Global Enhanced Vision System Market - Key Trends and Drivers Summarized

How Are Enhanced Vision Systems Revolutionizing Safety and Navigation in Aviation and Beyond?

Enhanced Vision Systems (EVS) are revolutionizing safety and navigation in aviation and beyond by providing pilots and operators with critical visual information in challenging environments where natural visibility is limited. These advanced systems use infrared cameras, radar, and other sensor technologies to provide real-time imagery of the terrain, obstacles, and runway environments, even in conditions of poor visibility due to fog, rain, snow, or darkness. By overlaying this enhanced visual data onto a pilot's head-up display (HUD) or cockpit screens, EVS significantly improves situational awareness, allowing for safer landings, takeoffs, and in-flight navigation. Beyond aviation, enhanced vision systems are being adapted for use in various sectors, including automotive, maritime, and military applications, where enhanced situational awareness can prevent accidents and improve operational efficiency. As industries increasingly prioritize safety and operational reliability, EVS technology is becoming a crucial tool in ensuring that operators can navigate and make informed decisions in complex and often hazardous environments.What Innovations Are Enhancing the Functionality of Enhanced Vision Systems?

Innovations in Enhanced Vision Systems (EVS) are enhancing their functionality through advancements in sensor technology, data integration, and artificial intelligence (AI). One of the most significant developments is the use of high-definition infrared sensors and multi-spectral imaging technologies that provide clearer, more detailed images in a wide range of environmental conditions. These sensors can detect heat signatures and other critical visual cues that are invisible to the naked eye, allowing operators to see through fog, darkness, and other visual obstructions. The integration of multi-spectral imaging, which combines data from different parts of the electromagnetic spectrum, further improves the clarity and accuracy of the visual information provided by EVS, making it easier to distinguish between different objects and terrain features.Another key innovation is the integration of EVS with other avionics and navigation systems, such as synthetic vision systems (SVS) and head-up displays (HUD). By combining real-time EVS data with preloaded topographical and airport information, these systems provide a comprehensive and intuitive visual representation of the environment, even in zero visibility conditions. The overlay of EVS data onto a HUD allows pilots to maintain their focus on the external environment without needing to look down at cockpit instruments, enhancing both safety and efficiency during critical phases of flight.

Artificial intelligence is also playing an increasingly important role in the functionality of enhanced vision systems. AI algorithms can process and analyze the vast amounts of data captured by EVS sensors in real time, identifying potential hazards, optimizing image quality, and even predicting the movement of obstacles. This capability not only improves the accuracy of the information provided to operators but also reduces cognitive workload by filtering out irrelevant data and highlighting the most critical information. For example, AI-driven EVS can automatically enhance the contrast of objects in low-visibility conditions or alert pilots to potential collision risks based on real-time data analysis.

These innovations are making enhanced vision systems more powerful, reliable, and user-friendly, ensuring that they continue to play a vital role in improving safety and navigation across various industries.

How Do Enhanced Vision Systems Impact Operational Safety and Efficiency?

Enhanced Vision Systems (EVS) have a profound impact on operational safety and efficiency by significantly improving visibility and situational awareness in environments where traditional visual cues are obscured. In aviation, EVS enhances safety during critical phases of flight, such as takeoff and landing, by allowing pilots to see the runway and surrounding terrain even in adverse weather conditions. This capability reduces the risk of accidents caused by runway incursions, missed approaches, or controlled flight into terrain (CFIT), which are among the leading causes of aviation accidents. By providing clear, real-time visual information, EVS helps pilots make more informed decisions, reduces the likelihood of human error, and enhances overall flight safety.Beyond aviation, the impact of enhanced vision systems extends to other sectors, such as automotive and maritime transportation, where improved visibility can prevent accidents and save lives. In the automotive industry, EVS technology is being integrated into advanced driver-assistance systems (ADAS) to help drivers detect obstacles, pedestrians, and other vehicles in low-visibility conditions, such as nighttime driving or heavy rain. This technology is particularly beneficial for preventing collisions in situations where the driver's visibility is compromised. Similarly, in maritime operations, EVS can assist in navigation through fog, darkness, or other challenging conditions, reducing the risk of collisions with other vessels or obstacles.

The use of enhanced vision systems also improves operational efficiency by enabling continued operations in conditions that would otherwise require delays or cancellations. For example, in aviation, EVS allows for landings and takeoffs in low-visibility conditions that might otherwise necessitate diverting to an alternate airport, saving time and reducing fuel consumption. In military applications, EVS technology enables operations in complete darkness or in environments where visibility is intentionally obscured, providing a tactical advantage.

Moreover, the integration of EVS with other onboard systems, such as synthetic vision and terrain awareness and warning systems (TAWS), creates a more comprehensive and intuitive interface for operators, further enhancing safety and reducing the cognitive load. This seamless integration ensures that operators have access to the most relevant and up-to-date information, enabling faster and more accurate decision-making in critical situations.

By enhancing both safety and operational efficiency, enhanced vision systems play a crucial role in enabling safer, more reliable operations across a range of industries, from aviation and automotive to maritime and military applications.

What Trends Are Driving Growth in the Enhanced Vision Systems Market?

Several trends are driving growth in the Enhanced Vision Systems (EVS) market, including the increasing demand for safety enhancements in transportation, advancements in sensor and imaging technologies, and regulatory support for safety innovations. One of the primary drivers is the growing emphasis on safety in the aviation and automotive industries. As both sectors face increasing pressure to reduce accidents and improve operational safety, there is a rising demand for technologies that can enhance visibility and situational awareness in challenging conditions. Enhanced vision systems, with their ability to provide clear, real-time visual information in low-visibility environments, are increasingly being adopted as a critical component of safety systems in aircraft, vehicles, and other transportation modes.Advancements in sensor and imaging technologies are also contributing to the growth of the EVS market. The development of more sensitive and high-resolution infrared sensors, along with the integration of multi-spectral and thermal imaging, is expanding the capabilities of EVS, making them more effective in a wider range of conditions. These technological improvements are not only enhancing the performance of EVS but also reducing their cost, making them more accessible to a broader range of users, from commercial aviation to general aviation and beyond.

Regulatory support for safety innovations is another significant factor driving the adoption of enhanced vision systems. In aviation, for example, regulatory bodies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have recognized the safety benefits of EVS and have introduced guidelines and standards that encourage their use in commercial and private aircraft. Similarly, in the automotive industry, regulations aimed at improving vehicle safety, particularly in low-visibility conditions, are prompting manufacturers to integrate EVS into their advanced driver-assistance systems (ADAS) and autonomous driving technologies.

The growing adoption of autonomous and semi-autonomous systems in both aviation and automotive sectors is further boosting the demand for enhanced vision systems. As vehicles and aircraft become more autonomous, the need for reliable, real-time visual information becomes even more critical to ensure safe and efficient operations. EVS technology provides the necessary visual data to support autonomous decision-making, enabling vehicles and aircraft to navigate safely in complex and dynamic environments.

Additionally, the expansion of EVS applications beyond aviation into sectors such as maritime, defense, and industrial operations is contributing to market growth. In these industries, the ability to operate safely and efficiently in low-visibility conditions is crucial, making enhanced vision systems an increasingly valuable tool.

These trends underscore the growing importance of enhanced vision systems in improving safety, operational efficiency, and reliability across a wide range of industries. As technology continues to advance and the demand for safety innovations increases, the EVS market is poised for continued growth and expansion.

Report Scope

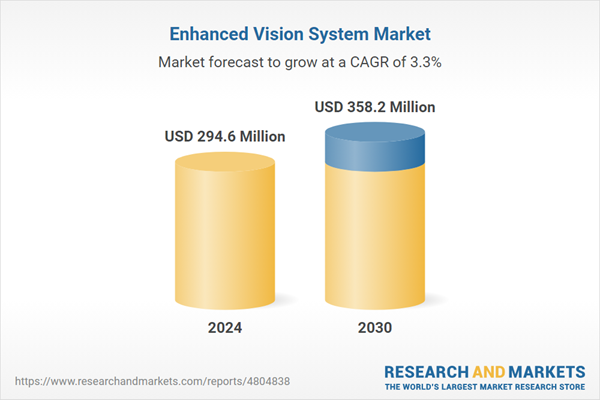

The report analyzes the Enhanced Vision System market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: System (Synthetic Vision Systems, Enhanced Vision System); Component (Display Screen, Sensors, Camera, Other Components).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Display Screen Component segment, which is expected to reach US$135.3 Million by 2030 with a CAGR of 3%. The Sensors Component segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $78.3 Million in 2024, and China, forecasted to grow at an impressive 3.2% CAGR to reach $57.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Enhanced Vision System Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Enhanced Vision System Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Enhanced Vision System Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Astronics Corporation, ATS Automation Tooling Systems, Inc., Collins Aerospace, Elbit Systems Ltd., Icare Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Enhanced Vision System market report include:

- Astronics Corporation

- ATS Automation Tooling Systems, Inc.

- Collins Aerospace

- Elbit Systems Ltd.

- Icare Industries, Inc.

- Industrial Vision Systems Ltd.

- iVision International LLC

- L3Harris Technologies, Inc.

- Max-Viz

- MediWorks

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Astronics Corporation

- ATS Automation Tooling Systems, Inc.

- Collins Aerospace

- Elbit Systems Ltd.

- Icare Industries, Inc.

- Industrial Vision Systems Ltd.

- iVision International LLC

- L3Harris Technologies, Inc.

- Max-Viz

- MediWorks

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 294.6 Million |

| Forecasted Market Value ( USD | $ 358.2 Million |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |