Global Circuit Protection Market - Key Trends and Drivers Summarized

Why Is Circuit Protection Vital in Modern Electrical Systems?

Circuit protection plays an essential role in safeguarding electrical systems from damage caused by overloads, short circuits, and electrical faults. These protective devices - such as fuses, circuit breakers, surge protectors, and relays - are designed to interrupt the flow of electricity when dangerous conditions arise, preventing overheating, fire hazards, or equipment damage. With the increasing complexity of today's electrical networks, from residential systems to industrial applications, reliable circuit protection is more important than ever. As the demand for electricity rises and as modern electrical systems become more sensitive and integrated, ensuring that circuits are adequately protected is critical for preventing costly downtime, maintaining system reliability, and protecting valuable equipment. Circuit protection not only ensures the safety of electrical systems but also extends the lifespan of devices by preventing damage caused by electrical disturbances. In sectors such as telecommunications, energy, and transportation, circuit protection is indispensable for maintaining uninterrupted service and preventing catastrophic failures.How Are Technological Advancements Revolutionizing Circuit Protection Devices?

The field of circuit protection has seen significant advancements in recent years, driven by the development of smarter and more adaptive protection technologies. Innovations in circuit protection devices, such as smart circuit breakers and programmable relays, have improved the ability of electrical systems to respond to real-time conditions. These advanced devices can monitor electrical loads, detect potential issues early, and provide diagnostics to identify and address faults before they result in major damage. With the rise of the Internet of Things (IoT) and connected devices, smart circuit protection systems can communicate with other components of an electrical network, enabling remote monitoring and control. This has greatly enhanced the efficiency of maintenance and troubleshooting, particularly in large-scale industrial and commercial applications. Another area of innovation is in surge protection, where devices are becoming more effective at protecting sensitive electronics from transient voltage spikes caused by lightning strikes, power surges, or switching events. These technological advancements are not only improving the safety and reliability of electrical systems but are also making them more adaptable to the growing complexity of modern infrastructures, including smart grids and renewable energy integration.Which Industries Are Most Dependent on Circuit Protection for Reliability and Safety?

Several industries rely heavily on robust circuit protection solutions to ensure the reliability and safety of their electrical systems, with critical sectors such as energy, manufacturing, and telecommunications leading the way. In the energy sector, particularly in power generation and distribution, circuit protection is vital to safeguarding equipment like transformers, generators, and grid components from overloads and faults. As renewable energy sources such as solar and wind power are integrated into the grid, the need for dynamic circuit protection solutions that can handle variable loads and potential surges is becoming increasingly important. In manufacturing, circuit protection is crucial to preventing costly machinery breakdowns and minimizing production downtime. Industrial facilities rely on complex electrical systems to power their operations, and any interruption can result in significant financial losses. The telecommunications industry, which depends on a continuous flow of data and communication signals, uses sophisticated circuit protection mechanisms to ensure that sensitive electronics are shielded from voltage surges and fluctuations that could cause service disruptions. The automotive sector, particularly with the rise of electric vehicles (EVs), also places a premium on advanced circuit protection systems that can safeguard battery management systems, power electronics, and onboard computers. Across these industries, reliable circuit protection is key to maintaining operational efficiency, protecting sensitive equipment, and ensuring the safety of workers and consumers.What Are the Key Growth Drivers in the Circuit Protection Market?

The growth in the circuit protection market is driven by several factors, with increasing electrification and the rising demand for advanced electronics at the forefront. One of the primary drivers is the rapid expansion of renewable energy projects, such as solar and wind power installations, which require advanced circuit protection to manage variable power loads and prevent system failures. As more homes and industries integrate renewable energy sources into their electrical grids, the need for reliable and adaptive protection solutions is growing. The automotive industry's shift towards electric vehicles (EVs) is another major growth driver, as EVs require sophisticated circuit protection systems to safeguard batteries and power electronics from overloads and short circuits. Additionally, the trend toward smart homes and buildings, equipped with IoT-enabled devices and automated systems, has increased the demand for circuit protection devices that can manage complex electrical loads and provide enhanced safety. The rising consumer awareness about the importance of protecting electronic devices from power surges and voltage fluctuations is also boosting the market for surge protectors and similar products. In industrial and commercial settings, the push for operational efficiency and the need to minimize downtime are driving the adoption of smart circuit protection solutions that offer real-time monitoring and diagnostic capabilities. Furthermore, as global regulatory standards become stricter regarding electrical safety, industries are being pushed to invest in more advanced circuit protection systems to comply with safety regulations and avoid costly fines. These diverse trends are contributing to the steady growth of the circuit protection market, as both businesses and consumers prioritize the reliability and safety of their electrical systems.Report Scope

The report analyzes the Circuit Protection market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Device (ESD Protection Devices, Surge Protection Devices, Circuit Breakers, Fuses); End-Use (Construction, Electronics & Electrical Equipment, Automotive & Transportation, Industrial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ESD Protection Devices segment, which is expected to reach US$25.3 Billion by 2030 with a CAGR of 6.2%. The Surge Protection Devices segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $14.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Circuit Protection Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Circuit Protection Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Circuit Protection Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Bel Fuse, Inc., Eaton Corporation PLC, General Electric Company, Larsen & Toubro Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Circuit Protection market report include:

- ABB Ltd.

- Bel Fuse, Inc.

- Eaton Corporation PLC

- General Electric Company

- Larsen & Toubro Ltd.

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

- Texas Instruments, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Bel Fuse, Inc.

- Eaton Corporation PLC

- General Electric Company

- Larsen & Toubro Ltd.

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

- Texas Instruments, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 212 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

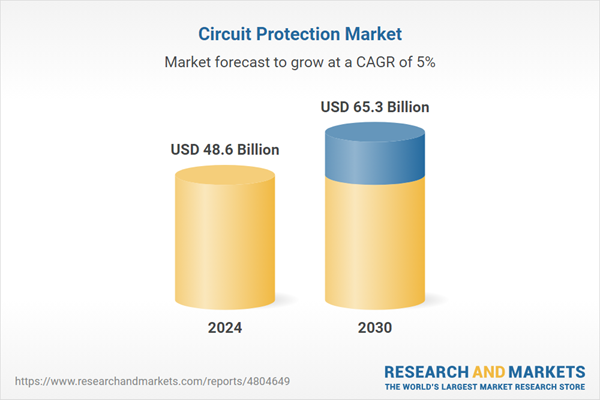

| Estimated Market Value ( USD | $ 48.6 Billion |

| Forecasted Market Value ( USD | $ 65.3 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |