Global Cloud Supply Chain Management Market - Key Trends and Drivers Summarized

What Is Cloud Supply Chain Management and Why Is It Revolutionizing Logistics?

Cloud Supply Chain Management (Cloud SCM) refers to the integration of cloud-based technology into the management and optimization of supply chains, allowing businesses to monitor and control their entire supply chain in real-time from anywhere in the world. By shifting to the cloud, organizations gain the ability to track goods, manage inventory, and coordinate logistics processes using advanced analytics, artificial intelligence, and real-time data sharing. This system eliminates the need for traditional, siloed on-premise software, creating a more interconnected and transparent supply chain. One of the primary advantages of Cloud SCM is its scalability and flexibility, allowing businesses to adjust their supply chain operations quickly in response to changing market demands, disruptions, or shifts in consumer behavior. Moreover, cloud platforms enable better collaboration between all stakeholders, from suppliers to manufacturers, distributors, and retailers, by centralizing data and providing real-time insights into inventory levels, production schedules, shipping timelines, and more. This technology is particularly vital in today's fast-paced global economy, where supply chain resilience, speed, and accuracy are critical to staying competitive.How Is Cloud Supply Chain Management Transforming Global Trade and Industry Operations?

The adoption of Cloud Supply Chain Management is having a profound impact across industries, from manufacturing and retail to healthcare and agriculture, by enabling more efficient, responsive, and integrated operations. In manufacturing, Cloud SCM allows companies to synchronize their production processes with real-time data on material availability, customer demand, and logistics constraints, reducing inefficiencies and ensuring just-in-time production. This is particularly valuable in industries with complex, multi-tiered supply chains, such as automotive or electronics manufacturing, where disruptions at any stage can cause costly delays. Retailers, particularly e-commerce companies, are leveraging Cloud SCM to manage inventory across multiple locations, track shipments in real time, and optimize order fulfillment processes, ensuring that products are available when and where consumers demand them. The healthcare sector, where supply chain disruptions can have life-threatening consequences, is benefiting from cloud-based systems that ensure a seamless flow of critical supplies, such as medications and medical devices, by providing visibility into stock levels, expiration dates, and delivery schedules. Agriculture is also being transformed by Cloud SCM, which helps farmers and distributors manage the entire supply chain for food products, from harvesting to distribution, ensuring quality control and compliance with regulations while minimizing waste.What Technological Innovations Are Driving Cloud Supply Chain Management?

Several technological innovations are propelling the widespread adoption and effectiveness of Cloud Supply Chain Management. One of the most significant developments is the integration of advanced analytics and artificial intelligence into cloud-based supply chain platforms. AI and machine learning algorithms allow businesses to analyze vast amounts of data from various sources, providing predictive insights into potential supply chain disruptions, demand fluctuations, and optimal resource allocation. For example, these tools can forecast future demand based on historical sales data, seasonal trends, and market conditions, enabling companies to optimize inventory levels and production schedules. Additionally, the Internet of Things (IoT) is playing a critical role in Cloud SCM by connecting physical devices and sensors across the supply chain to the cloud. This network of connected devices provides real-time data on the status and location of goods, machinery, and inventory, enabling businesses to track shipments, monitor equipment health, and ensure timely deliveries. Blockchain technology is also emerging as a key innovation in Cloud SCM, offering enhanced security, transparency, and traceability throughout the supply chain. By creating immutable records of transactions and product movements, blockchain helps companies verify the origin and authenticity of goods, reduce fraud, and ensure compliance with regulatory requirements. Together, these technologies are creating a more intelligent, responsive, and secure supply chain ecosystem.What Are the Key Growth Drivers in the Cloud Supply Chain Management Market?

The growth in the Cloud Supply Chain Management market is driven by several factors, with the increasing complexity of global supply chains and the need for real-time visibility being among the most significant. As businesses expand internationally and deal with a larger network of suppliers, manufacturers, and distributors, the ability to manage these relationships efficiently and mitigate risks becomes more challenging. Cloud SCM provides a centralized platform that enables businesses to gain end-to-end visibility across their supply chains, allowing for better coordination and faster decision-making. Another key driver is the growing pressure on companies to meet consumer demand for faster, more accurate deliveries, particularly in the wake of the e-commerce boom. Consumers today expect same-day or next-day shipping, which requires a highly efficient and responsive supply chain. Cloud SCM solutions, with their real-time data capabilities and integration with logistics providers, allow companies to optimize their delivery processes and meet these heightened expectations. Furthermore, the increasing frequency of supply chain disruptions, whether due to natural disasters, geopolitical issues, or global pandemics, is pushing businesses to adopt cloud-based systems that offer greater flexibility and resilience. Cloud SCM allows companies to quickly adjust their supply chain strategies, reroute shipments, and manage risks in real time, minimizing the impact of such disruptions. Lastly, the growing focus on sustainability and ethical sourcing is also contributing to the rise of Cloud SCM, as companies seek to track and verify their environmental and social impacts across the supply chain.Report Scope

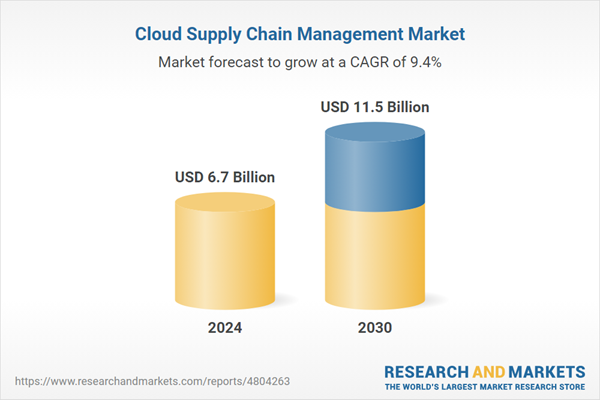

The report analyzes the Cloud Supply Chain Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Solution (Demand Planning & Forecasting, Inventory & Warehouse Management, Product Life Cycle Management, Transportation Management, Sales & Operation Planning, Other Solutions); Deployment (Public Cloud, Private Cloud, Hybrid Cloud); End-Use (Retail & Wholesale, Transportation & Logistics, Manufacturing, Food & Beverage, Healthcare & Life Sciences, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Public Cloud Deployment segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of 8.2%. The Private Cloud Deployment segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Supply Chain Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Supply Chain Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Supply Chain Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cloudlogix, Inc., Highjump, Infor, JDA Software Group, Inc., Kinaxis Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Cloud Supply Chain Management market report include:

- Cloudlogix, Inc.

- Highjump

- Infor

- JDA Software Group, Inc.

- Kinaxis Inc.

- Logility, Inc.

- Manhattan Associates, Inc.

- Oracle Corporation

- SAP SE

- TECSYS, Inc.

- The Descartes Systems Group Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cloudlogix, Inc.

- Highjump

- Infor

- JDA Software Group, Inc.

- Kinaxis Inc.

- Logility, Inc.

- Manhattan Associates, Inc.

- Oracle Corporation

- SAP SE

- TECSYS, Inc.

- The Descartes Systems Group Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.7 Billion |

| Forecasted Market Value ( USD | $ 11.5 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |