Global Digital Logistics Market - Key Trends and Drivers Summarized

What Is Digital Logistics and How Is It Transforming the Supply Chain?

Digital logistics refers to the process of managing the flow of goods, information, and resources through the integration of advanced digital technologies within the logistics and supply chain management framework. This digital transformation is aimed at increasing efficiency, reducing costs, and enhancing visibility across the entire supply chain. By leveraging technologies such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and big data analytics, digital logistics enables companies to optimize routes, manage inventory in real-time, and improve customer service by providing precise tracking updates and faster delivery times. The shift towards digital logistics is a critical move as businesses globalize and consumer expectations for speed and transparency continue to grow. This integration not only streamlines operations but also offers significant advantages in adaptability and decision-making in the fast-paced global market.How Are Emerging Technologies Driving Innovation in Digital Logistics?

The rapid advancement of technologies like AI, machine learning, and IoT is profoundly impacting the logistics industry, driving the creation of more efficient and intelligent supply chains. AI and machine learning algorithms are used to predict market trends and consumer behavior, allowing companies to plan more effectively and manage inventory dynamically. IoT devices facilitate enhanced asset tracking and condition monitoring, ensuring that goods are stored and transported under optimal conditions, thus minimizing waste and enhancing product quality. Additionally, robotics and automation technologies are increasingly employed in warehouses and during transportation, not only to reduce human error but also to decrease labor costs and improve safety. These technologies collectively contribute to creating a highly responsive and flexible logistics network that can adapt to changing market dynamics and disruptions.What Challenges and Opportunities Does Digital Logistics Present?

While digital logistics offers transformative potential, it also presents several challenges that need to be addressed. One of the primary challenges is the significant investment required for the adoption of new technologies and the integration of digital systems into existing infrastructure. There is also the hurdle of managing cybersecurity risks, as increased digitization exposes logistics systems to potential data breaches and cyber-attacks, which can jeopardize sensitive information and disrupt operations. However, these challenges are met with substantial opportunities. Digital logistics opens avenues for creating more sustainable logistics practices through optimized route planning and reduced resource wastage. It also enables companies to tap into new markets by enhancing supply chain agility and responsiveness, thus meeting customer demands more effectively and bolstering customer satisfaction.What Drives the Growth in the Digital Logistics Market?

The growth in the digital logistics market is driven by several factors, including the increasing demand for streamlined supply chains, the need for reduced delivery times, and the push towards sustainability in logistics operations. As e-commerce continues to expand, the demand for efficient logistics systems capable of managing high-volume, fast-paced environments is becoming imperative. Additionally, the global nature of modern supply chains requires enhanced coordination and integration, which digital logistics platforms facilitate. Consumer behavior that increasingly values sustainability and transparency also pushes companies to adopt digital logistics solutions that offer greater control over supply chain processes and more environmentally friendly alternatives. Moreover, the continuous evolution in technology that makes digital solutions more accessible and cost-effective encourages more companies to transition towards digital logistics, ensuring robust market growth and ongoing innovation within the industry.Report Scope

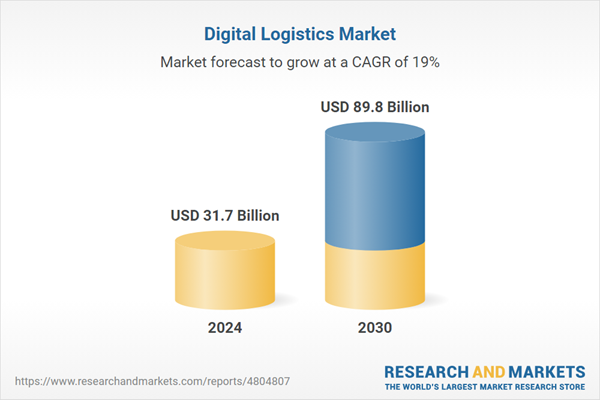

The report analyzes the Digital Logistics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Function (Transportation Management, Warehouse Management, Workforce Management); Vertical (Retail & eCommerce, Automotive, Manufacturing, Pharmaceuticals & Healthcare, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Digital Logistics Solutions segment, which is expected to reach US$50.1 Billion by 2030 with a CAGR of 18.2%. The Digital Logistics Services segment is also set to grow at 20% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.7 Billion in 2024, and China, forecasted to grow at an impressive 18% CAGR to reach $13.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Logistics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Logistics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Logistics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advantech Co., Ltd., DigiLogistics Technology Ltd., Hexaware Technologies Ltd., IBM Corporation, JDA Software Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Digital Logistics market report include:

- Advantech Co., Ltd.

- DigiLogistics Technology Ltd.

- Hexaware Technologies Ltd.

- IBM Corporation

- JDA Software Pvt. Ltd.

- Oracle Corporation

- Samsung Electronics Co., Ltd.

- SAP SE

- Tech Mahindra Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advantech Co., Ltd.

- DigiLogistics Technology Ltd.

- Hexaware Technologies Ltd.

- IBM Corporation

- JDA Software Pvt. Ltd.

- Oracle Corporation

- Samsung Electronics Co., Ltd.

- SAP SE

- Tech Mahindra Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.7 Billion |

| Forecasted Market Value ( USD | $ 89.8 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |