Global Ceramic Fiber Market - Key Trends and Drivers Summarized

What Is Ceramic Fiber and Why Is It Crucial in High-Temperature Applications?

Ceramic fiber, a type of refractory material made from alumina-silicate compounds, has become a vital component in industries where extreme heat resistance is required. But what exactly is ceramic fiber, and how does it perform in such demanding environments? Ceramic fiber is manufactured by melting raw materials like alumina, silica, and other chemical additives, which are then spun into fibers that can be woven into blankets, boards, or other forms. Its primary attribute is its ability to withstand high temperatures - often reaching up to 1,800°C - while maintaining its structural integrity. This makes it indispensable in industries such as metallurgy, petrochemicals, power generation, and manufacturing, where furnaces, kilns, and thermal barriers are exposed to extreme heat. Ceramic fiber provides exceptional thermal insulation properties, low thermal conductivity, and minimal heat storage, making it ideal for reducing energy consumption in high-temperature industrial processes. Furthermore, its lightweight nature and flexibility allow it to be easily shaped or molded to fit complex thermal insulation needs, providing added value in applications requiring precise thermal management.How Does Ceramic Fiber Benefit Different Industrial Sectors?

How does ceramic fiber find its way into so many different industries, and what makes it so versatile? One of the primary reasons for its widespread use is its superior heat resistance, which has made it a key material in sectors that require protection from high temperatures or need to control heat transfer. In the steel and foundry industry, ceramic fiber is employed in the linings of furnaces and ladles, ensuring that molten metal can be processed without losing heat or compromising material quality. Similarly, in the petrochemical and oil refining industries, ceramic fiber provides insulation for pipelines and reactors, safeguarding the infrastructure from thermal shock and corrosion due to constant exposure to high-temperature fluids. Power generation facilities, particularly those relying on gas turbines or coal-fired plants, depend on ceramic fiber to insulate boilers and combustion chambers, thereby improving thermal efficiency and reducing emissions. In aerospace and automotive industries, ceramic fiber materials are used in exhaust systems, heat shields, and other components that face significant thermal stress, ensuring safety and durability. Even the glassmaking industry uses ceramic fiber in its kilns and furnaces, where consistent high temperatures are critical for maintaining product quality. Its adaptability to various industrial needs makes ceramic fiber a cornerstone in sectors requiring thermal protection and efficiency.What Are the Emerging Trends and Innovations in Ceramic Fiber Technology?

Technological advancements are continuously reshaping the ceramic fiber landscape, leading to improvements in performance, sustainability, and customization. What are the key trends driving innovation in this field? One significant development is the shift toward more environmentally friendly production methods, particularly the use of bio-soluble ceramic fibers that pose less of an inhalation hazard compared to traditional refractory ceramic fibers (RCFs). These bio-soluble fibers are gaining traction in industries where health and safety regulations are becoming stricter, especially in Europe and North America. Another notable trend is the increasing use of nano-sized fibers, which offer enhanced thermal insulation and mechanical strength at lower thicknesses, making them suitable for applications where space and weight are at a premium, such as in aerospace and advanced manufacturing. The integration of ceramic fibers with other high-performance materials, such as carbon or glass fibers, is also expanding the material's application potential, creating hybrid solutions that combine the best properties of each material for superior performance in extreme environments. Moreover, the development of pre-engineered ceramic fiber components is enabling industries to adopt more efficient, standardized thermal insulation solutions, reducing installation time and improving consistency in large-scale industrial operations. These advancements are opening new opportunities for ceramic fiber materials in sectors that require cutting-edge thermal management solutions.What Are the Key Growth Drivers in the Ceramic Fiber Market?

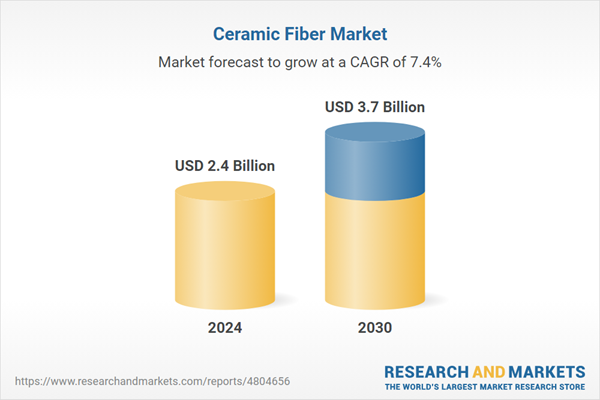

The growth in the ceramic fiber market is driven by several factors, reflecting advancements in technology, changing industrial needs, and evolving consumer behavior. A major driver is the increasing demand for energy-efficient solutions in industries like power generation, manufacturing, and metallurgy, where reducing heat loss and improving thermal efficiency are critical for both cost savings and environmental compliance. As industries face mounting pressure to cut emissions and reduce energy consumption, ceramic fiber materials, with their superior insulating properties, are becoming a preferred choice for enhancing operational efficiency. The rapid expansion of infrastructure and construction projects, particularly in developing economies, has also spurred the demand for ceramic fiber in applications such as fireproofing, insulation, and high-temperature linings for furnaces and kilns. Additionally, stricter regulatory standards for occupational health and safety are leading to a growing preference for bio-soluble ceramic fibers, which are less hazardous than traditional RCFs, driving growth in markets with stringent worker safety requirements. Consumer behavior is shifting as well, with industries increasingly seeking durable, low-maintenance insulation materials that offer long-term cost savings and improved operational reliability. The push for advanced materials in cutting-edge industries, such as aerospace, automotive, and renewable energy, is further accelerating the adoption of ceramic fibers, especially in applications requiring lightweight, high-temperature-resistant materials. These factors, combined with continuous technological innovations, are propelling the global ceramic fiber market to new heights.Report Scope

The report analyzes the Ceramic Fiber market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (RCF, AES Wool, Other Types); Product Form (Blanket, Board, Module, Paper, Other Product Forms); End-Use (Refining & Petrochemical, Iron & Steel, Power Generation, Aluminum, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the RCF segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of 7.1%. The AES Wool segment is also set to grow at 8.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $647.9 Million in 2024, and China, forecasted to grow at an impressive 10.8% CAGR to reach $792.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ceramic Fiber Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ceramic Fiber Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ceramic Fiber Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADL Insulflex, Inc., Ceramsource, Inc., Double Egret Thermal Insulation, Co, Ltd., Etex Building Performance NV, Fibrecast Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 28 companies featured in this Ceramic Fiber market report include:

- ADL Insulflex, Inc.

- Ceramsource, Inc.

- Double Egret Thermal Insulation, Co, Ltd.

- Etex Building Performance NV

- Fibrecast Inc.

- Harbisonwalker International

- Ibiden Co., Ltd.

- Isolite Insulating Products Co., Ltd.

- Lewco Specialty Products, Inc.

- Luyang Energy-Saving Materials Co., Ltd.

- Morgan Advanced Materials PLC

- Pyrotek Inc.

- Rath Inc.

- Unifrax I LLC

- Yeso Insulating Products Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADL Insulflex, Inc.

- Ceramsource, Inc.

- Double Egret Thermal Insulation, Co, Ltd.

- Etex Building Performance NV

- Fibrecast Inc.

- Harbisonwalker International

- Ibiden Co., Ltd.

- Isolite Insulating Products Co., Ltd.

- Lewco Specialty Products, Inc.

- Luyang Energy-Saving Materials Co., Ltd.

- Morgan Advanced Materials PLC

- Pyrotek Inc.

- Rath Inc.

- Unifrax I LLC

- Yeso Insulating Products Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |