Global Autosamplers Market - Key Trends & Drivers Summarized

Autosamplers are a critical component in modern analytical laboratories, automating the process of sample introduction for various analytical techniques such as chromatography, spectroscopy, and mass spectrometry. By automating sample handling, autosamplers enhance the efficiency, accuracy, and reproducibility of analytical measurements, reducing human error and enabling high-throughput analysis. These devices are particularly beneficial in laboratories where large volumes of samples need to be processed rapidly and consistently. Autosamplers come in various configurations, ranging from simple systems designed for single tasks to complex, multi-functional units capable of handling diverse sample types and integrating seamlessly with sophisticated laboratory information management systems (LIMS).The growth in the autosampler market is driven by several factors, including advancements in analytical instrumentation, increasing demand for high-throughput screening, and the need for greater efficiency in laboratory operations. The market is heading forward to impressive gains and solid growth thrust from increasing R&D activity, laboratory automation trend, food safety concerns, and massive popularity of chromatography in the drug approval arena. The global autosamplers market is gaining high ground with notable expansion of the pharmaceutical industry along with increasing R&D efforts by pharmaceutical companies to develop novel drugs. The market growth is propelled by increasing number of pre-clinical, clinical and drug discovery initiatives by pharmaceutical and biotechnology players to develop new and efficient products. Autosamplers are witnessing increasing adoption for drug discovery, development, and approval programs. In addition, the lab automation trend is poised to create high requirement of autosamplers for clinical and pre-clinical trials.

The integration of autosamplers supports various applications for contract and research laboratories. These systems are slated to gain from rising focus on automation for different workflows and samples. The market growth is buoyed by strong focus on the pharmaceutical industry on R&D activity for new drug development along with increasing government support to early-stage and basic research. Moreover, rising concerns over food safety are anticipated to further bolster growth of the global autosamplers market. Future expansion of the market is expected to be favored by ongoing advances in electrophoresis systems, chromatographs and mass spectrometers.

Report Scope

The report analyzes the Autosamplers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Systems, Accessories); End-Use (Pharma & Biotech Companies, Food & Beverage, Environmental Testing, Oil & Gas, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Autosamplers Systems segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of 6%. The Autosamplers Accessories segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $463.3 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $231.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autosamplers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autosamplers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autosamplers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Inc., Anton Paar GmbH, Avantor, Inc., Bio-Rad Laboratories, Inc., Gilson, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 110 companies featured in this Autosamplers market report include:

- Agilent Technologies, Inc.

- Anton Paar GmbH

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Gilson, Inc.

- HTA S.R.L

- JASCO, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Merck KGaA

- PerkinElmer, Inc.

- Restek Corporation

- SCION Instruments NL BV

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Anton Paar GmbH

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Gilson, Inc.

- HTA S.R.L

- JASCO, Inc.

- KNAUER Wissenschaftliche Geräte GmbH

- Merck KGaA

- PerkinElmer, Inc.

- Restek Corporation

- SCION Instruments NL BV

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 485 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

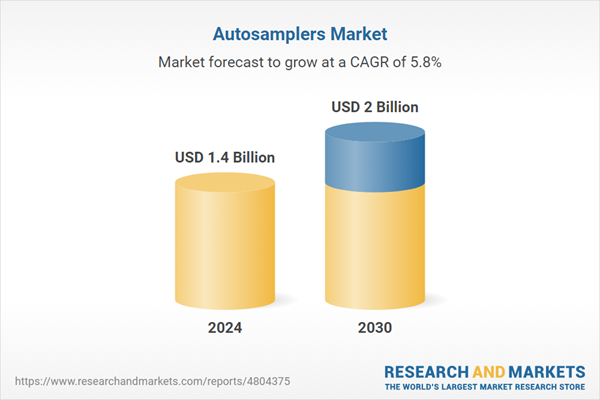

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |