Global Cladding Systems Market - Key Trends and Drivers Summarized

Why Are Cladding Systems Crucial for Modern Building Designs?

Cladding systems play an essential role in modern architecture, serving as both a protective barrier and an aesthetic enhancement for buildings. These systems involve applying one material over another to provide a skin-like layer that shields the underlying structure from environmental elements such as wind, rain, and UV radiation. Cladding also improves thermal insulation, energy efficiency, and fire resistance, making it a vital component for sustainable building practices. In addition to functional benefits, cladding systems allow architects to experiment with diverse materials - such as metal, stone, wood, and composite panels - to achieve desired design aesthetics, offering endless customization options for commercial, residential, and industrial projects. The importance of cladding extends beyond mere protection and decoration; it is instrumental in ensuring the structural integrity of a building and enhancing the comfort and safety of its occupants. As urbanization continues and building regulations become more stringent, the demand for advanced cladding systems that combine performance with visual appeal is growing.How Are Technological Advancements Transforming Cladding Systems?

The cladding industry has experienced rapid innovation in recent years, driven by the development of new materials, manufacturing processes, and installation techniques. One of the most significant advancements is the rise of high-performance composite cladding panels, which offer a combination of durability, lightweight properties, and ease of installation. These composite materials, often made from aluminum, fiberglass, or other synthetic compounds, are engineered to provide superior resistance to environmental stressors like moisture, UV rays, and temperature fluctuations. In addition to composites, smart cladding systems are emerging, featuring integrated technologies like energy-efficient coatings or solar panels, enabling buildings to generate energy or regulate temperature more effectively. Furthermore, advancements in fire-resistant materials have led to the creation of cladding that not only protects against fire but also limits its spread, a feature that is becoming increasingly important following high-profile incidents involving cladding-related fires. These innovations are also making cladding systems more sustainable, with recycled and eco-friendly materials gaining popularity. Overall, technology is driving the cladding industry forward, creating more resilient, energy-efficient, and sustainable building solutions.Which Industries and Building Types Are Driving the Demand for Cladding Systems?

A variety of sectors are fueling the demand for advanced cladding systems, particularly in commercial construction, residential housing, and industrial buildings. In the commercial construction sector, cladding systems are widely used in office buildings, retail spaces, and skyscrapers, where aesthetics, durability, and energy efficiency are essential. The ability of modern cladding materials to combine both form and function makes them a popular choice for iconic architectural projects that seek to achieve visually striking designs while maintaining safety and sustainability standards. Residential housing, especially multi-unit developments like apartments and condominiums, is another key driver, where cladding is essential for providing insulation and weather protection. The growing focus on green building certifications, such as LEED and BREEAM, has also encouraged the use of cladding systems that can improve a building's energy efficiency and reduce its carbon footprint. The industrial sector relies on robust cladding systems to protect warehouses, factories, and other facilities from harsh weather conditions, while also addressing concerns about fire resistance and thermal regulation. Additionally, the retrofitting of older buildings to meet modern safety and environmental standards has increased the demand for cladding solutions that can enhance existing structures. Across these sectors, cladding systems are becoming integral to both new constructions and renovations as the market seeks solutions that offer long-term durability, improved performance, and aesthetic versatility.What Are the Key Growth Drivers in the Cladding Systems Market?

The growth in the cladding systems market is driven by several factors, including rising demand for energy-efficient building solutions, stricter fire safety regulations, and the growing need for sustainable construction materials. One of the primary drivers is the increasing focus on reducing energy consumption in buildings, which has led to the adoption of cladding systems that offer superior insulation and help regulate interior temperatures. As a result, materials like insulated metal panels, composite cladding, and ventilated facades are gaining popularity, particularly in regions with extreme weather conditions. Another significant growth driver is the implementation of more rigorous fire safety codes and standards, especially in high-rise buildings, pushing the demand for fire-resistant cladding materials that can prevent the spread of flames in the event of a fire. The construction industry's shift toward sustainability is also driving demand for eco-friendly and recycled cladding materials, as developers and architects look for ways to meet green building certifications and reduce the environmental impact of new constructions. Additionally, the rise of urbanization and increasing construction activities in emerging markets are expanding the cladding systems market, as these regions require cost-effective, durable, and aesthetically pleasing solutions for both residential and commercial projects. Finally, technological advancements in cladding manufacturing and installation processes are making these systems more efficient and easier to implement, further propelling market growth. These factors combined indicate strong growth potential for the cladding systems market in the coming years as it aligns with the global trends of sustainability, safety, and energy efficiency.Report Scope

The report analyzes the Cladding Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Ceramic, Wood, Stucco & Eifs, Brick & Stone, Metal, Vinyl, Fiber Cement, Other Materials); Component (Walls, Roofs, Other Components); Application (Commercial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Walls Component segment, which is expected to reach US$210.8 Billion by 2030 with a CAGR of 6.9%. The Roofs Component segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $75.3 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $99.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cladding Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cladding Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cladding Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alcoa, Inc., Axiall Corporation, Boral Ltd., Cembrit Holding A/S, Compagnie De Saint-Gobain SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Cladding Systems market report include:

- Alcoa, Inc.

- Axiall Corporation

- Boral Ltd.

- Cembrit Holding A/S

- Compagnie De Saint-Gobain SA

- CSR Ltd.

- Etex SA

- James Hardie Industries PLC

- Nichiha Corporation

- Tata Steel Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alcoa, Inc.

- Axiall Corporation

- Boral Ltd.

- Cembrit Holding A/S

- Compagnie De Saint-Gobain SA

- CSR Ltd.

- Etex SA

- James Hardie Industries PLC

- Nichiha Corporation

- Tata Steel Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

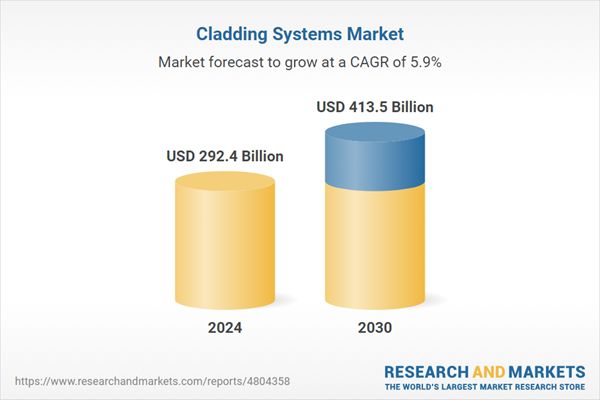

| Estimated Market Value ( USD | $ 292.4 Billion |

| Forecasted Market Value ( USD | $ 413.5 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |