Global Distribution Automation Market - Key Trends and Drivers Summarized

What Is Distribution Automation and Why Is It Transformative for Modern Power Systems?

Distribution automation refers to the process of managing and controlling electrical power distribution networks automatically using intelligent systems and real-time communication technologies. This aspect of smart grid technology enables utility companies to monitor, coordinate, and operate distribution components remotely, improving the efficiency, reliability, and quality of electric power delivery. These systems play a crucial role in optimizing the performance of the electrical grid by reducing outage time, managing load efficiently, and even integrating renewable energy sources seamlessly into the grid. The ability to rapidly detect, isolate, and restore power outages, or to dynamically manage the flow of electricity based on real-time demand and supply, marks a significant shift towards more adaptive and resilient power infrastructure.Key Components and Technologies Driving Distribution Automation

The backbone of distribution automation lies in its sophisticated technologies and components, including advanced sensors, intelligent electronic devices (IEDs), remote terminal units (RTUs), and communication networks that provide real-time data transmission and control across the grid. These elements are integrated with IT systems that utilize advanced analytics to process data and automate decision-making processes. One of the most critical technologies in distribution automation is the implementation of fault detection, isolation, and restoration (FDIR) systems, which significantly minimize outage durations by quickly identifying and isolating faults and rerouting power to restore service to unaffected areas. Moreover, voltage and reactive power control devices help maintain voltage levels within specified limits, enhancing the overall power quality delivered to consumers.The Impact of Distribution Automation on Utility Operations and Consumer Benefits

Distribution automation dramatically enhances the operational capabilities of utility companies, allowing them to manage their networks more effectively and at lower costs. By automating routine tasks and responses to system disturbances, utilities can allocate resources more efficiently, focusing on system improvements and preventive maintenance. For consumers, the primary benefit lies in the increased reliability and quality of their electric service. Distribution automation reduces the frequency and duration of power outages, provides better voltage control, and supports a more consistent service, which is particularly crucial in today's digital age where even minor disruptions can have significant consequences. Furthermore, as distribution automation facilitates the integration of distributed energy resources such as solar and wind, consumers can participate in grid operations through demand response programs, potentially leading to reduced energy costs.What Drives the Growth in the Distribution Automation Market?

The growth in the distribution automation market is driven by several factors, including the global push towards smarter energy solutions and the increasing demand for energy efficiency and grid reliability. As regions worldwide continue to modernize their electrical infrastructure, the adoption of smart grid technologies, including distribution automation, becomes essential. The integration of renewable energy sources into the grid, necessitating more dynamic and flexible grid management solutions, also propels this market forward. Additionally, technological advancements that lower the cost and increase the efficiency and capabilities of automation components encourage more utilities to invest in these systems. Regulatory policies and incentives that promote energy conservation and sustainable practices further boost the adoption of distribution automation, making it a cornerstone of future-oriented energy strategies.Report Scope

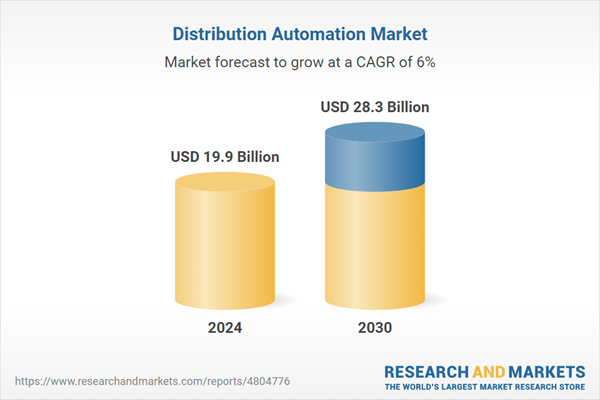

The report analyzes the Distribution Automation market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Field Device, Software & Services, Communications Technology).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Field Device Component segment, which is expected to reach US$15 Billion by 2030 with a CAGR of 6.4%. The Software & Services Component segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.5 Billion in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $4.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Distribution Automation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Distribution Automation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Distribution Automation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Cisco Systems, Inc., Eaton Corporation PLC, G&W Electric Company, General Electric Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Distribution Automation market report include:

- ABB Group

- Cisco Systems, Inc.

- Eaton Corporation PLC

- G&W Electric Company

- General Electric Company

- Landis+Gyr AG

- Power System Engineering, Inc.

- S&C Electric Company

- Schneider Electric SE

- Schweitzer Engineering Laboratories

- Siemens AG

- Xylem, Inc. - Sensus

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Cisco Systems, Inc.

- Eaton Corporation PLC

- G&W Electric Company

- General Electric Company

- Landis+Gyr AG

- Power System Engineering, Inc.

- S&C Electric Company

- Schneider Electric SE

- Schweitzer Engineering Laboratories

- Siemens AG

- Xylem, Inc. - Sensus

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 212 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.9 Billion |

| Forecasted Market Value ( USD | $ 28.3 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |