Global Cell Harvesting Market - Key Trends & Drivers Summarized

What is Cell Harvesting and Why is it Pivotal in Biomedical Research?

Cell harvesting is a crucial process in the field of biotechnology and medical research, involving the collection of cells from culture media during the logarithmic growth phase to maximize their viability for downstream applications. This technique is foundational for various biomedical pursuits, including therapeutic treatments, regenerative medicine, and research on cellular behaviors and genetics. The cells harvested are used to develop vaccines, model diseases, perform drug screening, and even cultivate tissues and synthetic organs. Effective cell harvesting is critical because the quality of the cells collected directly influences the reliability and effectiveness of experimental outcomes and clinical interventions. As such, advancements in cell harvesting methods continue to focus on enhancing the efficiency and purity of the cells collected, which is essential for the progress of medical science and treatment.How Technological Advancements Are Transforming Cell Harvesting

The evolution of cell harvesting technologies has significantly improved the efficiency and safety of these procedures. Innovations include automated systems that reduce the risk of contamination and human error, enhancing the reproducibility of results in research and clinical environments. Such systems use sophisticated sensors and algorithms to optimize the timing and techniques of cell collection, ensuring that cells are harvested at their peak viability. Additionally, the integration of microfluidic devices has revolutionized cell harvesting by enabling the handling of smaller volume samples with higher precision, minimizing cell damage and loss. These technological advancements not only streamline workflows but also open new avenues for research and therapies that require highly specific and viable cells, thereby pushing the boundaries of what's possible in medical treatments and biotechnological applications.Emerging Trends in the Cell Harvesting Market

Several emerging trends are shaping the future of the cell harvesting market, driven by the expanding scope of biotechnological applications and the growing demand for personalized medicine. There is an increasing investment in stem cell research, where efficient cell harvesting is essential for cultivating stem cells used in regenerative treatments and disease modeling. The push towards personalized medicine is also driving the need for more sophisticated cell harvesting techniques that can provide tailored cellular materials for individual patients' treatments. Moreover, the biopharmaceutical industry's growth fuels demand for cells used in drug development and testing, necessitating large-scale cell harvesting solutions that maintain cell integrity and functionality. As the market for cell-based products grows, regulatory standards are becoming more stringent to ensure that cell harvesting processes are safe, effective, and consistent, which influences market practices and technologies.What Drives the Growth of the Cell Harvesting Market?

The growth in the cell harvesting market is driven by several factors, including the increasing prevalence of chronic diseases, the rising demand for biopharmaceuticals, advancements in cell-based research, and the growing focus on personalized medicine. The aging global population and the corresponding rise in healthcare needs are accelerating the demand for innovative treatments and therapies, many of which rely on harvested cells. Technological innovations that enhance the efficiency and yield of cell harvesting are also critical, as they improve the feasibility and cost-effectiveness of cell-based approaches. Additionally, the expanding regenerative medicine field, which utilizes harvested cells to engineer tissues and organs, is a significant market driver. Consumer behavior, particularly the increasing preference for targeted and effective treatments with fewer side effects, supports the adoption of therapies involving harvested cells. Moreover, government and private funding for research in cell dynamics and genetic engineering are contributing to the market's expansion, reflecting a robust interest in advancing healthcare solutions through improved cell harvesting technologies.Report Scope

The report analyzes the Cell Harvesting market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Manual, Automated); Application (Peripheral Blood, Bone Marrow, Umbilical Cord, Adipose Tissue, Other Applications); End-Use (Biotech & Biopharma Companies, Research Institutes, Other End-Uses).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Peripheral Blood Application segment, which is expected to reach US$271 Million by 2030 with a CAGR of 7.2%. The Bone Marrow Application segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $96.7 Million in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $47.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cell Harvesting Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cell Harvesting Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cell Harvesting Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Corning, Inc., Sartorius AG, Arthrex, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 30 companies featured in this Cell Harvesting market report include:

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Corning, Inc.

- Sartorius AG

- Arthrex, Inc.

- SP Industries, Inc.

- Trevigen, Inc.

- ANGLE PLC

- Ranfac Corporation

- ADS Biotec, Inc.

- Biotium, Inc.

- Global Life Sciences Solutions USA LLC (Cytiva)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Corning, Inc.

- Sartorius AG

- Arthrex, Inc.

- SP Industries, Inc.

- Trevigen, Inc.

- ANGLE PLC

- Ranfac Corporation

- ADS Biotec, Inc.

- Biotium, Inc.

- Global Life Sciences Solutions USA LLC (Cytiva)

Table Information

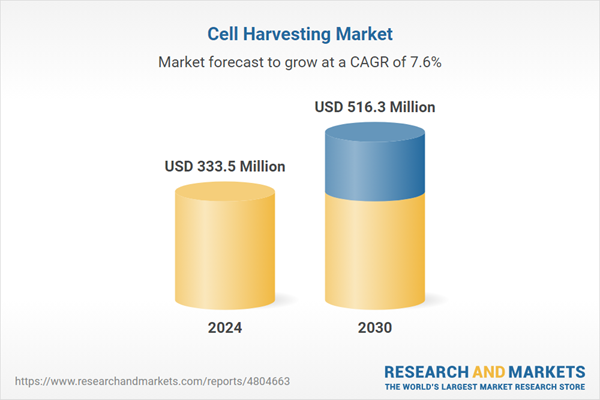

| Report Attribute | Details |

|---|---|

| No. of Pages | 306 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 333.5 Million |

| Forecasted Market Value ( USD | $ 516.3 Million |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |