Global Automotive Interior Materials Market - Key Trends and Drivers Summarized

What Makes Automotive Interior Materials Critical To Vehicle Design?

The selection of automotive interior materials is a pivotal aspect of vehicle design, significantly influencing both aesthetics and functionality. These materials, ranging from traditional leather and textiles to advanced composites and smart fabrics, are not merely about appearance; they play a crucial role in shaping the overall driving experience. The tactile feel, durability, and acoustic properties of interior materials can greatly impact driver and passenger comfort, while also contributing to the vehicle's perceived quality and luxury. With the increasing focus on creating personalized and comfortable cabin environments, automakers are pushing the boundaries of material science to offer interiors that are both stylish and functional. The rise of electric vehicles (EVs) has further emphasized the importance of lightweight and sustainable materials, as manufacturers seek to enhance energy efficiency without compromising on comfort or safety. Consequently, the choice of interior materials is no longer a secondary consideration but a core component of vehicle design and branding.How Are Technological Innovations Reshaping The Automotive Interior Landscape?

Technological advancements are transforming the automotive interior materials landscape, leading to the development of smarter, more sustainable, and highly customizable options. Innovations in material science have given rise to new products such as smart fabrics, which can integrate electronic functions like temperature control and connectivity directly into the vehicle's interior. Additionally, the advent of 3D printing technology has opened up possibilities for highly customized interior components, allowing manufacturers to create complex designs that were previously unfeasible with traditional manufacturing methods. The push towards sustainability has also led to the increased use of recycled and bio-based materials, aligning with broader environmental goals and responding to consumer demand for eco-friendly options. Moreover, as autonomous vehicles become more of a reality, the focus on interior materials has shifted from traditional durability and aesthetics to enhancing comfort and functionality, with materials now being selected for their ability to support a more relaxed, home-like cabin environment. These innovations are not just meeting current demands but are also setting the stage for the future of automotive interiors.What Are The Key Challenges And Opportunities In The Automotive Interior Materials Market?

The automotive interior materials market is fraught with challenges and opportunities, as manufacturers navigate the complex demands of modern consumers while adhering to stringent regulatory requirements. One of the primary challenges lies in balancing the need for luxurious, high-quality interiors with the growing pressure to reduce vehicle weight and improve fuel efficiency, particularly in electric vehicles. The shift towards more sustainable materials, such as recycled plastics and natural fibers, presents both an opportunity and a challenge, as these materials must meet the rigorous safety and performance standards expected in automotive applications. Another significant challenge is the need for interior materials that can withstand the test of time, especially in ride-sharing and fleet vehicles that experience higher usage rates than personal vehicles. However, these challenges also present opportunities for innovation, as companies that can successfully develop materials that are lightweight, durable, and sustainable are likely to gain a competitive edge in the market. The integration of smart materials that enhance the connectivity and functionality of vehicle interiors is another area where significant growth opportunities exist, particularly as consumers increasingly prioritize technology in their vehicles.What Factors Are Driving Growth In The Automotive Interior Materials Market?

The growth in the automotive interior materials market is driven by several factors that reflect broader trends in technology, consumer behavior, and vehicle design. One of the most significant drivers is the increasing consumer demand for customized and premium interiors, which has spurred the adoption of high-quality, aesthetically pleasing materials in vehicles across all segments. The rise of electric and hybrid vehicles is another key factor, as these vehicles require lightweight materials to enhance energy efficiency, pushing manufacturers to innovate in the development of advanced composites and other lightweight alternatives. Additionally, the trend towards sustainability has led to a growing demand for eco-friendly materials, such as recycled and bio-based options, which align with both consumer preferences and regulatory requirements. The shift towards autonomous driving is also impacting the market, as it places a greater emphasis on interior comfort and functionality, driving the development of materials that can enhance the passenger experience in these next-generation vehicles. Furthermore, the integration of smart technologies into vehicle interiors is accelerating the demand for innovative materials that can support new functionalities, such as in-seat heating, ambient lighting, and enhanced connectivity, making the automotive interior materials market a dynamic and rapidly evolving sector.Report Scope

The report analyzes the Automotive Interior Materials market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Polymers, Synthetic Leather, Genuine Leather, Fabric, Other Types); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polymers segment, which is expected to reach US$23.8 Billion by 2030 with a CAGR of 3.6%. The Synthetic Leather segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.5 Billion in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $12.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Interior Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Interior Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Interior Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adient PLC, AGM Automotive, Benecke-Kaliko AG, BOXMARK Leather GmbH & Co KG, Calsonic Kansei Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Automotive Interior Materials market report include:

- Adient PLC

- AGM Automotive

- Benecke-Kaliko AG

- BOXMARK Leather GmbH & Co KG

- Calsonic Kansei Corporation

- Classic Soft Trim, Inc.

- Eissmann Automotive Deutschland GmbH

- Elmo Sweden AB

- Faurecia SA

- Fritz Draxlmaier GmbH & Co. KG (Draxlmaier Group)

- Grammer AG

- Groclin SA

- Grupo Antolin-Irausa SA

- Katzkin Leather, Inc.

- Lear Corporation

- Magna International Inc.

- Nbhx Trim GmbH

- Sage Automotive Interiors, Inc.

- Seiren Co., Ltd.

- SMS Auto Fabrics

- Toyoda Gosei Co., Ltd.

- Toyota Boshoku Corporation

- Wollsdorf Leder Schmidt & Co. Ges.M.B.H.

- Yanfeng Automotive Interior Systems

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adient PLC

- AGM Automotive

- Benecke-Kaliko AG

- BOXMARK Leather GmbH & Co KG

- Calsonic Kansei Corporation

- Classic Soft Trim, Inc.

- Eissmann Automotive Deutschland GmbH

- Elmo Sweden AB

- Faurecia SA

- Fritz Draxlmaier GmbH & Co. KG (Draxlmaier Group)

- Grammer AG

- Groclin SA

- Grupo Antolin-Irausa SA

- Katzkin Leather, Inc.

- Lear Corporation

- Magna International Inc.

- Nbhx Trim GmbH

- Sage Automotive Interiors, Inc.

- Seiren Co., Ltd.

- SMS Auto Fabrics

- Toyoda Gosei Co., Ltd.

- Toyota Boshoku Corporation

- Wollsdorf Leder Schmidt & Co. Ges.M.B.H.

- Yanfeng Automotive Interior Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

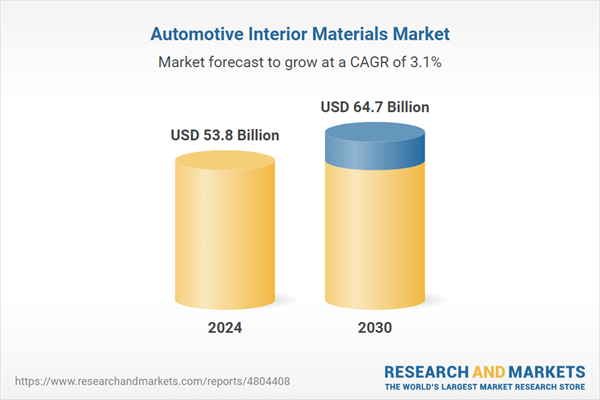

| Estimated Market Value ( USD | $ 53.8 Billion |

| Forecasted Market Value ( USD | $ 64.7 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |