Global Cloud Application Security Market - Key Trends and Drivers Summarized

Why Is Cloud Application Security Crucial for Modern Businesses?

Cloud application security has become a critical concern for businesses as they increasingly shift their operations to cloud environments. The adoption of cloud-based applications and services offers significant advantages in terms of scalability, cost savings, and operational efficiency, but it also introduces complex security challenges that organizations must address to protect sensitive data and maintain regulatory compliance. Cloud applications, unlike traditional on-premises systems, operate in a shared infrastructure where data is transmitted, processed, and stored across various cloud providers, exposing them to a wider range of potential vulnerabilities. Cybercriminals are constantly evolving their tactics to exploit these weaknesses, leading to threats such as unauthorized access, data breaches, account hijacking, and insider attacks. As businesses depend more on cloud-based systems to manage critical operations and customer data, the importance of robust cloud application security has intensified. Ensuring secure access, preventing data leaks, and maintaining compliance with industry standards such as GDPR, HIPAA, and PCI-DSS have become top priorities for enterprises across industries. Cloud application security helps organizations protect their assets from the growing wave of cyberattacks and ensures the continuity of business operations, reducing the risk of financial loss, reputational damage, and legal liabilities.How Are Technological Advancements Shaping Cloud Application Security?

Technological advancements are continuously shaping and improving the cloud application security landscape, allowing organizations to address emerging threats with greater precision and agility. One of the most notable innovations in this space is the use of artificial intelligence (AI) and machine learning (ML) to enhance security operations. AI-driven security solutions are capable of analyzing vast amounts of data in real-time, detecting patterns of anomalous behavior that could indicate a cyberattack or insider threat. Machine learning algorithms can learn from historical data and continuously refine their ability to identify potential risks, enabling faster and more accurate threat detection compared to traditional, rule-based systems. Another significant advancement is the growing adoption of automation in security processes. Automation helps organizations reduce the complexity and labor-intensive nature of security management by automating routine tasks such as vulnerability assessments, patch management, and configuration monitoring. This not only reduces the potential for human error but also ensures faster response times to security incidents. The emergence of cloud-native security tools, designed specifically for managing cloud workloads, has also played a pivotal role in securing cloud applications. These tools provide deep visibility into cloud infrastructure, enabling businesses to monitor security risks at every layer of their cloud environment, from virtual machines to containers and serverless architectures. Additionally, the adoption of zero-trust security frameworks has gained momentum in the cloud application security domain. Zero trust assumes that no user, device, or application should be trusted by default, regardless of their location within or outside the network. By enforcing strict verification measures for every access request, zero trust frameworks ensure that cloud applications remain secure even as the number of endpoints, devices, and users accessing cloud resources grows.Where Is Cloud Application Security Having the Biggest Impact?

Cloud application security is having a profound impact across several industries, particularly those where data privacy and regulatory compliance are critical concerns. In the financial services sector, for instance, the use of cloud-based applications for customer portals, mobile banking, and financial transactions has made securing these platforms a top priority. Financial institutions handle vast amounts of sensitive data, and a breach or cyberattack could have devastating consequences for both the institution and its customers. Cloud application security in this sector ensures that sensitive data is encrypted, access is tightly controlled, and that compliance with regulations such as PCI-DSS and GDPR is maintained. In the healthcare industry, cloud application security is essential for protecting patient data stored in electronic health records (EHRs), medical imaging systems, and telemedicine platforms. The healthcare sector faces stringent requirements under regulations like HIPAA, and failure to secure cloud applications could result in both compromised patient safety and hefty regulatory fines. Cloud application security solutions help healthcare providers safeguard their data and maintain patient confidentiality, ensuring that sensitive information is protected while enabling the efficient delivery of care. In the retail and e-commerce industries, the growing reliance on cloud applications for managing inventory, customer data, and payment transactions has made security a vital concern. Retailers must secure cloud platforms against breaches that could expose customer payment information and personal details, which could severely damage their reputation and result in financial losses. Across all of these industries, cloud application security is vital for ensuring the safety and reliability of cloud-based operations, providing the necessary protection for both businesses and their customers.What's Driving the Expansion of the Cloud Application Security Market?

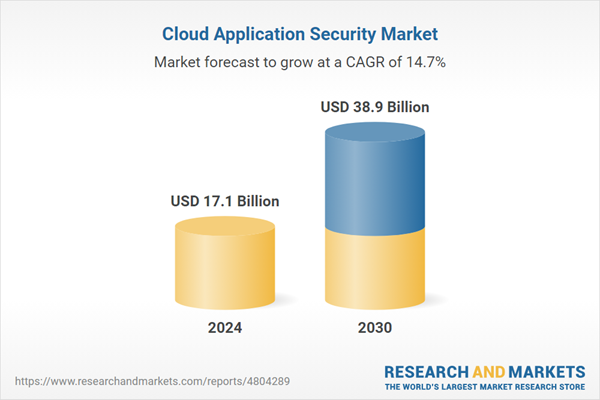

The growth in the cloud application security market is being driven by several key factors, starting with the increasing migration of business applications to the cloud. As organizations across industries embrace digital transformation, the need for secure cloud environments has become paramount. Businesses are moving their critical applications, such as customer relationship management (CRM) systems, enterprise resource planning (ERP) software, and data analytics tools, to the cloud, where they can leverage greater scalability and flexibility. However, this shift has also exposed companies to new vulnerabilities, driving the demand for advanced cloud application security solutions that can protect data, monitor for threats, and ensure compliance with industry regulations. Another significant driver is the rise of sophisticated cyber threats. Cyberattacks targeting cloud applications, including data breaches, distributed denial-of-service (DDoS) attacks, and account hijacking, have become more frequent and advanced, pushing organizations to invest in security solutions that can mitigate these risks. The increasing complexity of multi-cloud and hybrid cloud environments is also contributing to the growth of the cloud application security market. As businesses adopt a mix of public, private, and hybrid cloud infrastructures, they need comprehensive security solutions that provide visibility and control across these diverse environments. The growing importance of zero-trust security models is further accelerating the adoption of cloud application security, as organizations seek to implement stronger access control measures that verify every user and device accessing their cloud resources. Lastly, the shift to remote work has underscored the need for secure access to cloud applications from anywhere. As employees work from home or other remote locations, businesses need cloud application security solutions that ensure secure connectivity and protect sensitive data. These factors, combined with the ongoing expansion of cloud adoption across industries, are driving the rapid growth of the cloud application security market, making it a critical component of modern cybersecurity strategies.Report Scope

The report analyzes the Cloud Application Security market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Organization Size (Large Enterprises, SMEs); Vertical (BFSI, Government & Defense, Healthcare & Life Sciences, IT & Telecom, Retail, Manufacturing, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$20.5 Billion by 2030 with a CAGR of 13.4%. The Services Component segment is also set to grow at 16.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.6 Billion in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $5.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud Application Security Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud Application Security Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud Application Security Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bitglass, Inc., CensorNet Ltd., Ciphercloud, Inc., Cisco Systems, Inc., Fortinet, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 176 companies featured in this Cloud Application Security market report include:

- Bitglass, Inc.

- CensorNet Ltd.

- Ciphercloud, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Microsoft Corporation

- Netskope, Inc.

- Oracle Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Symantec Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bitglass, Inc.

- CensorNet Ltd.

- Ciphercloud, Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Microsoft Corporation

- Netskope, Inc.

- Oracle Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Symantec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 261 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.1 Billion |

| Forecasted Market Value ( USD | $ 38.9 Billion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | Global |