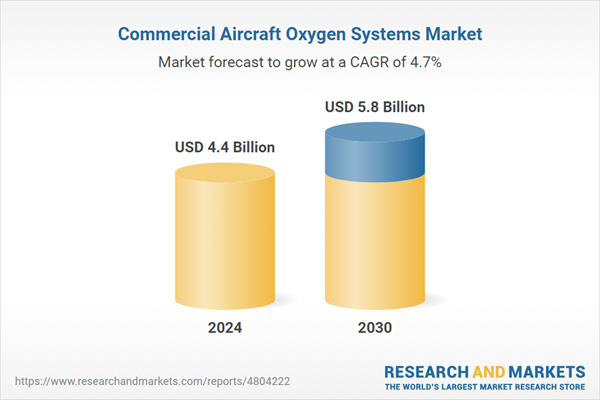

Global Commercial Aircraft Oxygen Systems Market - Key Trends and Drivers Summarized

How Do Oxygen Systems Function in Commercial Aircraft and Why Are They Vital?

Commercial aircraft oxygen systems are critical safety components designed to provide breathable air to passengers and crew in the event of cabin depressurization or other emergencies. At high altitudes, where the air is thin and oxygen levels are significantly lower, the aircraft's pressurization system maintains a safe and breathable environment inside the cabin. However, in rare cases of system failure or sudden depressurization, the oxygen systems automatically activate to supply supplemental oxygen. Typically, these systems include oxygen masks for passengers and portable oxygen supplies for flight attendants and pilots, ensuring that everyone on board can maintain adequate oxygen levels until the aircraft can descend to a safer altitude. In the cockpit, specialized oxygen masks allow pilots to continue operating the aircraft without interruption during emergencies. Oxygen systems are not only vital for ensuring safety during depressurization but are also used for medical emergencies when passengers require supplemental oxygen. Given the life-saving function of these systems, they are rigorously tested and maintained to ensure reliability, making them a mandatory and integral part of any commercial aircraft's safety infrastructure.What Innovations Are Shaping the Future of Commercial Aircraft Oxygen Systems?

Technological advancements are driving significant improvements in the design, functionality, and efficiency of commercial aircraft oxygen systems. One of the most notable innovations is the development of more advanced oxygen generation systems, such as the Onboard Oxygen Generation Systems (OBOGS), which have started to replace traditional oxygen storage tanks. OBOGS generate oxygen from the surrounding air, ensuring an unlimited supply of oxygen without the need for heavy tanks, thereby reducing the overall weight of the aircraft and improving fuel efficiency. Another area of innovation is in the design of oxygen masks. Modern masks are now equipped with features that improve ease of use and comfort, such as quick-deploy mechanisms and improved sealing to ensure oxygen flow even in challenging situations. These systems are also becoming more compact and efficient, allowing for quicker deployment in emergencies. Furthermore, advancements in sensor technology and automated systems mean that oxygen systems can now detect changes in cabin pressure and activate more quickly and precisely than older, manual systems. In the cockpit, oxygen systems have been upgraded to provide continuous oxygen flow without requiring pilots to interrupt critical operations. Additionally, as environmental concerns grow, manufacturers are focusing on developing oxygen systems that are more environmentally friendly by reducing the use of harmful chemicals in oxygen storage and generating systems. These technological improvements are not only making oxygen systems more efficient but also enhancing their reliability, ensuring that passengers and crew are better protected in emergencies.What Obstacles Do Oxygen Systems Face in Modern Aviation?

Despite their critical importance, commercial aircraft oxygen systems face several challenges in both their development and ongoing maintenance. One of the primary issues is ensuring the system's reliability under extreme conditions. Oxygen systems must be able to function flawlessly at high altitudes and in a wide range of environmental conditions, from extreme cold to high heat, all while meeting stringent regulatory standards. This requires extensive testing and certification, which can be costly and time-consuming for manufacturers. Another challenge lies in the balance between system complexity and ease of use. While newer oxygen systems offer advanced features, they must remain easy to deploy and use during high-stress emergencies, both for passengers and crew. Complexity in design or operation could lead to delays in accessing oxygen when it is most needed, so simplicity and speed are key factors. Maintenance is another significant challenge, as oxygen systems must be regularly inspected, tested, and serviced to ensure they are fully functional at all times. The logistics of maintaining oxygen systems - especially in large commercial fleets - can be complicated and costly, as any failure or oversight in maintenance can have catastrophic consequences. Additionally, older aircraft in service may still be equipped with outdated oxygen systems that need to be replaced or retrofitted, which can be expensive for airlines. Finally, there are challenges related to the storage and transportation of compressed oxygen, which is classified as a hazardous material. Airlines must comply with strict regulations for handling and transporting oxygen tanks, further complicating logistics and raising operational costs. Addressing these challenges requires a careful balance between innovation, safety, and operational efficiency.What Factors Are Driving the Growth of the Commercial Aircraft Oxygen Systems Market?

The growth in the commercial aircraft oxygen systems market is driven by several key factors, including increasing air traffic, rising safety standards, and technological advancements. One of the most significant growth drivers is the expansion of the global aviation industry, particularly in emerging markets such as Asia-Pacific and the Middle East, where air travel is increasing rapidly. As more airlines enter service and fleets grow, the demand for reliable and efficient oxygen systems rises in tandem. Additionally, stringent regulatory requirements set by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), are pushing airlines to invest in newer, more advanced oxygen systems that meet updated safety standards. The focus on enhancing passenger safety and comfort has led to the development of more sophisticated oxygen systems that offer improved deployment speed, comfort, and reliability. Technological advancements, particularly in oxygen generation systems, are also contributing to market growth. Systems like OBOGS, which eliminate the need for bulky oxygen storage tanks, are gaining traction as airlines look for ways to reduce weight and improve fuel efficiency. Furthermore, the increasing focus on health and safety, especially in the wake of global health crises like COVID-19, has heightened awareness around in-flight medical emergencies, leading airlines to invest in portable oxygen systems and better medical equipment on board. Lastly, the rise in retrofitting and upgrading older aircraft with modern oxygen systems is contributing to market growth, as airlines look to modernize their fleets without investing in entirely new planes. These factors are collectively fueling the expansion of the commercial aircraft oxygen systems market, making it a critical area of development for the aviation industry.Report Scope

The report analyzes the Commercial Aircraft Oxygen Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Aircraft Type (Narrow Body, Wide Body, Regional Transport Aircraft).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Narrow Body Aircraft segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of 5.4%. The Wide Body Aircraft segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $909.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Aircraft Oxygen Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Aircraft Oxygen Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Aircraft Oxygen Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, BASA Aviation Ltd., Cobham PLC, Precise Flight, Inc., Technodinamika Holding, Jsc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 17 companies featured in this Commercial Aircraft Oxygen Systems market report include:

- Air Liquide SA

- BASA Aviation Ltd.

- Cobham PLC

- Precise Flight, Inc.

- Technodinamika Holding, Jsc

- Ventura Aerospace, Inc.

- Zodiac Aerospace

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- BASA Aviation Ltd.

- Cobham PLC

- Precise Flight, Inc.

- Technodinamika Holding, Jsc

- Ventura Aerospace, Inc.

- Zodiac Aerospace

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 5.8 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |