Global Busbars Market - Key Trends and Drivers Summarized

What Exactly Are Busbars and Why Are They Vital to Electrical Infrastructure?

Busbars, though often overlooked in conversations about electrical systems, serve as the fundamental backbone for distributing electrical power efficiently. These conductive strips or bars, made predominantly from metals like copper, aluminum, or brass, are tasked with the critical function of carrying large currents of electricity across a network. Unlike flexible cables, busbars are rigid and engineered for stability, reducing the risks of short circuits, overheating, or electrical fires. Their design allows for the easy and secure transmission of electricity from one point to another, particularly in environments requiring high power loads, such as industrial plants, substations, or commercial facilities. The structure of busbars, often flat or hollow, offers a larger surface area for heat dissipation, which minimizes temperature rise and electrical losses during operation. This not only enhances the safety of the system but also ensures the longevity of electrical equipment. Furthermore, busbars can be customized to suit various configurations and layouts, allowing them to be tailored for specific applications - from the power grids of large-scale cities to the compact systems of electric vehicles. As electrical demands rise with technological advancements, the busbar's role in efficiently managing and distributing energy becomes increasingly indispensable.How Do Busbars Improve Efficiency and Reduce Complexity in Electrical Systems?

In modern power distribution systems, busbars offer an unparalleled solution to improving both efficiency and reducing complexity. Their key advantage lies in their ability to carry high current loads with significantly reduced electrical impedance, meaning that less energy is lost as heat. This property makes busbars more efficient than traditional wiring, particularly in systems requiring high power, such as industrial motors, transformers, and large-scale HVAC systems. The inherent rigidity of busbars also allows for streamlined and compact installations, especially in environments where space is at a premium. For instance, in high-density power installations like data centers, the use of busbars minimizes the need for a tangled web of cables, making the system not only more organized but also safer. The reduced number of connections compared to traditional wiring significantly decreases the potential points of failure, which translates into improved reliability. In terms of maintenance, busbars offer a clear advantage; their straightforward design means fewer connections and joints to monitor, leading to quicker diagnostics and less downtime during repairs. Additionally, busbars support modular designs, meaning they can be easily upgraded or expanded as power demands grow, without the need to rewire entire systems. This flexibility is crucial in industries with rapidly evolving energy needs, such as telecommunications, renewable energy, and electric vehicle infrastructure.What Cutting-Edge Technologies Are Shaping the Future of Busbars?

The busbar market is evolving rapidly, with several key technological innovations driving its advancement. One of the most transformative developments is the rise of laminated busbars, which consist of multiple conductive layers, separated by insulating materials. Laminated busbars drastically reduce parasitic inductance and electrical noise, making them ideal for high-precision environments like medical devices, aerospace systems, and high-frequency power electronics. In addition, they enhance thermal management due to their layered structure, improving heat dissipation and ensuring that systems operate within safe temperature ranges. Another significant trend is the integration of smart technologies into busbar systems. Smart busbars, equipped with sensors, enable real-time monitoring of current flow, voltage, temperature, and other critical operational metrics. This capability facilitates predictive maintenance, as any deviations from normal operating conditions can be detected early, allowing for preventive action before a failure occurs. This is particularly vital in mission-critical applications such as data centers or hospitals, where power interruptions can have severe consequences. Furthermore, advancements in the materials used for busbars are enhancing their performance. For example, the use of silver-plated copper or specialized alloys is becoming more common in environments where corrosion resistance and conductivity are paramount. Additionally, busbars are playing a crucial role in renewable energy systems, particularly in solar and wind energy installations. In these setups, busbars enable efficient energy transmission from generation sources to storage systems or directly into the grid, reducing energy loss and ensuring that renewable energy projects can meet growing energy demands effectively.What Factors Are Fueling the Rapid Growth of the Busbar Market?

The growth in the busbar market is driven by several factors, primarily linked to advancements in technology, the increasing adoption of renewable energy systems, and the surging demand for electric vehicles (EVs). The renewable energy sector is one of the most significant growth drivers, with solar and wind energy projects relying heavily on busbars for effective power distribution. As governments and corporations push for cleaner energy solutions to combat climate change, the demand for busbars in solar panels and wind farms continues to rise, ensuring efficient energy transfer from these renewable sources to the grid. Another major factor is the global shift towards electric vehicles. As EV production accelerates, the internal power distribution systems within these vehicles, which rely on compact, lightweight busbars, are becoming increasingly sophisticated. These busbars ensure the efficient distribution of electricity from the vehicle's battery to its propulsion systems, on-board electronics, and charging circuits. Additionally, the expansion of data centers worldwide, driven by the rise of cloud computing, artificial intelligence, and data analytics, has created a huge demand for high-efficiency power distribution solutions. Busbars, with their ability to manage high current loads with minimal energy loss, are becoming the preferred choice for data centers looking to optimize their energy use while reducing the risk of power outages. Moreover, as consumer preferences shift towards energy-efficient systems, industries are increasingly adopting busbars to enhance the overall efficiency of their power distribution infrastructure. These market drivers are compounded by innovations in busbar design and materials, which have made them more versatile, durable, and cost-effective across a wide range of industries, further boosting their adoption in both established and emerging sectors.Report Scope

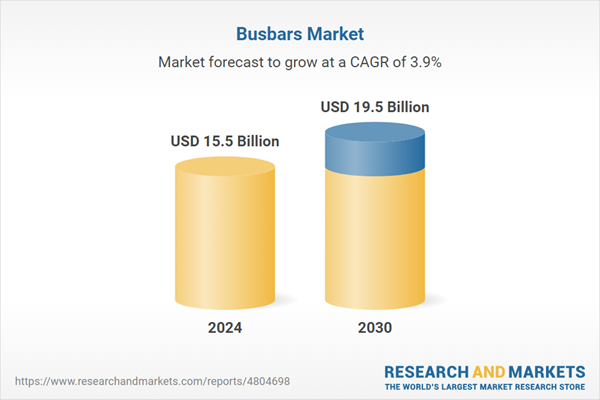

The report analyzes the Busbars market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Copper, Aluminum); Power Range (Low, Medium, High); End-Use (Utilities, Commercial, Industrial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Copper Material segment, which is expected to reach US$14.9 Billion by 2030 with a CAGR of 3.6%. The Aluminum Material segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.2 Billion in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Busbars Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Busbars Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Busbars Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Bhagyanagar India Limited, Busbar Systems Belgium BVBA, C&S Electric Ltd., Eaton Corporation PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Busbars market report include:

- ABB Group

- Bhagyanagar India Limited

- Busbar Systems Belgium BVBA

- C&S Electric Ltd.

- Eaton Corporation PLC

- Godrej & Boyce Manufacturing Co., Ltd.

- HALCOR S. A.

- Legrand Group

- Littlefuse Inc.

- Mersen Corporate Services SAS

- Methode Electronics, Inc.

- Oriental Copper Co., Ltd.

- Rittal Corporation

- Schneider Electric SA

- Siemens AG

- Southwire Company LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Bhagyanagar India Limited

- Busbar Systems Belgium BVBA

- C&S Electric Ltd.

- Eaton Corporation PLC

- Godrej & Boyce Manufacturing Co., Ltd.

- HALCOR S. A.

- Legrand Group

- Littlefuse Inc.

- Mersen Corporate Services SAS

- Methode Electronics, Inc.

- Oriental Copper Co., Ltd.

- Rittal Corporation

- Schneider Electric SA

- Siemens AG

- Southwire Company LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.5 Billion |

| Forecasted Market Value ( USD | $ 19.5 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |