Global Concrete Admixtures Market - Key Trends and Drivers Summarized

How Are Concrete Admixtures Transforming Modern Construction Practices?

Concrete admixtures have become essential components in modern construction, offering a wide range of benefits that enhance the performance, durability, and workability of concrete. These chemical additives, when mixed with cement, water, and aggregates, modify the properties of concrete to meet the specific demands of various construction projects. From improving setting time to increasing strength, admixtures allow construction professionals to adapt concrete for challenging environmental conditions, complex architectural designs, and accelerated project timelines. Admixtures such as plasticizers, accelerators, retarders, and air-entraining agents can optimize the behavior of concrete, ensuring it remains workable for longer periods, hardens faster, or performs well in extreme weather conditions. As construction projects become more complex and the demand for sustainable and high-performance structures increases, the use of concrete admixtures is critical in achieving superior results. By enhancing durability, reducing water content, and improving overall concrete quality, admixtures enable more innovative and efficient construction techniques that meet modern engineering standards.What Technological Innovations Are Shaping the Development of Concrete Admixtures?

The field of concrete admixtures has seen significant advancements, driven by innovations in material science and chemistry that are pushing the boundaries of what concrete can achieve. One of the most notable developments is the rise of superplasticizers, which dramatically improve the fluidity and workability of concrete while reducing water content. These high-range water reducers allow for the creation of high-strength concrete with minimal shrinkage and cracking, making them ideal for use in large-scale infrastructure projects like bridges and high-rise buildings. Another technological breakthrough is the development of self-healing concrete, where admixtures include microcapsules of healing agents that are released when cracks form, automatically repairing damage and extending the lifespan of structures. Sustainability has also become a significant driver of innovation in concrete admixtures. New formulations are being developed to reduce the carbon footprint of concrete by incorporating industrial by-products like fly ash, silica fume, and slag into the mix. These materials not only enhance the strength and durability of concrete but also reduce the amount of cement needed, lowering greenhouse gas emissions associated with cement production. Additionally, advancements in nanotechnology have enabled the development of nano-silica and other nanomaterials as admixtures, which improve the mechanical properties of concrete and its resistance to chemicals, abrasion, and weathering.How Are Concrete Admixtures Applied Across Various Construction Sectors?

Concrete admixtures are used across a diverse range of construction sectors, each benefiting from the ability to customize the properties of concrete to meet specific project requirements. In the infrastructure sector, admixtures are vital for constructing roads, bridges, tunnels, and dams, where concrete must endure heavy loads, extreme temperatures, and exposure to chemicals and water. In residential and commercial construction, admixtures are used to optimize the workability and finishing of concrete, allowing for more complex architectural designs and faster project completion. Accelerators, for instance, help speed up the curing process, enabling quicker formwork removal and reducing construction timelines, which is crucial in fast-paced urban development projects. Retarders, on the other hand, are used in hot climates or large pours where extended setting time is necessary to prevent premature hardening. The precast concrete industry also relies heavily on admixtures to enhance the performance and aesthetic quality of prefabricated elements, such as beams, columns, and panels. These admixtures ensure consistent color, texture, and strength, while reducing production times and labor costs. The marine and industrial sectors also benefit from the use of corrosion-inhibiting admixtures, which protect reinforced concrete structures exposed to saltwater or harsh chemical environments, such as piers, docks, wastewater treatment plants, and chemical factories.What Factors Are Driving the Growth of the Concrete Admixtures Market?

The growth in the concrete admixtures market is driven by several key factors that reflect the changing dynamics of the construction industry, advancements in technology, and the push for sustainable building solutions. One of the primary drivers is the increasing demand for high-performance concrete in large-scale infrastructure projects. As countries invest heavily in roads, bridges, airports, and commercial buildings to support economic growth, the need for durable and versatile concrete solutions, enabled by admixtures, is rising sharply. Another significant factor is the growing emphasis on sustainability and environmental regulations in the construction sector. Admixtures that reduce water and cement content not only improve the performance of concrete but also reduce its environmental impact, aligning with global efforts to reduce carbon emissions and promote green building practices. The rise of green certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) is pushing contractors and developers to adopt admixtures that enhance energy efficiency and resource conservation in their projects. Technological advancements, particularly in the development of specialized admixtures such as self-healing, shrinkage-reducing, and corrosion-inhibiting products, are also driving market growth. These innovations allow for more resilient and low-maintenance concrete structures, which are especially appealing in high-demand sectors like infrastructure, industrial construction, and marine engineering. Lastly, the expansion of the precast concrete market is fueling demand for admixtures that ensure consistency, strength, and aesthetic quality in prefabricated building components. As the global construction industry shifts towards more prefabricated solutions to reduce costs and improve project efficiency, admixtures are playing a critical role in ensuring that precast elements meet the necessary standards. Collectively, these factors are driving robust growth in the concrete admixtures market.Report Scope

The report analyzes the Concrete Admixtures market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Retarding Agents, Waterproofing Agents, Accelerating Agents, Air-Entraining Agents, Other Types); Application (Residential, Infrastructure, Industrial & Institutional, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Residential Application segment, which is expected to reach US$10.5 Billion by 2030 with a CAGR of 6.5%. The Infrastructure Application segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $5.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Concrete Admixtures Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Concrete Admixtures Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Concrete Admixtures Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Chryso SAS, CICO Technologies Ltd., Dow, Inc., DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Concrete Admixtures market report include:

- BASF SE

- Chryso SAS

- CICO Technologies Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Fosroc International Ltd.

- Mapei S.p.A.

- Pidilite Industries Ltd.

- RPM International, Inc.

- Sika AG

- W. R. Grace & Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Chryso SAS

- CICO Technologies Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Fosroc International Ltd.

- Mapei S.p.A.

- Pidilite Industries Ltd.

- RPM International, Inc.

- Sika AG

- W. R. Grace & Co.

Table Information

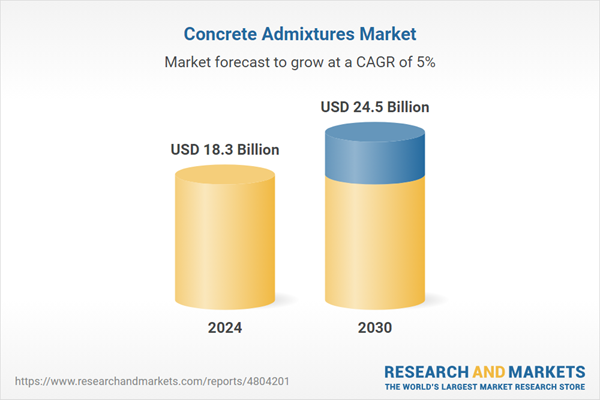

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.3 Billion |

| Forecasted Market Value ( USD | $ 24.5 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |