Global Building Analytics Market - Key Trends and Drivers Summarized

How Is Building Analytics Revolutionizing Facility Management?

Building analytics has emerged as a transformative tool in facility management, offering real-time insights into the operational performance of buildings. At its core, building analytics leverages data from various systems such as HVAC, lighting, security, and energy management to provide actionable insights that help improve efficiency, reduce costs, and enhance overall building performance. This technology is particularly important as modern buildings become more complex, with integrated systems that need constant monitoring and optimization. Through the use of advanced algorithms and data analysis, building analytics platforms can detect inefficiencies that might go unnoticed by traditional monitoring systems. For instance, they can identify equipment that is consuming excessive energy, detect patterns that suggest preventive maintenance is needed, or highlight areas where energy savings could be achieved without compromising comfort. As a result, building analytics empowers facility managers to make informed decisions, proactively address potential issues, and ensure that buildings are operating at peak performance levels. In industries such as commercial real estate, healthcare, and education, where operational costs are high and efficiency is critical, the adoption of building analytics is becoming increasingly essential.How Is Technology Driving the Adoption of Building Analytics?

Technological advancements have played a pivotal role in the adoption of building analytics, particularly through the integration of the Internet of Things (IoT), artificial intelligence (AI), and cloud computing. IoT devices, which include sensors and smart meters, provide the real-time data necessary for comprehensive building analysis. These sensors collect detailed information about temperature, humidity, energy use, occupancy, and more, feeding into building analytics platforms that process the data to offer actionable insights. AI further enhances these platforms by enabling predictive analytics, where potential issues can be identified before they occur. For example, AI-powered analytics can predict when HVAC systems are likely to fail based on historical performance data, allowing for timely maintenance and avoiding costly downtimes. Cloud computing has also made building analytics more accessible by allowing for the storage and processing of large datasets at a fraction of the cost compared to traditional on-premises solutions. Cloud-based platforms enable remote monitoring, making it easier for facility managers to oversee multiple buildings in different locations from a centralized dashboard. These technological advances are not only making building analytics more powerful but also more scalable, allowing both large enterprises and smaller organizations to benefit from the efficiencies it offers.Why Are Sustainability and Energy Efficiency Key Drivers for Building Analytics?

The growing emphasis on sustainability and energy efficiency has been a major driver in the adoption of building analytics, particularly as regulatory pressures and corporate social responsibility initiatives push organizations to reduce their carbon footprint. Buildings are significant consumers of energy, accounting for nearly 40% of global energy use, and building analytics provides a way to monitor, optimize, and reduce this consumption. By analyzing real-time data, building analytics platforms can identify inefficiencies in energy use and suggest actionable changes, such as adjusting HVAC settings, optimizing lighting schedules, or switching to renewable energy sources. Furthermore, the ability to continuously monitor energy use allows businesses to benchmark their performance against sustainability goals, ensuring compliance with increasingly stringent environmental regulations. In many industries, such as retail, manufacturing, and hospitality, sustainability has also become a key differentiator, with businesses that demonstrate energy efficiency gaining a competitive edge in the market. Additionally, customers and investors are increasingly demanding transparency about a company's environmental impact, and building analytics provides the data necessary to produce accurate sustainability reports. As organizations seek to improve their energy management and align with green building certifications such as LEED or BREEAM, building analytics has become an essential tool in their sustainability strategy.What Are the Major Factors Driving Expansion of the Building Analytics Market?

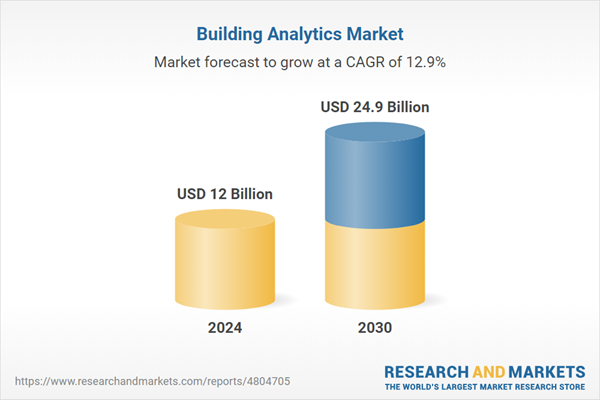

The growth in the building analytics market is driven by several factors, with the increasing complexity of building systems and the rising demand for energy-efficient solutions being at the forefront. As buildings integrate more advanced technologies, such as IoT and AI, the need for comprehensive analytics tools to manage and optimize these systems has become critical. This has led to a significant increase in the adoption of building analytics in sectors such as commercial real estate, healthcare, education, and manufacturing, where operational efficiency is paramount. The push towards smart buildings and the implementation of building management systems (BMS) have also contributed to the growth of the market, as these systems generate large volumes of data that need to be analyzed for optimal decision-making. Additionally, consumer behavior is shifting towards greater environmental responsibility, which has heightened the focus on sustainability in building management. The ability of building analytics to provide real-time insights into energy use and help organizations meet sustainability goals is a significant driver of market growth. Furthermore, regulatory pressures, such as energy efficiency mandates and carbon reduction targets, are compelling businesses to adopt building analytics to comply with environmental standards. Finally, the rise of cloud-based analytics solutions has made building analytics more accessible and cost-effective, encouraging wider adoption across industries. These factors combined are expected to continue fueling the expansion of the building analytics market in the coming years.Report Scope

The report analyzes the Building Analytics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Building Type (Commercial, Residential, Public Places, Manufacturing Facilities, Government Buildings, Other Building Types); Application (Energy Management, Security Management, Fault Detection & Monitoring, Parking Management, Operations Management, Emergency Management, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Energy Management Application segment, which is expected to reach US$7.2 Billion by 2030 with a CAGR of 13.9%. The Security Management Application segment is also set to grow at 12% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Building Analytics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Building Analytics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Building Analytics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BuildingIQ, Inc., Buildinglogix, BuildPulse, Coppertree Analytics, Crestron Electronics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Building Analytics market report include:

- BuildingIQ, Inc.

- Buildinglogix

- BuildPulse

- Coppertree Analytics

- Crestron Electronics, Inc.

- Delta Electronics, Inc.

- EcoVox, Inc.

- Energy Advantage

- EnerNOC, Inc.

- ENGIE Group

- General Electric Company

- GridPoint, Inc.

- Honeywell International, Inc.

- IBM Corporation

- Iconics, Inc.

- Johnson Controls, Inc.

- KGS Buildings, LLC.

- Lucid Design Group

- Lutron Electronics Co., Inc.

- Noveda Technologies, Inc.

- PointGrab Inc.

- Schneider Electric SA

- Senseware

- Siemens AG

- Verdigris Technologies, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BuildingIQ, Inc.

- Buildinglogix

- BuildPulse

- Coppertree Analytics

- Crestron Electronics, Inc.

- Delta Electronics, Inc.

- EcoVox, Inc.

- Energy Advantage

- EnerNOC, Inc.

- ENGIE Group

- General Electric Company

- GridPoint, Inc.

- Honeywell International, Inc.

- IBM Corporation

- Iconics, Inc.

- Johnson Controls, Inc.

- KGS Buildings, LLC.

- Lucid Design Group

- Lutron Electronics Co., Inc.

- Noveda Technologies, Inc.

- PointGrab Inc.

- Schneider Electric SA

- Senseware

- Siemens AG

- Verdigris Technologies, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12 Billion |

| Forecasted Market Value ( USD | $ 24.9 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |