Global Automotive Diagnostic Scan Tools Market - Key Trends and Drivers Summarized

How Are Automotive Diagnostic Scan Tools Revolutionizing Vehicle Maintenance?

Automotive diagnostic scan tools have become indispensable in the modern vehicle maintenance and repair landscape, but how exactly are they transforming the industry? These tools allow mechanics and technicians to quickly and accurately diagnose a wide range of vehicle issues, from engine problems to electrical faults. By interfacing directly with a vehicle's onboard computer systems, diagnostic scan tools can retrieve error codes, monitor system performance, and even reprogram electronic control units (ECUs). This capability is crucial as vehicles become increasingly complex, with more electronics and software integrated into their systems. The speed and accuracy provided by diagnostic scan tools not only enhance the efficiency of repair processes but also reduce the likelihood of misdiagnosis, which can lead to unnecessary repairs and higher costs for vehicle owners. As the automotive industry continues to evolve, the role of these tools in ensuring vehicles are properly maintained and safe to operate is more critical than ever.What Technological Innovations Are Shaping the Future of Automotive Diagnostic Tools?

The development of automotive diagnostic scan tools is closely tied to advancements in technology. But what innovations are driving the next generation of these tools? One of the most significant trends is the integration of wireless connectivity and cloud computing. Modern diagnostic tools can now connect to cloud-based databases, allowing technicians to access the latest software updates, diagnostic data, and repair procedures directly from their scan tools. This connectivity also facilitates remote diagnostics, where technicians can diagnose issues in a vehicle from a different location, greatly expanding the possibilities for service delivery. Additionally, the rise of artificial intelligence (AI) and machine learning is enabling more advanced diagnostic capabilities, with tools that can learn from previous repairs and improve their diagnostic accuracy over time. The growing use of mobile apps linked to diagnostic scan tools is another innovation, allowing vehicle owners to perform basic diagnostics themselves, thereby empowering them with more control over their vehicle's health. These technological advancements are not only enhancing the functionality of diagnostic tools but also making them more accessible and user-friendly for both professionals and consumers.What Market Dynamics Are Influencing the Demand for Automotive Diagnostic Scan Tools?

Several key market dynamics are shaping the demand for automotive diagnostic scan tools, reflecting broader trends within the automotive industry. How are these dynamics influencing the market? The increasing complexity of modern vehicles, driven by the integration of advanced electronics, sensors, and software, is one of the primary factors driving the demand for sophisticated diagnostic tools. As vehicles become more technologically advanced, traditional diagnostic methods are no longer sufficient, necessitating the use of high-tech scan tools that can accurately diagnose issues in these complex systems. The growing emphasis on preventive maintenance and the need for faster, more efficient repairs is also contributing to the increased demand for diagnostic scan tools. Additionally, the expansion of the automotive aftermarket, particularly in emerging markets, is driving the need for affordable and reliable diagnostic solutions that can be used in a wide range of vehicles. The rise of electric vehicles (EVs) is another significant factor, as these vehicles require specialized diagnostic tools that can interface with their unique powertrains and battery management systems. These market dynamics underscore the essential role that diagnostic scan tools play in the modern automotive industry, from ensuring vehicle safety to reducing repair costs and downtime.What Are the Key Growth Drivers in the Automotive Diagnostic Scan Tool Market?

The growth in the automotive diagnostic scan tool market is driven by several factors that are reshaping the industry. The increasing complexity of vehicles, particularly with the rise of electric and hybrid powertrains, is a major driver, as these vehicles require advanced diagnostic tools that can handle the intricacies of their systems. The expansion of the global automotive aftermarket, especially in emerging markets, is also propelling demand for diagnostic tools that are both affordable and versatile. Another significant factor is the growing adoption of connected cars, which generate vast amounts of data that can be analyzed using diagnostic tools to predict and prevent potential issues before they occur. The trend towards remote diagnostics, facilitated by advancements in wireless technology and cloud computing, is further expanding the market by allowing technicians to diagnose and repair vehicles from afar. Additionally, regulatory pressures to reduce vehicle emissions and improve safety are driving the need for more sophisticated diagnostic tools that can ensure compliance with these standards. Finally, the increasing focus on customer satisfaction and the desire to reduce vehicle downtime are leading to greater investment in diagnostic technologies, as automakers and service providers seek to offer faster and more accurate repairs.Report Scope

The report analyzes the Automotive Diagnostic Scan Tools market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Workshop Equipment (Wheel Alignment Equipment, Exhaust Gas Analyzer, Paint Scan Equipment, Dynamometer, Other Workshop Equipment); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$33 Billion by 2030 with a CAGR of 4.3%. The Commercial Vehicles End-Use segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.3 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $9.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Diagnostic Scan Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Diagnostic Scan Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Diagnostic Scan Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACTIA Group, Avl List GmbH, Continental AG, Delphi Auto Parts, Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 27 companies featured in this Automotive Diagnostic Scan Tools market report include:

- ACTIA Group

- Avl List GmbH

- Continental AG

- Delphi Auto Parts

- Denso Corporation

- Hickok Waekon LLC

- KPIT Technologies Ltd.

- Robert Bosch GmbH

- SGS SA

- Siemens AG

- Snap-on, Inc.

- Softing AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACTIA Group

- Avl List GmbH

- Continental AG

- Delphi Auto Parts

- Denso Corporation

- Hickok Waekon LLC

- KPIT Technologies Ltd.

- Robert Bosch GmbH

- SGS SA

- Siemens AG

- Snap-on, Inc.

- Softing AG

Table Information

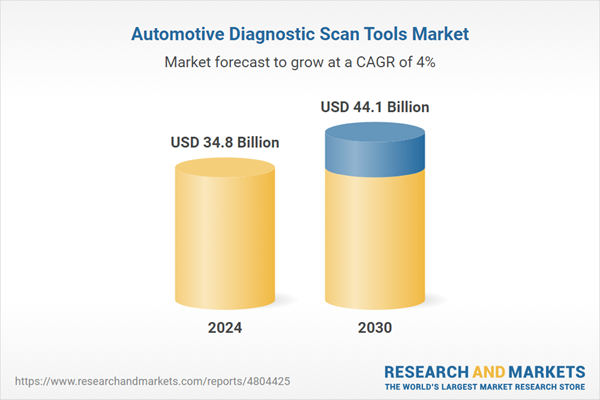

| Report Attribute | Details |

|---|---|

| No. of Pages | 237 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.8 Billion |

| Forecasted Market Value ( USD | $ 44.1 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |