Global Chocolate Flavors Market - Key Trends and Drivers Summarized

What Makes Chocolate Flavors So Irresistible in the Food Industry?

Chocolate flavors are among the most beloved and widely used flavor profiles in the global food and beverage industry, but what makes them so universally appealing? The allure of chocolate flavors stems from their rich, complex taste, which balances sweetness, bitterness, and a variety of subtle notes like vanilla, fruit, and caramel. Whether derived from milk chocolate, dark chocolate, or white chocolate, these flavors add a luxurious depth to a wide array of products. Chocolate's versatility allows it to be used in everything from confectioneries, ice creams, and baked goods to beverages, snacks, and even savory dishes. What makes chocolate flavors particularly essential is their ability to evoke indulgence and comfort, making them ideal for both premium and mass-market products. Additionally, advances in flavor technology have enabled manufacturers to recreate the experience of chocolate in innovative forms, such as low-sugar or vegan alternatives, expanding the accessibility of chocolate flavors to a broader audience without compromising the sensory appeal that consumers expect.How Are Chocolate Flavors Developed, and What Factors Influence Their Complexity?

The creation of chocolate flavors involves a meticulous process of balancing natural ingredients and synthetic compounds, but how exactly are these flavors developed? At the core of chocolate flavors is the cacao bean, which undergoes a complex transformation from fermentation and roasting to refining and conching. Each step in this process influences the flavor profile of the final product. For instance, the roasting process can bring out deeper, more robust flavors, while fermentation can introduce fruity or nutty notes. To replicate or enhance these characteristics in food products, flavor houses use a combination of natural cocoa extracts and synthetic flavor compounds. These compounds can include vanillin (a key component of vanilla), ethyl vanillin, or even spices like cinnamon to mimic or complement the natural nuances of chocolate. The variety of chocolate flavors available today is also influenced by factors such as the cacao origin, bean variety, and processing methods. Cacao beans from different regions - such as West Africa, South America, or Southeast Asia - each offer distinct flavor profiles, from fruity and floral to earthy and nutty. This diversity allows flavor developers to craft custom chocolate flavor profiles that align with specific product requirements, whether it be a bold dark chocolate flavor for artisanal desserts or a smooth milk chocolate for mass-produced confections. Moreover, advances in food technology have enabled the creation of heat-stable, fat-reduced, or sugar-free chocolate flavors that meet the needs of health-conscious consumers and the growing demand for specialty diets like vegan and keto, without sacrificing flavor intensity or quality.What Are the Key Applications of Chocolate Flavors in the Food and Beverage Industry?

Chocolate flavors play an integral role in a wide range of food and beverage products. Confectionery remains the dominant sector for chocolate flavors, with products like chocolate bars, truffles, and pralines leading the way. However, their use extends far beyond traditional sweets. Chocolate flavors are indispensable in the bakery industry, where they enhance the taste of cakes, cookies, pastries, and brownies, contributing to their indulgent appeal. In the dairy sector, chocolate is one of the most popular flavors for ice cream, yogurt, and milkshakes, where its rich and creamy profile complements the smooth texture of these products. The beverage industry has also seen a surge in chocolate-flavored drinks, from hot chocolates and flavored coffees to chocolate protein shakes and meal replacement beverages, all capitalizing on the comforting and indulgent nature of chocolate. Beyond sweet applications, chocolate flavors are increasingly being used in more unconventional categories, such as savory snacks and sauces. Mole sauces, which combine chocolate with spices and chilies, showcase how chocolate can be used to add complexity to savory dishes. Meanwhile, chocolate-flavored popcorn, chips, and nut mixes reflect the growing trend of sweet-and-savory flavor combinations that are becoming popular with snack enthusiasts. Additionally, chocolate flavors are finding their way into healthier and functional products, such as protein bars and energy snacks, where the flavor serves to mask the bitterness of high-protein or low-sugar formulations, making these items more palatable to consumers.What Are the Factors Propelling Growth in the Chocolate Flavors Market?

The growth in the chocolate flavors market is driven by several key factors tied to evolving consumer preferences, technological advancements, and expanding product categories. One of the primary drivers is the increasing demand for indulgent experiences in food and beverage products, as consumers continue to seek comfort and pleasure in their food choices. Chocolate, with its rich, satisfying taste, remains a top choice for both premium and everyday treats. The global trend toward premiumization has also fueled demand for high-quality, artisanal chocolate flavors, where consumers are willing to pay more for products featuring single-origin cacao or unique flavor combinations that offer a more sophisticated taste experience. Another critical growth factor is the rise of health-conscious consumers and the corresponding demand for healthier chocolate-flavored products. The market has seen a surge in demand for low-sugar, sugar-free, and plant-based options, as well as vegan chocolate flavors that cater to growing dietary restrictions. Flavor companies have responded by developing innovative chocolate flavor solutions that replicate the taste and mouthfeel of traditional chocolate while meeting the needs of these niche markets. Technological advancements in flavor creation, such as the development of heat-stable and fat-reduced chocolate flavors, have also enabled manufacturers to incorporate chocolate into a wider array of products, including baked goods, functional foods, and beverages that would otherwise degrade the flavor or texture under high-temperature processing. Furthermore, the increasing global demand for convenience foods, such as ready-to-drink beverages, snack bars, and meal replacements, has driven the integration of chocolate flavors into more diverse product formats. The popularity of chocolate-flavored protein shakes and sports nutrition products reflects the ongoing trend of functional foods becoming more mainstream, with consumers expecting these items to deliver on both taste and nutritional benefits. Lastly, the rise of e-commerce and digital marketing has allowed brands to introduce new, innovative chocolate-flavored products to a global audience, further accelerating market growth. These factors, combined with chocolate's timeless appeal, ensure that the chocolate flavors market will continue to thrive and evolve.Report Scope

The report analyzes the Chocolate Flavors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Bakery Products, Confectionery, Dairy & Hot Drinks, Frozen Products, Convenience Products).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bakery Products End-Use segment, which is expected to reach US$239.1 Million by 2030 with a CAGR of 5.2%. The Confectionery End-Use segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $115.3 Million in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $121.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chocolate Flavors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chocolate Flavors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chocolate Flavors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

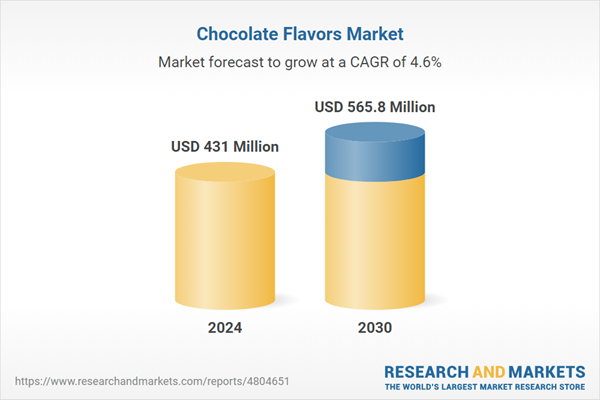

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Chocolate Flavors market report include:

- Archer Daniels Midland Company

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Inc.

- Cemoi Group

- Frutarom Industries Ltd.

- Givaudan SA

- International Flavors & Fragrances, Inc.

- Olam International Ltd.

- Puratos Group NV

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Inc.

- Cemoi Group

- Frutarom Industries Ltd.

- Givaudan SA

- International Flavors & Fragrances, Inc.

- Olam International Ltd.

- Puratos Group NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 319 |

| Published | March 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 431 Million |

| Forecasted Market Value ( USD | $ 565.8 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |