Global Combined Heat and Power (CHP) Market - Key Trends and Drivers Summarized

What Is Combined Heat and Power (CHP) and Why Is It Transforming Energy Efficiency?

Combined Heat and Power (CHP), also known as cogeneration, is an advanced system that simultaneously generates electricity and useful heat from a single fuel source, such as natural gas, biomass, or coal. Unlike traditional power generation, which typically wastes the heat produced during electricity generation, CHP captures and repurposes this heat for industrial processes, heating, or cooling. This dual-purpose functionality significantly increases energy efficiency, making CHP systems an ideal solution for factories, hospitals, universities, and residential buildings that require both power and heating. CHP can achieve energy efficiency levels of up to 80%, compared to conventional power plants, which only reach around 50% efficiency. As energy costs rise and environmental concerns grow, CHP systems are becoming a critical technology in the global push for greener, more sustainable energy solutions.How Is Combined Heat and Power (CHP) Revolutionizing Energy Use Across Sectors?

Combined Heat and Power systems are reshaping how industries and institutions manage their energy needs by providing an efficient, reliable, and cost-effective solution for both electricity and heating. In industrial settings, CHP systems are used to power factories while also supplying the heat needed for manufacturing processes, thereby reducing energy costs and improving operational efficiency. Universities, hospitals, and large commercial buildings also benefit from CHP systems, which provide continuous power and heat, even during grid outages, enhancing energy security and reducing reliance on external energy providers. In the residential sector, CHP is becoming increasingly popular in district heating systems, offering local communities a way to share energy resources while reducing emissions. One of the key advantages of CHP systems is their flexibility. They can operate using a wide range of fuel sources, from natural gas to renewable options like biomass, making them adaptable to the specific energy needs and environmental goals of different sectors. In regions with stringent emissions regulations or high energy prices, CHP systems offer a way to meet sustainability goals without sacrificing reliability or increasing operational costs. The widespread application of CHP technology is contributing to a more sustainable energy landscape, where efficiency and environmental impact are both optimized.What Technological Advancements Are Propelling the Growth of CHP Systems?

Technological innovations in CHP systems are driving improvements in efficiency, flexibility, and environmental performance, making these systems more attractive across a wide range of applications. One of the most significant advancements is the development of micro-CHP systems, which are designed for smaller-scale applications, such as residential buildings or small businesses. These systems allow individual households or small enterprises to generate their own electricity and heating on-site, reducing dependence on external grids and lowering energy costs. Advances in fuel cell technology are also making CHP systems cleaner and more efficient, with some models capable of running on hydrogen, further reducing carbon emissions. Another key area of innovation is in the integration of CHP systems with renewable energy sources. Hybrid systems that combine CHP with solar panels or wind turbines are emerging as a way to optimize energy use by balancing renewable energy generation with the reliable, continuous output of CHP. These systems offer the advantage of providing backup power when renewable sources are not available, ensuring energy stability. Moreover, the digitalization of energy systems has made it easier to monitor and optimize CHP operations through smart grids and IoT-enabled sensors, allowing for real-time adjustments and more precise control over energy production and consumption. Environmental regulations are also pushing the development of cleaner, more efficient CHP systems. Modern CHP units are being designed with emissions control technologies that meet or exceed regulatory requirements, making them a viable solution in regions with stringent environmental policies.What Is Driving the Growth in the Combined Heat and Power (CHP) Market?

The growth in the Combined Heat and Power (CHP) market is driven by several factors, including increasing demand for energy efficiency, the rise in industrialization, and stricter environmental regulations. As energy costs continue to rise globally, businesses and institutions are looking for ways to reduce their energy bills while maintaining reliable power and heating. CHP systems offer a solution by optimizing energy use, generating electricity, and capturing waste heat that would otherwise be lost. This efficiency not only lowers energy costs but also reduces the carbon footprint of energy-intensive operations, making CHP a compelling option for industries looking to meet both economic and environmental goals. Industrial growth, particularly in emerging markets, is another significant driver of the CHP market. As manufacturing and production sectors expand, the need for reliable and efficient power solutions increases. CHP systems are particularly valuable in industries such as chemicals, food processing, and pharmaceuticals, where heat is required for various processes, making CHP a natural fit for these energy-intensive sectors. Additionally, the growing emphasis on distributed energy systems is encouraging the adoption of CHP, as it offers an on-site power generation solution that can operate independently of the grid, enhancing energy security and resilience. Stringent environmental regulations are also playing a major role in accelerating the adoption of CHP technology. Governments and regulatory bodies are pushing industries to reduce greenhouse gas emissions and improve energy efficiency, making CHP an attractive option for compliance. Incentives, subsidies, and grants provided by governments to promote cleaner energy technologies are further driving market growth. These factors, combined with technological advancements in micro-CHP, fuel cells, and hybrid systems, are ensuring that CHP remains a key solution in the global transition toward sustainable energy systems.Report Scope

The report analyzes the Combined Heat and Power (CHP) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Capacity (Above 300 MW, 151 - 300 MW, 10 - 150 MW, Below 10 MW); Prime Mover (Reciprocating Engine, Gas Turbine, Steam Turbine, Other Prime Movers); Fuel (Natural Gas, Coal, Biogas / Biomass, Other Fuels); End-Use (Utilities, District Energy & Cooling, Residential, On-Site Industrial, On-Site Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Above 300 MW Capacity CHP segment, which is expected to reach US$13.4 Billion by 2030 with a CAGR of 2.9%. The 151 - 300 MW Capacity CHP segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 5.3% CAGR to reach $6.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Combined Heat and Power (CHP) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Combined Heat and Power (CHP) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Combined Heat and Power (CHP) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Holding SpA, Capstone Turbine Corporation, Caterpillar Energy Solutions (Mwm), Clarke Energy, FuelCell Energy, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Combined Heat and Power (CHP) market report include:

- AB Holding SpA

- Capstone Turbine Corporation

- Caterpillar Energy Solutions (Mwm)

- Clarke Energy

- FuelCell Energy, Inc.

- General Electric Company

- G-Energy Global Private Limited

- MAN Energy Solutions SE

- Mitsubishi Hitachi Power Systems Ltd.

- Siemens AG

- Veolia Environnement S.A.

- Wartsila Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Holding SpA

- Capstone Turbine Corporation

- Caterpillar Energy Solutions (Mwm)

- Clarke Energy

- FuelCell Energy, Inc.

- General Electric Company

- G-Energy Global Private Limited

- MAN Energy Solutions SE

- Mitsubishi Hitachi Power Systems Ltd.

- Siemens AG

- Veolia Environnement S.A.

- Wartsila Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

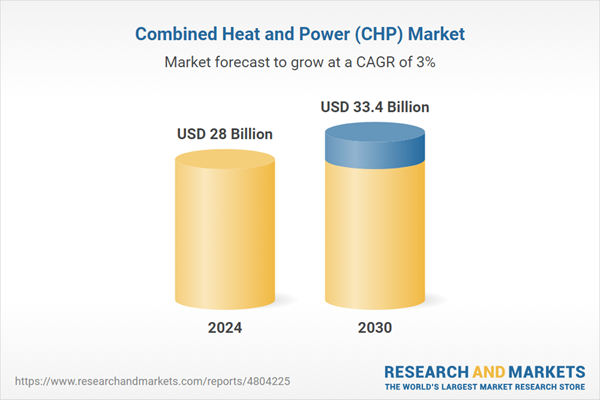

| Estimated Market Value ( USD | $ 28 Billion |

| Forecasted Market Value ( USD | $ 33.4 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |