing excess stock or stockouts. Autonomous vehicles, including drones and self-driving trucks, are also on the horizon, offering potential solutions to labor shortages, reducing human error, and enabling faster, more cost-effective deliveries. These advancements are driving innovation in logistics, with companies increasingly investing in connected technologies to stay competitive in a rapidly evolving market.What's Driving the Growth of the Connected Logistics Market?

The growth in the connected logistics market is driven by several factors, all closely tied to technological advancements, evolving industry needs, and shifting consumer behavior. First, the rapid adoption of IoT devices and cloud computing has made it easier for logistics companies to implement connected solutions that offer real-time tracking and automation. These technologies have reduced the cost of entry, allowing even smaller businesses to benefit from connected logistics platforms. Secondly, the rise of e-commerce has dramatically increased the demand for faster and more reliable deliveries, pushing logistics providers to adopt advanced technologies that optimize last-mile delivery and enhance customer satisfaction. Another critical driver is the increasing need for supply chain transparency and accountability, especially in industries dealing with perishable goods, pharmaceuticals, and other sensitive products. Consumers and regulators are demanding better visibility into where products come from and how they are handled during transit, and connected logistics provides the tools to meet these expectations. Furthermore, the focus on sustainability is accelerating the adoption of connected logistics solutions, as companies look for ways to reduce emissions, fuel consumption, and waste through more efficient routing and energy use. Lastly, the increasing use of data analytics and AI in optimizing logistics operations is allowing companies to anticipate disruptions, manage risks, and maintain resilient supply chains, making connected logistics an indispensable part of modern supply chain management.Report Scope

The report analyzes the Connected Logistics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Transportation Mode (Roadway, Railway, Seaway, Airway).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Roadway Transportation segment, which is expected to reach US$56.4 Billion by 2030 with a CAGR of 19.3%. The Railway Transportation segment is also set to grow at 20.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.4 Billion in 2024, and China, forecasted to grow at an impressive 18.4% CAGR to reach $18.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Connected Logistics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Connected Logistics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Connected Logistics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AT&T, Inc., Cisco Systems, Inc., Cloud Logistics Inc., Eurotech SpA, Freightgate Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Connected Logistics market report include:

- AT&T, Inc.

- Cisco Systems, Inc.

- Cloud Logistics Inc.

- Eurotech SpA

- Freightgate Inc.

- HCL Technologies Ltd.

- IBM Corporation

- Infosys Ltd.

- Intel Corporation

- ORBCOMM, Inc.

- SAP SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AT&T, Inc.

- Cisco Systems, Inc.

- Cloud Logistics Inc.

- Eurotech SpA

- Freightgate Inc.

- HCL Technologies Ltd.

- IBM Corporation

- Infosys Ltd.

- Intel Corporation

- ORBCOMM, Inc.

- SAP SE

Table Information

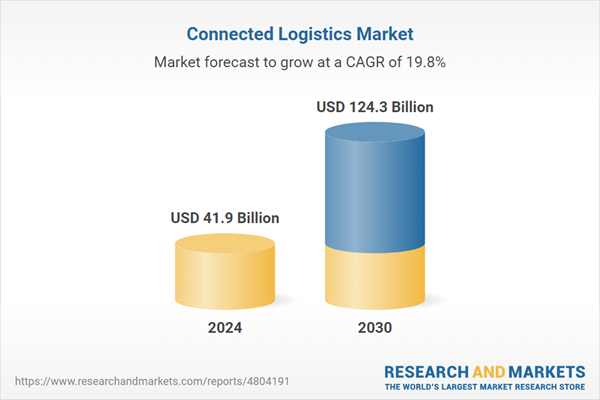

| Report Attribute | Details |

|---|---|

| No. of Pages | 271 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.9 Billion |

| Forecasted Market Value ( USD | $ 124.3 Billion |

| Compound Annual Growth Rate | 19.8% |

| Regions Covered | Global |