Global Cold Pain Therapy Market - Key Trends and Drivers Summarized

What Is Cold Pain Therapy and Why Is It a Go-To Solution for Pain Management?

Cold pain therapy, also known as cryotherapy, is a widely used treatment method that involves the application of cold compresses or devices to reduce inflammation, numb pain, and accelerate recovery from injuries. It is commonly used to treat acute injuries such as sprains, strains, bruises, and muscle soreness, as well as chronic conditions like arthritis. Cold pain therapy works by constricting blood vessels, which reduces blood flow to the affected area and decreases swelling, inflammation, and pain. This non-invasive, drug-free therapy has become a go-to solution for both athletes and individuals seeking relief from musculoskeletal pain, as it offers immediate relief without the side effects of medications. From simple ice packs to advanced cryotherapy devices, cold pain therapy is a versatile option for home treatment, physical therapy, and post-surgical recovery, making it an essential component of modern pain management.How Is Cold Pain Therapy Revolutionizing Injury Treatment and Recovery?

Cold pain therapy is transforming the way acute and chronic injuries are treated by providing an effective, easy-to-use solution that promotes faster recovery. In sports medicine, cold therapy is a cornerstone of injury treatment, used immediately after an injury to minimize swelling and prevent further tissue damage. Athletes often use cold therapy to reduce muscle soreness and improve recovery times after intense workouts or competitions. The application of cold compresses and cryotherapy devices not only reduces pain but also facilitates quicker rehabilitation by controlling inflammation and improving joint function. In addition to its use in sports, cold pain therapy is becoming more popular in everyday injury management, especially for individuals with conditions like osteoarthritis, where ongoing pain and inflammation are a major concern. Post-operative recovery is another area where cold pain therapy is making a significant impact. Surgeons and physical therapists recommend cold therapy after procedures like knee or shoulder surgeries to manage pain and swelling, allowing patients to heal more comfortably and with fewer complications. The combination of cold therapy with other rehabilitation techniques is proving highly effective in reducing reliance on pain medications, which is particularly important in addressing concerns over opioid use.What Technologies and Innovations Are Driving Advancements in Cold Pain Therapy?

Innovations in cold pain therapy are driving the development of more advanced, user-friendly devices that improve treatment outcomes and patient convenience. Traditional ice packs have evolved into more sophisticated cryotherapy devices that offer precise temperature control, targeted application, and even automated cycles of cooling and rest. Some of the most notable advancements include compression-based cold therapy systems, which combine cold treatment with controlled compression to enhance the therapeutic effects by further reducing swelling and improving circulation. These devices are particularly effective for post-surgical recovery and severe musculoskeletal injuries, where both pain management and inflammation control are critical. Wearable cold therapy devices are also gaining traction, allowing patients to receive continuous treatment while remaining mobile. These portable systems can be easily adjusted and worn during daily activities, making them ideal for athletes or individuals recovering from injury who need ongoing relief. Innovations in materials are another driving force behind improved cold therapy products. Gel packs and wraps designed to contour to the body offer more effective cooling with better comfort and longer-lasting cold retention. Furthermore, advancements in cryotherapy chambers, used for whole-body cryotherapy, are offering new ways to treat systemic inflammation and muscle pain by exposing the entire body to extremely low temperatures in short bursts.What Is Driving the Growth in the Cold Pain Therapy Market?

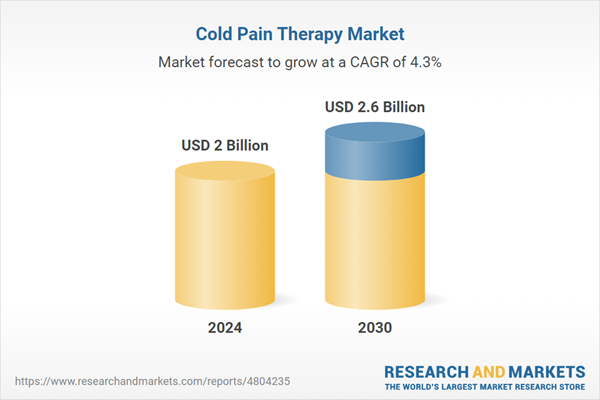

The growth in the cold pain therapy market is driven by several factors, including rising demand for non-invasive pain management solutions, increasing sports and physical activity participation, and the growing awareness of the benefits of cold therapy for recovery and rehabilitation. One of the primary drivers is the increasing preference for drug-free pain management, especially in light of the opioid crisis and concerns over the long-term use of pain medications. Consumers are seeking alternative therapies that provide effective relief without the risk of addiction or side effects, positioning cold pain therapy as a safer option for managing both acute and chronic pain. The rise in sports and fitness activities globally is another significant growth factor. As more people engage in athletic pursuits, the incidence of sports-related injuries is increasing, driving the demand for quick, effective recovery solutions. Cold pain therapy, which is widely used in sports medicine, is becoming more popular among amateur athletes and fitness enthusiasts for treating everything from muscle strains to joint injuries. In addition, the aging population is contributing to the demand for cold pain therapy products, as older adults often experience musculoskeletal pain and chronic conditions like arthritis that benefit from consistent cold therapy. Advancements in cold therapy technology are also playing a key role in market growth. The development of user-friendly, portable devices and wearable cold therapy systems is making it easier for consumers to access cold pain relief at home or on the go. Moreover, the increasing integration of cold therapy into post-operative care is driving demand in hospitals and clinics. Surgeons and healthcare providers are increasingly recommending cold therapy as part of recovery protocols to manage pain and reduce complications, further fueling its adoption. These factors, combined with greater consumer awareness of the benefits of cold therapy, are driving sustained growth in the cold pain therapy market across various demographics and regions.Report Scope

The report analyzes the Cold Pain Therapy market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (OTC Products, Prescription Products); Distribution Channel (Hospitals, Retail, ePharmacy); Application (Musculoskeletal Disorders, Sports Medicine, Post-Trauma Therapy, Post-Operative Therapy).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OTC Products segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of 4.5%. The Prescription Products segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $539.6 Million in 2024, and China, forecasted to grow at an impressive 4.1% CAGR to reach $415.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Pain Therapy Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Pain Therapy Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Pain Therapy Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Beiersdorf AG, BREG, Inc., Custom Ice Inc., DJO, LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Cold Pain Therapy market report include:

- 3M Company

- Beiersdorf AG

- BREG, Inc.

- Custom Ice Inc.

- DJO, LLC

- Hisamitsu Pharmaceutical Co., Inc.

- Johnson & Johnson Services, Inc.

- Medline Industries, Inc.

- Ossur

- Performance Health

- Pfizer, Inc.

- Rohto Pharmaceutical Co., Ltd.

- Romsons Group of Industries

- Sanofi

- Unexo Life Sciences Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Beiersdorf AG

- BREG, Inc.

- Custom Ice Inc.

- DJO, LLC

- Hisamitsu Pharmaceutical Co., Inc.

- Johnson & Johnson Services, Inc.

- Medline Industries, Inc.

- Ossur

- Performance Health

- Pfizer, Inc.

- Rohto Pharmaceutical Co., Ltd.

- Romsons Group of Industries

- Sanofi

- Unexo Life Sciences Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |