Global Class D Audio Amplifiers Market - Key Trends and Drivers Summarized

Why Are Class D Audio Amplifiers Revolutionizing the Audio Industry?

Class D audio amplifiers have fundamentally transformed the audio landscape by offering highly efficient amplification with minimal power loss, making them the go-to choice for modern audio systems. Unlike traditional amplifiers, which dissipate significant energy in the form of heat, Class D amplifiers switch on and off at an extremely high frequency, reducing heat generation and energy waste. This efficiency allows for smaller heat sinks and more compact designs, making them ideal for portable and compact audio devices, such as smartphones, Bluetooth speakers, and even car audio systems. Another key advantage of Class D amplifiers is their ability to deliver high power output while maintaining sound fidelity, even in small form factors. The technology behind Class D amplification has advanced rapidly, enabling higher-quality sound reproduction that rivals analog amplifiers, with minimal distortion and noise. As consumer electronics continue to evolve, the demand for energy-efficient and powerful amplifiers like Class D has surged, especially in industries where compact size and performance are critical.How Have Technological Advances Enhanced the Performance of Class D Amplifiers?

Technological advancements have played a pivotal role in enhancing the capabilities and performance of Class D amplifiers, addressing early concerns about sound quality and distortion. Improvements in pulse width modulation (PWM), feedback control systems, and semiconductor materials have significantly reduced the distortion levels that once limited the adoption of Class D amplifiers in high-end audio applications. These innovations have resulted in amplifiers that offer near-perfect efficiency while maintaining high sound fidelity, even at louder volumes. Additionally, the integration of digital signal processing (DSP) technology into Class D amplifiers has allowed for more sophisticated sound customization and tuning options, enabling users to fine-tune audio output to their preferences. Advances in MOSFET transistors and GaN (gallium nitride) materials have further boosted switching speeds, reducing power loss and allowing for even more compact designs. This technological progress has expanded the application of Class D amplifiers beyond portable devices to more demanding applications, such as home theater systems, professional audio equipment, and automotive audio systems, where both power efficiency and sound quality are paramount.Which Industries and Applications Are Leading the Adoption of Class D Amplifiers?

Class D amplifiers have seen widespread adoption across several industries, with consumer electronics, automotive, and professional audio equipment leading the way. In consumer electronics, the growing trend toward portable and wireless devices such as Bluetooth speakers, soundbars, and earbuds has driven the demand for compact, energy-efficient amplifiers capable of delivering powerful audio performance. Class D amplifiers are also widely used in automotive audio systems, where the need for powerful yet space-saving amplifiers is critical, particularly as electric vehicles (EVs) continue to rise in popularity. The low power consumption of Class D amplifiers makes them well-suited for EV audio systems, where minimizing battery drain is a key concern. Additionally, the professional audio industry, including live sound, theater, and broadcast applications, has increasingly adopted Class D amplifiers due to their lightweight, high-power output, and ability to maintain audio quality in demanding environments. Home audio and cinema systems are also leveraging Class D technology, as manufacturers prioritize efficiency and compact design without sacrificing sound quality. The versatility and scalability of Class D amplifiers ensure their growing presence in diverse audio applications, from personal devices to large-scale sound systems.What Factors Are Driving Growth in the Class D Amplifier Market?

The growth in the Class D audio amplifier market is driven by several factors, particularly technological advancements and evolving consumer preferences. The continued miniaturization of consumer electronics has significantly expanded the demand for compact, high-efficiency amplifiers, with Class D amplifiers being a perfect fit for portable devices like smartphones, tablets, and wireless speakers. In the automotive sector, the shift toward electric vehicles and the need for lightweight, energy-efficient components has further fueled the adoption of Class D amplifiers in car audio systems. Another key driver is the rise of smart home devices and IoT-enabled audio systems, where manufacturers require amplifiers that can integrate seamlessly with other technologies while delivering high-quality sound. Additionally, the increasing use of digital signal processing (DSP) in audio systems has created new opportunities for Class D amplifiers, allowing for more precise sound customization and better overall performance. The demand for high-quality audio in compact, energy-efficient systems is also being driven by sustainability concerns, as consumers and manufacturers alike prioritize energy-saving technologies. As the market for smart speakers, soundbars, and other connected devices grows, the demand for efficient Class D amplification technology is expected to rise in parallel, solidifying its role as a cornerstone of modern audio systems.Report Scope

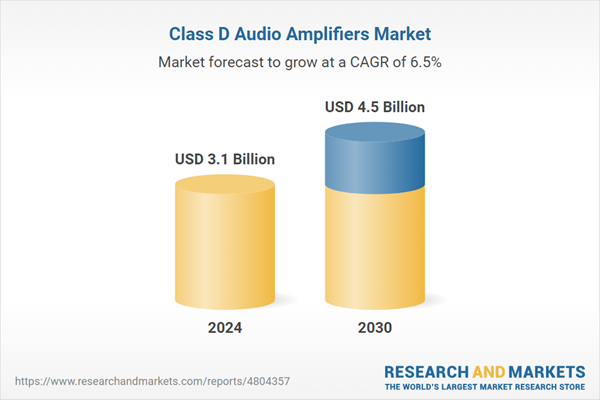

The report analyzes the Class D Audio Amplifiers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Mono Channel, 2-Channel, 4-Channel, 6-Channel, Other Types); End-Use (Consumer Electronics, Automotive, Healthcare, Telecommunications, Industrial & Retail, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mono Channel Amplifiers segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of 6.1%. The 2-Channel Amplifiers segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $819.7 Million in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Class D Audio Amplifiers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Class D Audio Amplifiers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Class D Audio Amplifiers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., Icepower A/S, Infineon Technologies AG, Monolithic Power Systems, Inc., NXP Semiconductors NV and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Class D Audio Amplifiers market report include:

- Analog Devices, Inc.

- Icepower A/S

- Infineon Technologies AG

- Monolithic Power Systems, Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Rohm Semiconductors

- Silicon Laboratories, Inc.

- STMicroelectronics NV

- Texas Instruments, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- Icepower A/S

- Infineon Technologies AG

- Monolithic Power Systems, Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Rohm Semiconductors

- Silicon Laboratories, Inc.

- STMicroelectronics NV

- Texas Instruments, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 224 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.5 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |