Global Automotive Windshield Market - Key Trends and Drivers Summarized

How Has the Automotive Windshield Evolved Beyond a Simple Safety Component?

The automotive windshield has evolved far beyond its original role as a simple safety component, becoming a crucial part of modern vehicle design and functionality. Traditionally, windshields were primarily designed to protect occupants from wind, debris, and weather while providing structural integrity to the vehicle's cabin. However, advancements in materials and technology have transformed the windshield into a multi-functional component that plays an integral role in vehicle safety and performance. Today's windshields are typically made from laminated glass, a combination of two layers of glass with a plastic interlayer, which not only provides superior impact resistance but also helps to prevent shattering upon impact. This design is critical for occupant safety during accidents, as it helps to maintain the structural integrity of the cabin and prevent passengers from being ejected. Moreover, the modern windshield is designed to work seamlessly with airbags, providing a solid surface for airbags to deploy against, enhancing their effectiveness.What Role Does the Windshield Play in Supporting Advanced Driver Assistance Systems (ADAS)?

The integration of advanced driver assistance systems (ADAS) into modern vehicles has significantly expanded the role of the automotive windshield. Windshields now serve as a mounting platform for a variety of sensors, cameras, and other technologies that enable features such as lane departure warning, automatic emergency braking, and adaptive cruise control. The positioning of these systems on the windshield is crucial for their accurate functioning, as they need an unobstructed view of the road ahead. Additionally, the development of heads-up displays (HUDs), which project important driving information directly onto the windshield, has further enhanced the windshield's role as a critical interface between the driver and the vehicle's technology. As vehicles become more connected and autonomous, the windshield is expected to support even more advanced systems, including augmented reality (AR) displays, which could provide real-time navigation, hazard detection, and other critical driving information directly in the driver's line of sight.How Are Innovations in Windshield Materials and Manufacturing Techniques Enhancing Vehicle Performance?

Innovations in materials and manufacturing techniques are playing a key role in the evolution of automotive windshields, enhancing both safety and performance. The use of advanced laminated glass and coatings has improved the durability and optical clarity of windshields, making them more resistant to impacts and environmental damage, such as UV radiation and thermal stress. In addition, new manufacturing processes have enabled the production of lighter and thinner windshields without compromising strength, contributing to the overall reduction of vehicle weight and improving fuel efficiency. Acoustic windshields, which incorporate sound-dampening layers, are another significant development, providing enhanced noise reduction for a quieter cabin environment. Moreover, the advent of solar control windshields, which incorporate coatings or embedded technologies to reduce heat build-up inside the vehicle, is improving passenger comfort and reducing the need for air conditioning, further contributing to fuel efficiency. These innovations are making the windshield a more integral and advanced component of the modern vehicle.What Are the Key Drivers Behind the Growth of the Automotive Windshield Market?

The growth in the automotive windshield market is driven by several factors, all of which are closely tied to advancements in vehicle technology, design trends, and consumer expectations. The increasing integration of advanced driver assistance systems (ADAS) in vehicles is a major driver, as these systems require high-quality, precision-engineered windshields to function effectively. The rise of electric vehicles (EVs) is also contributing to market growth, as manufacturers seek to develop lighter and more energy-efficient components, including windshields. Additionally, the demand for enhanced safety features, such as laminated glass that can withstand impacts and prevent shattering, is fueling innovation in windshield materials and manufacturing processes. The growing popularity of heads-up displays (HUDs) and augmented reality (AR) technologies, which rely on the windshield as a display surface, is further driving the need for advanced, high-performance windshields. Finally, stringent global regulations regarding vehicle safety and emissions are encouraging automakers to invest in state-of-the-art windshield technologies that can meet these demands while also enhancing the overall driving experience.Report Scope

The report analyzes the Automotive Windshield market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Glass Type (Laminated, Tempered); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$24 Billion by 2030 with a CAGR of 5.2%. The Commercial Vehicles End-Use segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.2 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $7.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Windshield Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Windshield Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Windshield Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGC, Inc., AGC, Inc., AIS Windshield Experts., ALP Group, Berner Group Holding SE & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Automotive Windshield market report include:

- AGC, Inc.

- AGC, Inc.

- AIS Windshield Experts.

- ALP Group

- Berner Group Holding SE & Co. KG

- Comglasco Aguila Glass Corporation

- Euro Car Parts Limited

- Fuyao Glass America

- Olimpia Auto Glass Inc.

- P&A Plastic Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGC, Inc.

- AGC, Inc.

- AIS Windshield Experts.

- ALP Group

- Berner Group Holding SE & Co. KG

- Comglasco Aguila Glass Corporation

- Euro Car Parts Limited

- Fuyao Glass America

- Olimpia Auto Glass Inc.

- P&A Plastic Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

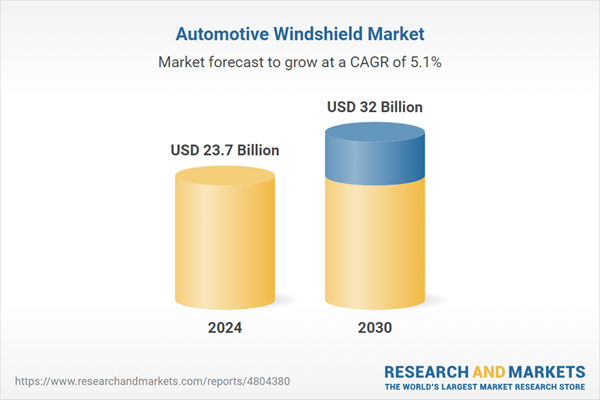

| Estimated Market Value ( USD | $ 23.7 Billion |

| Forecasted Market Value ( USD | $ 32 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |