Global Automotive Catalysts Market - Key Trends and Drivers Summarized

What Makes Automotive Catalysts Indispensable in Modern Emission Control Systems?

Automotive catalysts have become a cornerstone of modern emission control systems, playing a crucial role in reducing harmful emissions from internal combustion engines. These catalysts, typically made from precious metals like platinum, palladium, and rhodium, facilitate chemical reactions that convert toxic gases such as carbon monoxide, hydrocarbons, and nitrogen oxides into less harmful substances like carbon dioxide, water vapor, and nitrogen. The importance of these catalysts has grown significantly in recent decades as governments worldwide have imposed stricter emission regulations to combat air pollution and climate change. As a result, automotive catalysts are now standard components in almost all vehicles equipped with internal combustion engines. Their effectiveness in mitigating environmental impact makes them indispensable, not just in conventional gasoline and diesel vehicles, but also in hybrid powertrains, where they continue to play a vital role in emission reduction. As emission standards become increasingly stringent, the demand for more advanced and efficient catalyst technologies is expected to rise, pushing the boundaries of innovation in this field.How Are Technological Advancements Shaping the Future of Automotive Catalysts?

The automotive catalyst industry is witnessing a wave of technological advancements that are poised to redefine the future of emission control. One of the most significant developments is the incorporation of nanotechnology, which allows for the creation of catalysts with higher surface areas and improved reactivity. This innovation has led to the development of more efficient catalysts that require fewer precious metals, reducing costs while maintaining or even enhancing performance. Additionally, advancements in catalyst coating technologies have improved the durability and longevity of catalysts, making them more resistant to high temperatures and harsh operating conditions. Another emerging trend is the integration of dual-function catalysts, which combine multiple catalytic processes in a single unit, optimizing space and reducing weight in modern vehicles. This is particularly relevant for hybrid and electric vehicles, where space and weight savings are critical for maximizing efficiency. These technological innovations are not only driving the evolution of automotive catalysts but are also opening new avenues for their application in next-generation vehicles.What Are the Emerging Trends in the Adoption of Automotive Catalysts?

The adoption of automotive catalysts is being shaped by several emerging trends that reflect broader shifts in the automotive industry and consumer behavior. One of the most notable trends is the increasing penetration of electric and hybrid vehicles, which, despite relying less on traditional combustion engines, still require sophisticated catalytic systems to manage emissions during periods when the engine is running. This shift has led to the development of specialized catalysts tailored for hybrid powertrains, where the engine may operate intermittently, necessitating quick and efficient emission control upon startup. Another trend is the growing focus on reducing the overall environmental footprint of vehicles, which has spurred the adoption of more sustainable catalyst production methods and the use of recycled materials. Additionally, the rise of urbanization and the associated increase in vehicle density have intensified the demand for high-performance catalysts that can efficiently reduce emissions in congested, stop-and-go traffic conditions. These trends are driving the continuous evolution of automotive catalysts, ensuring they remain relevant and effective in an ever-changing automotive landscape.What Are the Key Drivers Fueling Growth in the Automotive Catalyst Market?

The growth in the automotive catalyst market is driven by several factors that are closely tied to technological advancements, regulatory developments, and shifts in consumer preferences. First and foremost, the tightening of global emission standards, particularly in regions like Europe, North America, and Asia-Pacific, has significantly propelled the demand for more advanced and efficient catalysts. Automakers are under increasing pressure to meet these stringent standards, which has led to the widespread adoption of cutting-edge catalytic technologies. Furthermore, the rapid expansion of the electric and hybrid vehicle market has created new opportunities for catalyst manufacturers, as these vehicles require specialized catalysts for their internal combustion engines and emissions control systems. Another critical driver is the growing consumer demand for environmentally friendly vehicles, which has prompted automakers to invest in cleaner technologies, including next-generation automotive catalysts. Additionally, advancements in catalyst recycling and the use of sustainable materials are becoming increasingly important as the industry seeks to reduce its reliance on precious metals and minimize its environmental impact. These factors, combined with the continuous push for innovation, are expected to sustain strong growth in the automotive catalyst market in the coming years.Report Scope

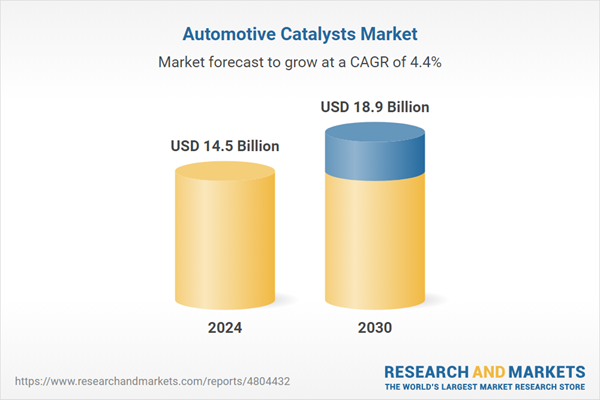

The report analyzes the Automotive Catalysts market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Palladium, Platinum, Rhodium); Vehicle Type (Light-Duty Vehicles, Heavy-Duty Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Palladium segment, which is expected to reach US$10.2 Billion by 2030 with a CAGR of 4.4%. The Platinum segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Catalysts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Catalysts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Catalysts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Cataler Corporation, Cummins, Inc., Heraeus Holding GmbH, INTERKAT Catalyst GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Catalysts market report include:

- BASF SE

- Cataler Corporation

- Cummins, Inc.

- Heraeus Holding GmbH

- INTERKAT Catalyst GmbH

- Johnson Matthey PLC

- Tenneco, Inc.

- Umicore NV/SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Cataler Corporation

- Cummins, Inc.

- Heraeus Holding GmbH

- INTERKAT Catalyst GmbH

- Johnson Matthey PLC

- Tenneco, Inc.

- Umicore NV/SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 18.9 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |