Global Data Center Solutions Market - Key Trends and Drivers Summarized

What Constitutes Comprehensive Data Center Solutions and Their Significance in Modern IT Infrastructure?

Data center solutions encompass a wide range of services, technologies, and products designed to support the infrastructure of modern data centers, which are the epicenters of IT operations for businesses worldwide. These solutions aim to optimize the performance, scalability, and efficiency of data centers, addressing aspects such as server density, networking, power management, cooling systems, and security. As businesses continue to generate and process unprecedented volumes of data, the need for robust, scalable, and efficient data centers becomes paramount. Data center solutions are tailored to ensure that these facilities can handle the demands of heavy data traffic and high transaction rates effectively, without compromising on speed or availability. This comprehensive approach not only supports the smooth operation of data centers but also helps businesses align their IT infrastructure with their strategic goals, ensuring agility and competitiveness in a fast-evolving digital landscape.How Are Emerging Technologies Transforming Data Center Solutions?

The rapid advancement of technology has significantly transformed data center solutions, incorporating cutting-edge innovations that enhance their capability and functionality. One of the key areas of transformation is the integration of artificial intelligence (AI) and machine learning (ML), which facilitates more intelligent and automated management of data center operations. These technologies enable predictive analytics for maintenance, optimizing energy consumption, and improving overall system reliability. Furthermore, the adoption of software-defined networking (SDN) and network functions virtualization (NFV) in data centers allows for more flexible and efficient network management, reducing operational costs and enhancing performance. Additionally, advancements in cooling technology, such as liquid cooling and advanced HVAC systems, are being implemented to address the increasing heat loads produced by high-performance computing resources, ensuring optimal hardware operation and longevity.What Challenges Do Data Center Solutions Aim to Overcome?

The dynamic nature of technology and the exponential growth of data pose significant challenges that data center solutions strive to overcome. One of the primary challenges is the need for data centers to be both highly available and resilient, as downtime can lead to significant financial losses and damage to a company's reputation. Data center solutions focus on building redundancy and failover capabilities to ensure continuous service availability. Another challenge is the scaling of resources; as organizations grow, their data needs expand, requiring data centers to scale efficiently without incurring prohibitive costs. Energy consumption also poses a significant challenge, as data centers are one of the largest consumers of power in the corporate world. Modern data center solutions emphasize energy efficiency, incorporating green technologies and designs that reduce the overall environmental impact while maintaining performance.What Drives the Growth in the Data Center Solutions Market?

The growth in the data center solutions market is driven by several factors, starting with the global increase in data consumption and cloud-based services. As enterprises continue to shift towards digital platforms, there is a burgeoning demand for data centers capable of supporting vast amounts of data and high-speed computing. This demand necessitates advanced solutions that can enhance data center capacity and efficiency. Additionally, the push towards globalization has compelled companies to ensure their data centers can operate seamlessly across different regions, adhering to various regulatory standards and providing uninterrupted services. The technological shift towards IoT, big data analytics, and AI also propels the need for sophisticated data center solutions capable of supporting these technologies. Moreover, as environmental concerns become more pronounced, there is an increasing focus on sustainable practices within data centers, driving innovations in energy-efficient solutions. These factors, combined with the critical need for businesses to maintain competitive advantage and operational efficiency in a digital-first world, ensure sustained growth and evolution in the data center solutions market.Report Scope

The report analyzes the Data Center Solutions market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (IT & Telecom, BFSI, Government, Energy, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the IT & Telecom End-Use segment, which is expected to reach US$35.3 Billion by 2030 with a CAGR of 9.9%. The BFSI End-Use segment is also set to grow at 11.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14 Billion in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $13.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Data Center Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Data Center Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Data Center Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Black Box Corporation, Delta Electronics, Inc., Eaton Corporation, Emerson Electric Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Data Center Solutions market report include:

- ABB Group

- Black Box Corporation

- Delta Electronics, Inc.

- Eaton Corporation

- Emerson Electric Company

- Hewlett-Packard Development Company LP

- Rittal GmbH & Co. KG

- Schneider Electric SA

- Siemens AG

- Tripp Lite

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Black Box Corporation

- Delta Electronics, Inc.

- Eaton Corporation

- Emerson Electric Company

- Hewlett-Packard Development Company LP

- Rittal GmbH & Co. KG

- Schneider Electric SA

- Siemens AG

- Tripp Lite

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

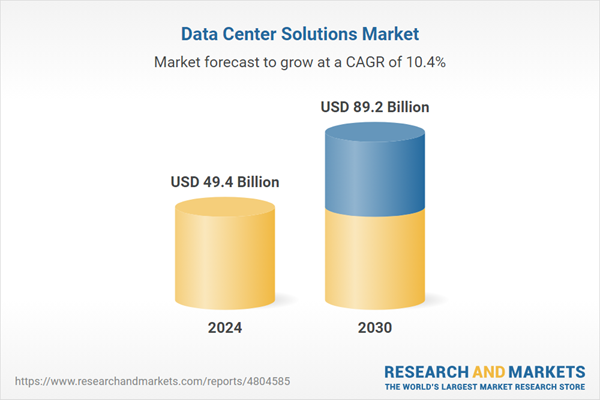

| Estimated Market Value ( USD | $ 49.4 Billion |

| Forecasted Market Value ( USD | $ 89.2 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |