Global Cloud Workload Protection Market - Key Trends and Drivers Summarized

Why Is Cloud Workload Protection Critical in Modern IT Environments?

As businesses increasingly migrate their applications and services to the cloud, the need for comprehensive Cloud Workload Protection (CWP) has become a top priority. Modern IT environments are highly dynamic, with workloads constantly moving across cloud infrastructures, including public, private, and hybrid clouds. These workloads contain sensitive data and business-critical processes, making them attractive targets for cyberattacks. Cloud workload protection solutions are essential for ensuring that these assets are secure from vulnerabilities such as unauthorized access, malware, and other malicious threats. Unlike traditional on-premise security models that are static and confined to specific infrastructure, cloud workloads are fluid, scaling up or down depending on demand, and can be distributed across multiple locations. This complexity demands a robust and flexible security framework capable of monitoring, identifying, and mitigating risks in real-time across diverse environments. As organizations expand their digital footprint, cloud workload protection offers real-time visibility, automated threat detection, and advanced security measures tailored to cloud-native architectures, making it a critical component of modern IT security strategies.How Are Evolving Cybersecurity Threats Shaping the Cloud Workload Protection Market?

The rise of sophisticated cyberattacks, particularly those targeting cloud environments, is significantly shaping the cloud workload protection landscape. Attackers are now employing advanced techniques such as ransomware, cryptojacking, and supply chain attacks, exploiting vulnerabilities in cloud infrastructures. In this context, the focus is shifting towards proactive security measures that prevent attacks before they occur, rather than merely reacting to breaches after the fact. Cloud workload protection solutions are evolving to incorporate artificial intelligence (AI) and machine learning (ML) capabilities to detect patterns and anomalies that may indicate potential threats. These tools can analyze massive amounts of data in real-time, identifying unusual behavior and providing alerts before an attack can cause damage. Additionally, as containerized applications and microservices become more prevalent, they present new security challenges, such as increased attack surfaces and vulnerabilities during rapid scaling or deployment. CWP platforms are increasingly incorporating security tools that are designed to protect containers and serverless functions, ensuring that these dynamic and ephemeral workloads remain secure. As cyber threats evolve in sophistication, cloud workload protection must adapt with advanced, intelligent security measures capable of defending against the latest attack vectors targeting the cloud.Why Are Businesses Adopting Cloud Workload Protection for Compliance and Governance?

In addition to defending against cyberattacks, businesses are turning to cloud workload protection solutions to meet regulatory compliance and governance requirements. Industries such as finance, healthcare, and government are subject to stringent data protection laws, such as GDPR, HIPAA, and PCI DSS, which require organizations to maintain strict control over how data is stored, accessed, and transferred. As workloads migrate to the cloud, maintaining compliance becomes more complex, given the distributed nature of cloud environments and the involvement of third-party cloud service providers. Cloud workload protection tools help businesses implement and enforce security policies that ensure compliance with these regulations, providing the necessary controls for encryption, identity management, and audit trails. Moreover, cloud environments often involve multi-tenant infrastructures, meaning businesses must safeguard their workloads from potential threats posed by other tenants sharing the same cloud resources. CWP solutions provide robust segmentation and isolation capabilities that protect workloads from unauthorized access and lateral movement within cloud networks. These features not only reduce security risks but also simplify the compliance process by offering automated reporting and real-time monitoring, ensuring that businesses can demonstrate adherence to regulatory requirements with ease.What Are the Factors Fueling Growth in the Cloud Workload Protection Market?

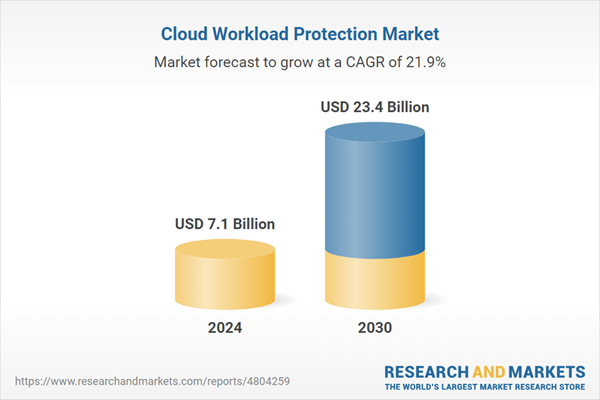

The growth in the cloud workload protection market is driven by several factors, including the increasing adoption of cloud-native applications, the rise in multi-cloud strategies, and the need for enhanced security in complex, distributed environments. As more organizations embrace cloud-native technologies such as containers, Kubernetes, and serverless architectures, they require security solutions designed specifically to protect workloads that are transient and highly dynamic. The shift towards multi-cloud strategies, where businesses use a combination of cloud providers to optimize cost, performance, and flexibility, further drives the need for centralized workload protection that spans across multiple cloud platforms. This trend is creating demand for solutions that offer uniform security policies and visibility across various cloud environments, ensuring consistency in security posture. Furthermore, the ongoing escalation of cyber threats, particularly those targeting cloud workloads, is pushing businesses to invest in more sophisticated and automated protection tools. Companies are increasingly relying on workload protection solutions to provide continuous monitoring, automated response, and intelligent threat detection, helping them stay ahead of attackers in an ever-evolving threat landscape. Finally, the increased focus on compliance and data governance, especially in highly regulated industries, is contributing to the growing demand for CWP solutions. As businesses navigate complex regulatory frameworks and seek to secure sensitive data in cloud environments, the need for robust, scalable, and compliant cloud workload protection tools will continue to fuel market expansion.Report Scope

The report analyzes the Cloud Workload Protection market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Solution (Monitoring & Logging, Policy & Compliance Management, Vulnerability Assessment, Threat Detection & Incident Response, Other Solutions); Deployment (Public Cloud, Private Cloud, Hybrid Cloud); End-Use (BFSI, Healthcare & Life Sciences, IT & Telecom, Retail & Consumer Goods, Manufacturing, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public Cloud Deployment segment, which is expected to reach US$8.5 Billion by 2030 with a CAGR of 17.6%. The Private Cloud Deployment segment is also set to grow at 22.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 20.9% CAGR to reach $3.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Workload Protection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Workload Protection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Workload Protection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bracket, CloudPassage, Inc., Dome9 Security Inc., Evident LLC, Guardicore Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Cloud Workload Protection market report include:

- Bracket

- CloudPassage, Inc.

- Dome9 Security Inc.

- Evident LLC

- Guardicore Ltd.

- HyTrust, Inc.

- Logrhythm, Inc.

- McAfee LLC

- Sophos Ltd.

- Symantec Corporation

- Trend Micro, Inc.

- Tripwire, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bracket

- CloudPassage, Inc.

- Dome9 Security Inc.

- Evident LLC

- Guardicore Ltd.

- HyTrust, Inc.

- Logrhythm, Inc.

- McAfee LLC

- Sophos Ltd.

- Symantec Corporation

- Trend Micro, Inc.

- Tripwire, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.1 Billion |

| Forecasted Market Value ( USD | $ 23.4 Billion |

| Compound Annual Growth Rate | 21.9% |

| Regions Covered | Global |