Global Automotive Paints Market - Key Trends and Drivers Summarized

How Are Automotive Paints Integral to Vehicle Aesthetics and Protection?

Automotive paints are essential in both the aesthetic appeal and the protection of vehicles, playing a dual role that enhances the value and longevity of automobiles. These paints not only provide a visually pleasing finish, reflecting the personality and brand of the vehicle, but also serve as a critical barrier against environmental factors such as UV radiation, moisture, and corrosion. The paint system on a vehicle typically involves multiple layers, including primers, base coats, and clear coats, each serving a specific function to ensure durability and a flawless finish. The choice of paint color and finish can significantly influence consumer perception and purchase decisions, making it a crucial element in automotive design. Moreover, the ability of automotive paints to withstand harsh conditions without fading or chipping is vital for maintaining the vehicle's appearance and resale value over time. As a result, automotive paints are a key consideration in the manufacturing process, with automakers investing heavily in advanced paint technologies that meet both aesthetic and functional demands.What Technological Innovations Are Shaping the Future of Automotive Paints?

Technological advancements are continuously driving innovation in the automotive paints industry, leading to the development of more sophisticated and environmentally friendly products. One of the most significant trends is the shift towards waterborne paints, which offer a lower environmental impact compared to traditional solvent-based paints by reducing volatile organic compound (VOC) emissions. This transition is not only in response to stricter environmental regulations but also reflects growing consumer demand for sustainable products. Additionally, advancements in nanotechnology have enabled the creation of paint formulations with superior durability, scratch resistance, and self-healing properties. These innovations enhance the longevity of the paint finish, reducing the need for frequent touch-ups and contributing to the overall sustainability of the vehicle. Another key development is the emergence of smart paints, which can change color or opacity in response to external stimuli, such as temperature or light, offering a new level of customization and functionality for consumers. These technological breakthroughs are reshaping the automotive paints landscape, providing manufacturers with the tools to create more durable, eco-friendly, and customizable finishes.What Are the Challenges and Opportunities in the Automotive Paints Market?

The automotive paints market is navigating a complex environment of challenges and opportunities, driven by evolving industry trends and consumer preferences. One of the primary challenges is the need to balance cost, performance, and environmental impact in paint formulations. While there is growing demand for high-performance paints that offer exceptional durability and resistance to environmental factors, there is also increasing pressure to reduce the environmental footprint of paint manufacturing and application processes. This challenge is compounded by the rising cost of raw materials, which can impact the affordability of advanced paint technologies. However, these challenges also present significant opportunities for innovation. The increasing consumer preference for unique and customized vehicle finishes is driving demand for specialized paint products, such as matte, pearlescent, and metallic finishes, which require advanced formulations and application techniques. Moreover, the expansion of the electric vehicle market presents new opportunities for automotive paints, as these vehicles often feature unique design elements and colors that differentiate them from traditional internal combustion engine vehicles. The ongoing trend towards sustainability is also creating opportunities for the development and adoption of more eco-friendly paints and coatings, positioning manufacturers to meet the growing demand for greener products.What Factors Are Driving Growth in the Automotive Paints Market?

The growth in the automotive paints market is driven by several factors that align with broader trends in automotive design, technology, and consumer behavior. One of the key drivers is the increasing global production and sales of vehicles, particularly in emerging markets, where rising incomes and urbanization are fueling demand for new cars. This growth in vehicle production directly translates to higher demand for automotive paints. Technological advancements, particularly in the development of eco-friendly and high-performance paint formulations, are also propelling market growth by enabling manufacturers to meet stringent environmental regulations while offering superior product performance. The shift towards electric vehicles is another significant factor, as these vehicles often require specialized paints and coatings that can withstand the unique thermal and chemical conditions associated with electric drivetrains. Additionally, the growing consumer demand for personalized and premium vehicle finishes is driving innovation in paint technologies, with manufacturers offering a wider range of colors, finishes, and effects to cater to diverse customer preferences. These factors, combined with the ongoing focus on sustainability and environmental responsibility, are shaping a dynamic and expanding market for automotive paints.Report Scope

The report analyzes the Automotive Paints market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (E-Coat, Primer, Basecoat, Clearcoat); Resin (Polyurethane, Epoxy, Acrylic, Other Resins); Technology (Water, Solvent, Powder); Paint Equipment (Airless Spray Gun, Electrostatic Spray Gun).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Clearcoat segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of 2.1%. The Primer segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.6 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Paints Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Paints Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Paints Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Akzo Nobel NV, BASF SE, Covestro AG, Dow Chemical Company, The and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Automotive Paints market report include:

- 3M Company

- Akzo Nobel NV

- BASF SE

- Covestro AG

- Dow Chemical Company, The

- KCC Corporation

- Nippon Paint Co., Ltd.

- PPG Industries, Inc.

- Solvay SA

- Valspar Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Akzo Nobel NV

- BASF SE

- Covestro AG

- Dow Chemical Company, The

- KCC Corporation

- Nippon Paint Co., Ltd.

- PPG Industries, Inc.

- Solvay SA

- Valspar Corporation

Table Information

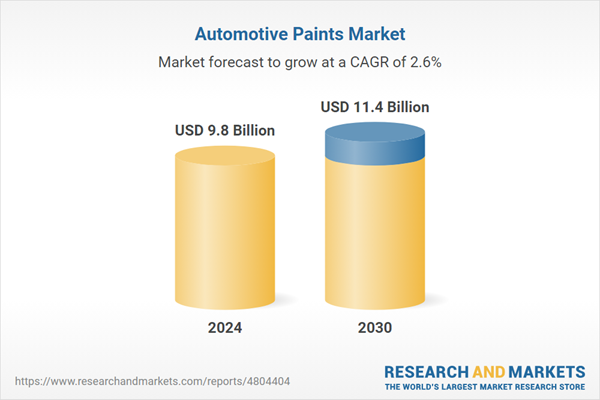

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.8 Billion |

| Forecasted Market Value ( USD | $ 11.4 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |