Global Catalog Management Systems Market - Key Trends and Drivers Summarized

How Are Catalog Management Systems Revolutionizing E-commerce and Retail?

Catalog Management Systems (CMS) have become an indispensable tool for businesses in the e-commerce and retail sectors, helping them organize, manage, and present product information efficiently across multiple sales channels. A CMS allows companies to consolidate product data, such as descriptions, prices, images, and specifications, into a single repository that can be easily updated and distributed. This centralized approach not only enhances the accuracy and consistency of product information but also improves the customer experience by ensuring that consumers have access to reliable, up-to-date details about the products they are considering. In today's fast-paced digital marketplace, where businesses often sell through numerous platforms - such as online stores, third-party marketplaces, and brick-and-mortar locations - an efficient catalog management system is critical for maintaining a seamless shopping experience. By streamlining product updates, pricing adjustments, and inventory management, CMS platforms help businesses maintain agility in the competitive retail environment, ultimately driving increased sales and customer satisfaction.Why Are Catalog Management Systems Essential for Multi-Channel Retailers?

Catalog Management Systems are particularly valuable for multi-channel retailers, who need to maintain consistent and accurate product information across various platforms. Managing a vast catalog manually can lead to errors, such as discrepancies in pricing, outdated product details, or missing images, which can frustrate customers and negatively impact sales. A CMS addresses these issues by automating the process of updating and synchronizing product information, ensuring that all channels reflect the most current data. Whether it's an e-commerce website, a mobile app, or a physical retail location, the system ensures that the information is uniform, preventing confusion and increasing brand credibility. Furthermore, catalog management systems facilitate the scaling of businesses, as they can handle large volumes of products and SKU numbers without sacrificing accuracy or efficiency. The integration of artificial intelligence and machine learning into CMS platforms has further enhanced their capabilities, allowing businesses to optimize their catalogs based on customer preferences, search trends, and inventory levels. By automating much of the catalog management process, these systems not only reduce manual labor but also minimize human error, making them essential for retailers looking to grow and thrive in the increasingly complex landscape of multi-channel sales.How Are Technological Advancements Shaping the Future of Catalog Management Systems?

Technological advancements have significantly influenced the evolution of Catalog Management Systems, driving improvements in both functionality and user experience. One of the most impactful innovations has been the integration of artificial intelligence (AI) and machine learning algorithms, which enable CMS platforms to automate key tasks such as product categorization, tagging, and attribute mapping. These technologies help businesses improve search engine optimization (SEO) for their catalogs, allowing customers to find products more easily through relevant and accurate search results. AI also powers personalized recommendations by analyzing consumer behavior, ensuring that customers are presented with products tailored to their preferences, which can drive higher conversion rates. Additionally, the rise of cloud-based CMS platforms has made it easier for businesses to manage product data across multiple locations and teams, as these systems can be accessed from anywhere with an internet connection. Cloud integration enhances collaboration and ensures that product updates are implemented in real-time, further streamlining operations. Another important advancement is the integration of omnichannel support within CMS platforms, allowing businesses to synchronize their product catalogs across diverse sales channels, from websites and mobile apps to in-store point-of-sale (POS) systems. This technological evolution has made catalog management more efficient, scalable, and customer-centric, paving the way for businesses to offer enhanced shopping experiences.What Are the Key Drivers of Growth in the Catalog Management Systems Market?

The growth in the Catalog Management Systems market is driven by several factors, particularly the increasing complexity of e-commerce environments and the rising demand for seamless omnichannel experiences. As businesses continue to expand their online presence, they are faced with the challenge of managing vast and diverse product catalogs across multiple platforms, making CMS solutions indispensable for maintaining accuracy and consistency. The rapid proliferation of digital sales channels, including third-party marketplaces, social commerce, and mobile apps, has intensified the need for centralized catalog management to ensure that product information is synchronized and up-to-date across all touchpoints. Another key driver is the growing consumer expectation for personalized and streamlined shopping experiences. Catalog management systems equipped with AI and machine learning enable retailers to offer tailored product recommendations, dynamic pricing, and customized marketing strategies based on real-time data. Furthermore, the increasing focus on automation in retail operations is pushing businesses to adopt CMS platforms that can handle high volumes of product data with minimal manual intervention. This is particularly critical for large enterprises and multinational brands that need to manage product catalogs in multiple languages and currencies, across various regions. Additionally, the push for improved data accuracy and compliance with global regulations regarding product information, such as labeling and safety standards, is encouraging more companies to invest in robust CMS platforms. These factors, combined with the ongoing digital transformation in retail, are propelling the growth of the catalog management systems market, as businesses strive to optimize their operations and meet evolving consumer demands.Report Scope

The report analyzes the Catalog Management Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (Cloud, On-Premise); Vertical (Retail & eCommerce, BFSI, IT & Telecom, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of 5.3%. The Services Component segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $381.9 Million in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $316.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Catalog Management Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Catalog Management Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Catalog Management Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMDOCS Ltd., CA Technologies, Inc., Cellent GmbH, Claritum Ltd., Comarch SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Catalog Management Systems market report include:

- AMDOCS Ltd.

- CA Technologies, Inc.

- Cellent GmbH

- Claritum Ltd.

- Comarch SA

- Coupa Software Inc.

- eJeeva

- Ericsson AB

- Fujitsu Ltd.

- GEP

- IBM Corporation

- Insite Software

- Mirakl Inc.

- Oracle Corporation

- Plytix.com ApS

- Salsify Inc.

- SAP SE

- Sellercloud

- ServiceNow, Inc.

- Sigma Systems Canada LP.

- SunTec

- Vinculum Solutions Pvt. Ltd.

- Vroozi

- Zycus Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMDOCS Ltd.

- CA Technologies, Inc.

- Cellent GmbH

- Claritum Ltd.

- Comarch SA

- Coupa Software Inc.

- eJeeva

- Ericsson AB

- Fujitsu Ltd.

- GEP

- IBM Corporation

- Insite Software

- Mirakl Inc.

- Oracle Corporation

- Plytix.com ApS

- Salsify Inc.

- SAP SE

- Sellercloud

- ServiceNow, Inc.

- Sigma Systems Canada LP.

- SunTec

- Vinculum Solutions Pvt. Ltd.

- Vroozi

- Zycus Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

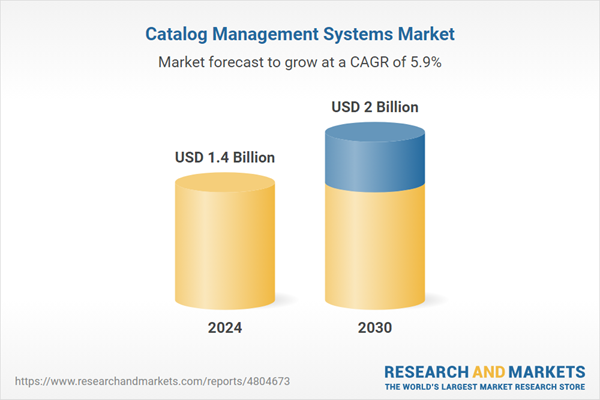

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |