Global Blood Screening Market - Key Trends and Drivers Summarized

Why Is Blood Screening Essential in Ensuring Safe Healthcare Practices?

Blood screening is a critical process in healthcare, designed to detect infectious agents, genetic disorders, and other health conditions in blood samples before they are used for transfusions, organ transplants, or diagnostic purposes. This screening process is vital to ensuring that blood and blood products are safe for use, thereby preventing the transmission of diseases such as HIV, hepatitis, and syphilis. Blood screening also plays a crucial role in the early detection of conditions like cancer and inherited genetic disorders, allowing for timely intervention and treatment. The accuracy and reliability of blood screening tests are paramount, as they directly impact patient safety and public health. As the demand for safe blood products continues to rise globally, blood screening has become an indispensable component of modern healthcare, protecting patients and ensuring the efficacy of medical treatments.How Has the Evolution of Technology Transformed Blood Screening Processes?

The field of blood screening has been revolutionized by advancements in technology, leading to faster, more accurate, and comprehensive testing methods. Traditionally, blood screening relied on manual techniques and basic serological tests, which, while effective, were limited in scope and could take days to yield results. The introduction of automated testing systems and molecular diagnostics has drastically improved the speed and accuracy of blood screening. Techniques such as nucleic acid testing (NAT) allow for the detection of viral and bacterial pathogens at a much earlier stage, reducing the risk of transmitting infections through blood transfusions. Additionally, the development of high-throughput screening systems has enabled the processing of large volumes of blood samples more efficiently, which is crucial in meeting the demands of modern healthcare facilities. As a result, the evolution of blood screening technology has not only enhanced the safety of blood products but has also expanded the range of detectable conditions, making it a cornerstone of preventive healthcare.What Are the Emerging Trends and Innovations in Blood Screening Technology?

Blood screening is currently undergoing significant innovation, driven by the need for more comprehensive, faster, and cost-effective diagnostic solutions. One of the most notable trends is the growing use of next-generation sequencing (NGS) in blood screening, which allows for the detailed analysis of genetic material and the identification of a wide range of pathogens and genetic disorders from a single blood sample. Another emerging trend is the integration of artificial intelligence (AI) and machine learning into blood screening processes, which enhances the accuracy of diagnostics by identifying patterns and anomalies that might be missed by conventional methods. Furthermore, the development of point-of-care (POC) testing devices is transforming blood screening by enabling rapid testing in various settings, including remote and resource-limited areas, thus improving access to critical diagnostics. These innovations are pushing the boundaries of what is possible in blood screening, offering the potential for earlier detection, more personalized treatment options, and improved patient outcomes.What Are the Factors Fueling Expansion of the Blood Screening Market?

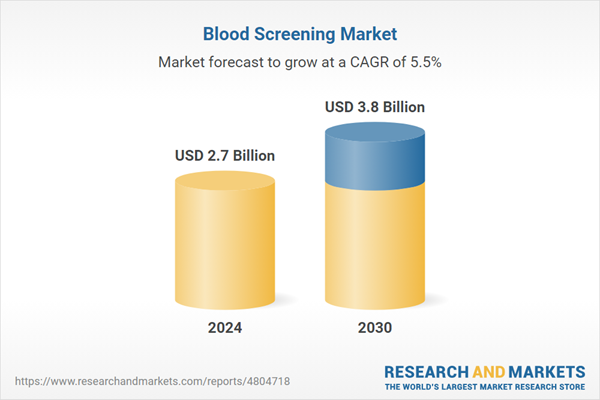

The growth in the blood screening market is driven by several critical factors that underscore the increasing importance of safe and accurate diagnostics in healthcare. One of the primary drivers is the rising demand for blood and blood products, particularly in emerging markets where healthcare infrastructure is expanding. As more surgeries, transfusions, and transplants are performed, the need for rigorous blood screening to prevent the transmission of infectious diseases is becoming more urgent. Technological advancements, such as the adoption of nucleic acid testing (NAT) and next-generation sequencing (NGS), are also fueling market growth by offering more precise and efficient screening options. Additionally, the increasing prevalence of chronic diseases and the growing focus on early detection and preventive care are boosting the demand for comprehensive blood screening tests. The global push for improved public health standards, supported by government initiatives and regulations, is further driving the expansion of the blood screening market. These factors, combined with ongoing innovations in diagnostic technology, highlight the critical role of blood screening in modern healthcare, ensuring the safety and well-being of patients worldwide.Report Scope

The report analyzes the Blood Screening market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product & Service (Reagents & Kits, Instruments, Software & Services); Technology (Nucleic Acid Test (NAT), Enzyme-Linked Immunosorbent Assay (ELISA), Rapid Tests, Western Blot Assay, Next-Generation Sequencing (NGS)); End-Use (Blood Banks, Hospitals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blood Screening Reagents & Kits segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of 6.3%. The Blood Screening Instruments segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $729.7 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $847.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blood Screening Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blood Screening Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blood Screening Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Beckman Coulter, Inc., Becton, Dickinson & Company, bioMerieux SA, Bio-Rad Laboratories, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Blood Screening market report include:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson & Company

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Grifols International SA

- Ortho Clinical Diagnostics, Inc.

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson & Company

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Grifols International SA

- Ortho Clinical Diagnostics, Inc.

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 158 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |