Global Composites Testing Market - Key Trends and Drivers Summarized

How Is Composites Testing Elevating Material Performance and Quality Assurance?

Composites testing refers to the evaluation of composite materials - such as carbon fiber, fiberglass, and other fiber-reinforced polymers - to ensure they meet stringent performance and safety standards before being used in various applications. These materials are prized for their high strength-to-weight ratio, durability, and resistance to environmental factors, making them essential in industries such as aerospace, automotive, defense, marine, and renewable energy. However, due to the complex nature of composite materials, which are often layered and feature diverse properties depending on their configuration, rigorous testing is crucial to assess their mechanical, thermal, and chemical performance. Composites testing evaluates factors like tensile strength, compressive strength, fatigue resistance, and environmental durability to verify that the material can withstand the operational conditions it will encounter. Without these tests, composite components risk failure in critical applications, which could lead to catastrophic outcomes, especially in high-performance sectors such as aviation or automotive racing. Consequently, composites testing is an indispensable step in quality assurance, ensuring that the materials used in advanced engineering applications meet both regulatory standards and the high-performance demands of modern manufacturing.What Technological Advancements Have Transformed Composites Testing?

The field of composites testing has been revolutionized by advancements in both testing methodologies and equipment, enabling more accurate, efficient, and non-destructive evaluations of composite materials. One of the major breakthroughs in composites testing is the increased use of non-destructive testing (NDT) techniques, which allow for thorough examination of composite structures without causing damage. Methods such as ultrasonic testing, X-ray tomography, and infrared thermography enable the detection of internal flaws, delamination, voids, or cracks within composite materials, providing detailed insights into the integrity of the material without compromising its usability. These advancements are particularly important in industries where components cannot be easily replaced, such as aerospace or energy infrastructure, and early detection of defects is critical to maintaining safety and performance. Additionally, digital technologies like automated testing systems, robotic arms, and high-speed data acquisition systems have dramatically increased the efficiency of testing processes. Automated systems can perform repetitive testing tasks with greater accuracy and consistency, reducing human error and accelerating the overall process. Simulation tools and computational modeling have also enhanced composites testing by allowing engineers to predict material behavior under various stress conditions before physical testing. This reduces the time and cost involved in developing new composite materials, as potential issues can be identified and addressed earlier in the development process. These technological advancements have made composites testing more precise, faster, and scalable, ensuring that modern composite materials can be tested to meet the increasingly demanding requirements of their applications.How Is Composites Testing Applied Across Various Industries?

Composites testing plays a crucial role in a wide array of industries that rely on the superior properties of composite materials to create high-performance products. In the aerospace industry, for instance, composites testing is used to verify the structural integrity and durability of aircraft components, such as wings, fuselages, and interior structures. These materials must endure extreme stresses, temperature variations, and environmental conditions, so testing for factors like fatigue resistance, impact strength, and thermal expansion is critical. Similarly, in the automotive industry, composites testing ensures that lightweight components such as body panels, chassis, and suspension systems meet performance standards while reducing vehicle weight to improve fuel efficiency and reduce emissions. The wind energy sector also depends on composites testing for evaluating wind turbine blades, which are typically made from fiberglass or carbon fiber composites. These blades must endure harsh environmental conditions over long periods, so testing for fatigue, environmental resistance, and structural strength is vital to ensure their longevity and efficiency. In marine applications, composites testing assesses the durability of materials used in hulls and other components exposed to corrosive saltwater environments. Additionally, the defense industry uses composites testing to validate the performance of lightweight yet robust materials used in armor, military vehicles, and advanced weaponry systems. Across these industries, composites testing not only ensures the safety and reliability of products but also helps manufacturers optimize material performance and reduce costs through more efficient use of materials.What Are the Factors Powering the Growth of the Composites Testing Market?

The growth in the composites testing market is driven by several key factors, most notably the increasing use of composite materials in high-performance industries and the rising need for quality assurance. One of the primary drivers is the growing demand for lightweight and durable materials in industries such as aerospace, automotive, and renewable energy, where composites are replacing traditional materials like steel and aluminum to improve efficiency and performance. As the use of composites expands, the need for rigorous testing to ensure these materials can meet strict safety and performance standards is rising accordingly. Another major factor is the increasing complexity of composite structures. Modern composites often feature intricate layering patterns and advanced configurations that make them highly effective but also more challenging to evaluate, necessitating more sophisticated testing methods. Advancements in non-destructive testing technologies, such as ultrasonic testing and digital radiography, are also fueling market growth by offering faster, more reliable, and cost-effective testing solutions. Additionally, stringent regulations in industries such as aerospace and automotive, where failure of materials can lead to severe consequences, are compelling manufacturers to invest heavily in comprehensive testing solutions to meet both governmental and industry standards. The ongoing push toward sustainability is another important factor, as industries focus on extending the life cycle of composite materials through proper maintenance and inspection, which composites testing enables. Lastly, as new composite materials and technologies, such as nanocomposites and bio-based composites, emerge, the need for specialized testing services is expanding, driving further growth in the composites testing market. Together, these factors underscore the critical importance of composites testing in ensuring the reliability and performance of materials that are integral to the future of advanced engineering and manufacturing.Report Scope

The report analyzes the Composites Testing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Testing Type (Non-Destructive, Destructive); Product Type (Continuous Fiber, Polymer Matrix, Ceramic Matrix, Other Product Types); Application (Aerospace & Defense, Transportation, Wind Energy, Sporting Goods, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Destructive Testing segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of 6.4%. The Destructive Testing segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $508.8 Million in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $641.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Composites Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Composites Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Composites Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

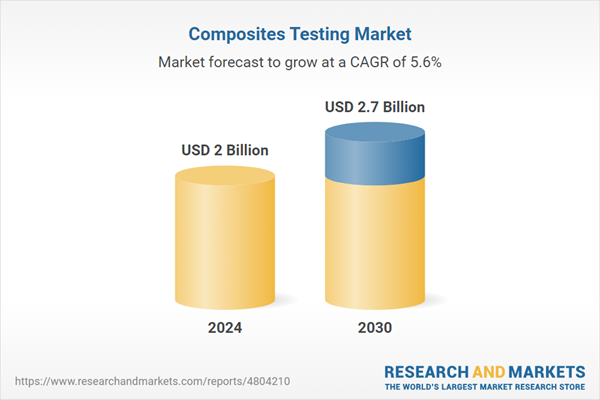

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Composites Testing Laboratory (CTL), Element Materials Technology, Etim SAS, Exova Group PLC, Henkel AG & Co. KGaA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Composites Testing market report include:

- Composites Testing Laboratory (CTL)

- Element Materials Technology

- Etim SAS

- Exova Group PLC

- Henkel AG & Co. KGaA

- Instron Corporation

- Intertek Group PLC

- Matrix Composites, Inc.

- Mistras Group, Inc.

- Westmoreland Mechanical Testing & Research, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Composites Testing Laboratory (CTL)

- Element Materials Technology

- Etim SAS

- Exova Group PLC

- Henkel AG & Co. KGaA

- Instron Corporation

- Intertek Group PLC

- Matrix Composites, Inc.

- Mistras Group, Inc.

- Westmoreland Mechanical Testing & Research, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |