Global Display Materials Market - Key Trends and Drivers Summarized

What Constitutes Display Materials and How Are They Integral to Modern Technology?

Display materials form the core of visual technology found in smartphones, televisions, monitors, and other digital displays. These materials are specialized chemicals and compounds designed to emit or manipulate light, playing a crucial role in determining display performance, color accuracy, brightness, and contrast. Major types of display materials include liquid crystals used in LCDs, organic light-emitting diode (OLED) materials, and more recently, quantum dots which enhance color and brightness in high-definition displays. Each material type is suited to specific display technologies and has distinct manufacturing requirements and cost implications, influencing the choice of material for different applications.Innovations in Display Material Science: Pushing the Boundaries of Visual Technology

The field of display materials is characterized by rapid innovation aimed at improving efficiency, durability, and environmental sustainability. One of the key advancements has been the development of OLED materials, which offer superior color contrast and deeper blacks compared to traditional LCDs. Further, quantum dot technology has made significant inroads in enhancing display brightness and color gamut, crucial for ultra-high-definition (UHD) displays. Additionally, there is ongoing research into environmentally friendly materials that reduce the use of toxic compounds and improve recyclability, such as organic or silicon-based alternatives that offer similar or enhanced performance characteristics compared to traditional inorganic materials.Applications and Industry Demand for Advanced Display Materials

The applications of advanced display materials are vast and varied across multiple industries. In consumer electronics, the demand for thinner, more energy-efficient, and higher-resolution displays drives the need for innovative materials that can deliver these features. In the automotive sector, durable display materials that can operate reliably in a range of environmental conditions are essential for dashboard and infotainment systems. Additionally, in sectors like healthcare and public safety, high-quality display materials are critical for devices that require absolute clarity and reliability, such as medical imaging equipment and aviation displays. As technology evolves, the demand for materials that can support flexible and wearable displays is also rising, highlighting the need for continuous advancements in material science.What Drives the Growth in the Display Materials Market?

The growth in the display materials market is driven by several factors, including the escalating demand for smarter, more energy-efficient, and visually superior displays across all sectors of consumer electronics. The relentless pursuit of higher resolution screens equipped with AMOLED and OLED technologies, especially in smartphones and televisions, significantly contributes to this demand. Additionally, the increasing adoption of high-performance displays in the automotive industry, coupled with advances in dashboard and in-vehicle entertainment technologies, fuels the need for specialized display materials. The trend towards sustainable and environmentally friendly materials is also pushing manufacturers to innovate and develop new compounds that meet both performance and ecological standards. Furthermore, as the global economy recovers from disruptions such as those caused by pandemics, the market is expected to see renewed investments in display technologies, driving further innovations and applications in display materials.Report Scope

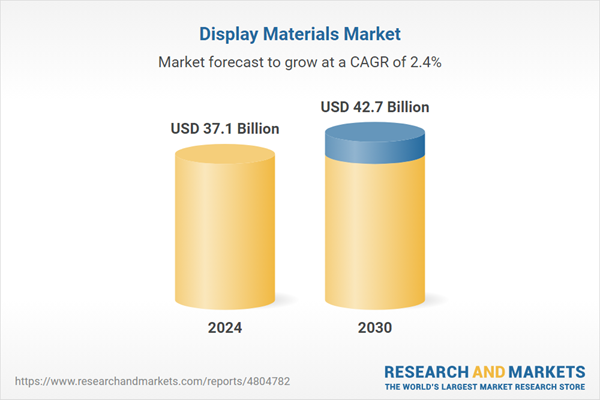

The report analyzes the Display Materials market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (LCD, OLED).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OLED Technology segment, which is expected to reach US$11.4 Billion by 2030 with a CAGR of 1.9%. The LCD Technology segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.8 Billion in 2024, and China, forecasted to grow at an impressive 2.3% CAGR to reach $6.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Display Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Display Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Display Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Glass Co., Ltd., Corning, Inc., cynora GmbH, DIC Corporation, Doosan Corporation Electro-Materials and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Display Materials market report include:

- Asahi Glass Co., Ltd.

- Corning, Inc.

- cynora GmbH

- DIC Corporation

- Doosan Corporation Electro-Materials

- Dow, Inc.

- DuPont de Nemours, Inc.

- DUKSAN Neolux Co., Ltd.

- JNC Corporation

- JSR Corporation

- LG Chem

- Luminescence Technology Corp.

- Merck & Co., Inc.

- Nissan Chemical Industries Ltd.

- Nitto Denko Avecia Inc.

- Samsung SDI Co., Ltd

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Universal Display Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Glass Co., Ltd.

- Corning, Inc.

- cynora GmbH

- DIC Corporation

- Doosan Corporation Electro-Materials

- Dow, Inc.

- DuPont de Nemours, Inc.

- DUKSAN Neolux Co., Ltd.

- JNC Corporation

- JSR Corporation

- LG Chem

- Luminescence Technology Corp.

- Merck & Co., Inc.

- Nissan Chemical Industries Ltd.

- Nitto Denko Avecia Inc.

- Samsung SDI Co., Ltd

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Universal Display Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 37.1 Billion |

| Forecasted Market Value ( USD | $ 42.7 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |