Global Well Casing and Cementation Hardware Market - Key Trends and Drivers Summarized

Why Is Well Casing and Cementation Hardware Critical for Drilling Operations?

Well casing and cementation hardware are fundamental components in the oil and gas drilling process, playing a crucial role in maintaining well integrity, safety, and productivity. Well casing refers to the large-diameter pipe inserted into a drilled well to stabilize the wellbore, prevent collapse, and isolate underground formations. Cementation, meanwhile, involves filling the space between the casing and the wellbore with cement, which further stabilizes the well, prevents fluid migration between different geological layers, and protects freshwater aquifers from contamination. These components ensure the safe and efficient extraction of oil and gas by maintaining the structural integrity of the well throughout its lifecycle. The importance of well casing and cementation hardware cannot be overstated, as they help to withstand the immense pressures and temperatures encountered in deep drilling operations. Their use is crucial for preventing blowouts, ensuring zonal isolation, and optimizing the long-term productivity of wells. Without proper casing and cementing practices, wells would be prone to structural failure, potentially leading to catastrophic environmental damage and costly operational shutdowns. As energy demand continues to grow globally, the need for advanced well casing and cementation hardware is becoming even more pronounced, ensuring that wells operate safely and efficiently in increasingly challenging environments.How Have Technological Advancements Enhanced Well Casing and Cementation?

Technological innovations have significantly improved the performance, safety, and efficiency of well casing and cementation processes. One of the most notable advancements is the development of advanced casing materials, such as high-strength steel alloys and corrosion-resistant coatings. These materials are designed to withstand the extreme pressures, temperatures, and corrosive conditions encountered in deep-sea or shale gas drilling. As drilling operations push deeper and enter more complex reservoirs, these new materials ensure that the well casing remains intact, even in the most hostile environments, thus prolonging the lifespan of wells and reducing maintenance costs. Cementation technologies have also seen major improvements. The use of advanced cement blends that incorporate additives like nanoparticles, latex, and synthetic fibers has enhanced the bonding strength, elasticity, and durability of cement slurries. These innovations provide better sealing capabilities and reduce the risk of cracks or leaks that could compromise well integrity. Additionally, real-time monitoring technologies, including sensors and downhole tools, have transformed how cementation is managed. Furthermore, automated casing running tools (CRTs) and cementing equipment have made the process more efficient, reducing the time and labor required for installation. By minimizing manual intervention, these technologies also improve safety and reduce the risk of human error. Innovations in directional drilling and 3D modeling are enabling more precise casing designs, optimizing well performance while minimizing material usage. Collectively, these technological advancements have led to safer, more efficient, and cost-effective well construction practices in the oil and gas industry.What Are the Key Trends Shaping the Well Casing and Cementation Market?

Several emerging trends are shaping the well casing and cementation hardware market as the oil and gas industry adapts to new challenges and opportunities. One of the most significant trends is the increasing focus on well integrity and safety regulations. As environmental and safety standards become stricter, particularly in regions like North America and Europe, oil and gas companies are investing in advanced well casing and cementation hardware that ensures compliance with regulatory requirements. This trend is driving demand for more durable materials and high-performance cement blends that can withstand extreme conditions and prevent leaks or blowouts, particularly in offshore and high-pressure, high-temperature (HPHT) wells. Another key trend is the shift toward digitalization and automation in well construction. The integration of data analytics, real-time monitoring, and automation tools is transforming how casing and cementation operations are conducted. Digital technologies, such as predictive analytics and machine learning, allow operators to optimize well design, predict potential failures, and enhance decision-making throughout the well construction process. Automated cementing units and casing running tools are also streamlining operations, reducing the time required to install casing and complete cementing jobs, which in turn lowers costs and improves operational efficiency. The rise of unconventional drilling, particularly in shale formations, is further driving demand for specialized well casing and cementation solutions. Horizontal drilling and hydraulic fracturing require casings that can withstand additional mechanical stresses, while ensuring proper zonal isolation is essential for controlling production from multiple layers. As operators explore more challenging reservoirs, the need for innovative casing designs and flexible cementation solutions that can adapt to these unique conditions is increasing.What Factors Are Driving Growth in the Well Casing and Cementation Market?

The growth in the well casing and cementation hardware market is driven by several key factors that reflect the evolving demands of the global oil and gas industry. One of the primary drivers is the increasing complexity of drilling operations, particularly in deepwater, shale, and HPHT environments. As the industry explores deeper reservoirs and more challenging geologies, the need for advanced well casing and cementation technologies that can withstand extreme conditions is critical. High-performance casings made from corrosion-resistant and high-strength materials are essential for ensuring well stability and reducing the risk of blowouts, while advanced cement blends are necessary for maintaining long-term well integrity. Another significant factor driving market growth is the rising demand for energy worldwide, which is fueling exploration and production activities. As oil and gas companies expand their drilling operations to meet global energy needs, the demand for well casing and cementation hardware continues to rise. This trend is particularly strong in regions with growing energy consumption, such as Asia-Pacific, the Middle East, and North America, where large-scale drilling projects are underway to tap into new reserves. The expansion of unconventional drilling, especially in shale plays, is also contributing to market growth, as these wells require specialized casing and cementation solutions to handle the unique challenges posed by hydraulic fracturing and horizontal drilling. Technological advancements are also playing a pivotal role in driving the market. The introduction of digital tools, real-time monitoring, and automated equipment is helping companies optimize well construction processes, reduce costs, and improve safety. Predictive maintenance and performance tracking are allowing operators to prevent failures before they occur, leading to more efficient operations and extended well lifespans. Finally, the increasing regulatory focus on environmental protection and well safety is pushing companies to adopt high-quality, environmentally friendly cementation solutions that minimize the risk of leaks and contamination. These combined factors are expected to sustain the growth of the well casing and cementation hardware market as the oil and gas industry continues to evolve.Report Scope

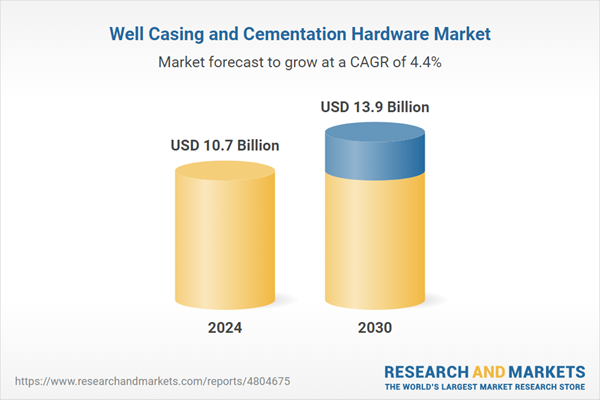

The report analyzes the Well Casing and Cementation Hardware market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Casing, Cementing); Services (Casing Pipe, Casing Equipment & Services, Cementing Equipment & Services); Application (On-Shore, Off-Shore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Shore Application segment, which is expected to reach US$10.7 Billion by 2030 with a CAGR of 4.2%. The Off-Shore Application segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Well Casing and Cementation Hardware Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Well Casing and Cementation Hardware Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Well Casing and Cementation Hardware Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Centek Group, Forum Energy Technologies, National Oilwell Varco, Inc., Neoz Energy Pvt., Ltd., Sledgehammer Oil Tools Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Well Casing and Cementation Hardware market report include:

- Centek Group

- Forum Energy Technologies

- National Oilwell Varco, Inc.

- Neoz Energy Pvt., Ltd.

- Sledgehammer Oil Tools Pvt. Ltd.

- Summit Casing Equipment

- Tenaris SA

- Vallourec Group

- Weatherford International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Centek Group

- Forum Energy Technologies

- National Oilwell Varco, Inc.

- Neoz Energy Pvt., Ltd.

- Sledgehammer Oil Tools Pvt. Ltd.

- Summit Casing Equipment

- Tenaris SA

- Vallourec Group

- Weatherford International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 297 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.7 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |