Global FRP Tanks Market - Key Trends and Drivers Summarized

How Are FRP Tanks Revolutionizing Industrial Storage and Chemical Containment?

Fiber Reinforced Polymer (FRP) tanks are revolutionizing the industrial storage and chemical containment sectors by providing a durable, lightweight, and corrosion-resistant solution for storing a wide range of liquids, including chemicals, wastewater, and potable water. Made from a composite material that combines a polymer matrix with reinforcing fibers such as glass, carbon, or aramid, FRP tanks are known for their high strength-to-weight ratio and ability to withstand harsh environmental conditions. These properties make them ideal for industries such as water treatment, chemical processing, oil and gas, and agriculture, where traditional materials like steel or concrete would quickly degrade due to corrosion or chemical exposure.One of the key advantages of FRP tanks is their superior corrosion resistance, particularly when compared to traditional steel or concrete tanks. Unlike steel, which can rust or corrode when exposed to moisture or chemicals, FRP is highly resistant to both, making it a reliable choice for storing aggressive chemicals such as acids, alkalis, and solvents. Additionally, FRP tanks are often used in environments with extreme temperatures, saltwater exposure, or other corrosive conditions, as they can maintain structural integrity without the need for costly coatings or linings. This durability translates into lower maintenance costs, a longer service life, and greater reliability for industries that rely on secure, long-term storage solutions.

What Technological Advancements Are Enhancing the Performance of FRP Tanks?

Technological advancements in the design, manufacturing, and material composition of FRP tanks have significantly enhanced their performance, making them a versatile solution for a wide range of industrial storage needs. One of the most important advancements is the improvement in resin systems used in FRP tanks. Modern resins, such as vinyl ester and epoxy, offer enhanced chemical resistance and improved mechanical properties, making FRP tanks suitable for storing more aggressive chemicals and extending their useful life. These resins are highly resistant to permeation and environmental degradation, ensuring that the stored contents remain secure without compromising the tank's structural integrity.In addition to advancements in resin chemistry, innovations in manufacturing processes, such as filament winding and pultrusion, have improved the precision and strength of FRP tanks. Filament winding, in particular, enables the production of tanks with optimized fiber orientation, ensuring maximum strength in specific areas where it is needed most. This process creates uniform, high-performance tanks with enhanced structural stability and resistance to cracking or deformation under high pressures. The ability to design custom fiber patterns also allows manufacturers to create tanks that are tailored to the specific needs of different industries, whether for chemical containment, water storage, or wastewater treatment.

The introduction of dual-laminate FRP tanks has further expanded their capabilities. These tanks combine the benefits of both FRP and thermoplastics, offering an additional layer of chemical resistance. The inner thermoplastic lining provides extra protection against permeation by highly corrosive chemicals, while the outer FRP layer provides the necessary structural strength. This combination is particularly useful for storing chemicals like hydrochloric acid, sulfuric acid, or other highly reactive substances. These technological advancements have made FRP tanks more robust, reliable, and adaptable, ensuring they meet the diverse needs of modern industrial applications.

How Are FRP Tanks Contributing to Sustainable Infrastructure and Industrial Practices?

FRP tanks are playing a crucial role in promoting sustainability in industrial and infrastructure projects by offering an eco-friendly alternative to traditional storage solutions. One of the key sustainability advantages of FRP tanks is their long service life and low maintenance requirements. Traditional tanks made from steel or concrete often require regular maintenance, coatings, and repairs due to corrosion, rust, or chemical damage. By contrast, FRP tanks are highly resistant to corrosion and do not require coatings, significantly reducing the amount of resources and chemicals used in maintenance over the tank's lifespan. This not only lowers operational costs but also reduces the environmental impact associated with frequent maintenance, repair, and replacement activities.The lightweight nature of FRP tanks also contributes to their sustainability by lowering transportation and installation costs. Because FRP tanks are lighter than their steel or concrete counterparts, they require less fuel to transport and can often be installed with smaller, less energy-intensive equipment. This reduction in fuel consumption and energy use during the transportation and installation process aligns with the increasing demand for sustainable practices in construction and industrial operations. Additionally, the ease of installation and reduced downtime associated with FRP tanks make them an attractive option for industries that seek to minimize environmental disruption during infrastructure projects.

Another sustainability benefit of FRP tanks is the ability to incorporate recycled materials into the manufacturing process, as well as the potential for recycling the tanks at the end of their service life. As industries move toward circular economy models, the use of recyclable composites and bio-based resins is becoming more prominent in FRP tank production. These innovations help reduce the environmental footprint of industrial storage and make FRP tanks an eco-friendly alternative to traditional materials that may be more difficult or costly to recycle. By offering a long-lasting, recyclable, and low-maintenance storage solution, FRP tanks are contributing to greener industrial practices and supporting the development of sustainable infrastructure.

What's Driving the Growth of the FRP Tank Market?

The growth of the FRP tank market is driven by several key factors, including the increasing demand for corrosion-resistant storage solutions, the need for lightweight and easy-to-install materials, and advancements in FRP manufacturing technologies. One of the primary drivers is the growing use of chemicals and wastewater treatment in industrial processes. In sectors like water treatment, chemical processing, oil and gas, and agriculture, the need for reliable storage solutions that can withstand corrosive substances is paramount. Traditional steel or concrete tanks often struggle to provide long-term durability in these environments due to their susceptibility to corrosion, leading to costly maintenance and frequent replacements. FRP tanks, with their superior resistance to chemicals, moisture, and environmental factors, are increasingly being adopted as a long-lasting alternative.Another significant driver is the rising need for more efficient and cost-effective storage solutions, particularly in industries where installation time and labor costs are major concerns. FRP tanks, being much lighter than traditional materials, are easier to transport and install, reducing overall project timelines and associated costs. This makes FRP tanks especially attractive in industries such as agriculture and water management, where large-scale storage systems need to be deployed quickly and efficiently. As companies continue to seek ways to reduce project costs and improve operational efficiency, the lightweight and versatile nature of FRP tanks is becoming a key factor driving market growth.

Furthermore, the increased focus on environmental sustainability and the need for more eco-friendly industrial practices are fueling demand for FRP tanks. As industries seek to minimize their environmental footprint, FRP's long service life, low maintenance requirements, and potential for recyclability offer a clear advantage over more resource-intensive materials like steel and concrete. This focus on sustainability is especially relevant in sectors such as wastewater management and renewable energy, where environmental impact is closely scrutinized. With these factors driving demand, the FRP tank market is expected to experience steady growth in both established and emerging industries.

What Future Trends Are Shaping the Development of FRP Tanks?

Several emerging trends are shaping the future of FRP tanks, including the increased focus on sustainability, advancements in composite materials, and the integration of smart technologies for improved monitoring and maintenance. One of the most prominent trends is the shift toward more sustainable materials in the production of FRP tanks. Manufacturers are increasingly exploring the use of bio-based resins and recycled fibers in the manufacturing process to reduce the environmental impact of FRP products. These eco-friendly alternatives offer the same high performance as traditional FRP materials but with a lower carbon footprint, aligning with the growing demand for greener industrial solutions.Another key trend is the development of new and advanced composite materials that enhance the performance of FRP tanks in demanding environments. For instance, the use of carbon fibers in FRP tanks is gaining traction due to its superior strength and stiffness compared to glass fibers. This allows for the production of tanks that can withstand higher pressures and more extreme temperatures, expanding the range of applications for FRP tanks in industries such as oil and gas, chemical processing, and renewable energy. Additionally, hybrid composite technologies, which combine different types of fibers, are emerging as a way to optimize the balance between strength, weight, and cost, making FRP tanks even more versatile and efficient.

The integration of smart technologies into FRP tanks is also expected to play a major role in the future of the industry. With the rise of the Internet of Things (IoT) and Industry 4.0, there is growing interest in embedding sensors into FRP tanks to monitor conditions such as pressure, temperature, and fluid levels in real-time. These smart tanks could provide valuable data for predictive maintenance, allowing operators to detect potential issues before they become critical and optimize the performance of storage systems. This trend toward digitalization and smart infrastructure is expected to enhance the reliability and efficiency of FRP tanks in a wide range of industrial applications.

As these trends continue to shape the development of FRP tanks, the industry is poised for further growth, driven by the demand for more sustainable, efficient, and technologically advanced storage solutions. Whether through innovations in materials, sustainability efforts, or smart technology integration, FRP tanks are set to play an increasingly important role in the future of industrial storage and containment.

Report Scope

The report analyzes the FRP Tanks market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Fiber Type (Glass, Carbon); Application (Water & Wastewater Treatment, Oil & Gas, Power, Pulp & Paper, Chemical).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water & Wastewater Treatment Application segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of 5.9%. The Oil & Gas Application segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $697.8 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $817.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global FRP Tanks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global FRP Tanks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global FRP Tanks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Composite Technology Development, Inc., Denali Inc., Enduro Composites, Inc., EPP Composites Pvt Ltd., Faber Industrie Spa and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this FRP Tanks market report include:

- Composite Technology Development, Inc.

- Denali Inc.

- Enduro Composites, Inc.

- EPP Composites Pvt Ltd.

- Faber Industrie Spa

- Hexagon Composite Engineering Sdn Bhd

- Hexagon Composites ASA

- Lf Manufacturing Inc.

- Luxfer Holdings Plc

- ZCL Composites Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Composite Technology Development, Inc.

- Denali Inc.

- Enduro Composites, Inc.

- EPP Composites Pvt Ltd.

- Faber Industrie Spa

- Hexagon Composite Engineering Sdn Bhd

- Hexagon Composites ASA

- Lf Manufacturing Inc.

- Luxfer Holdings Plc

- ZCL Composites Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

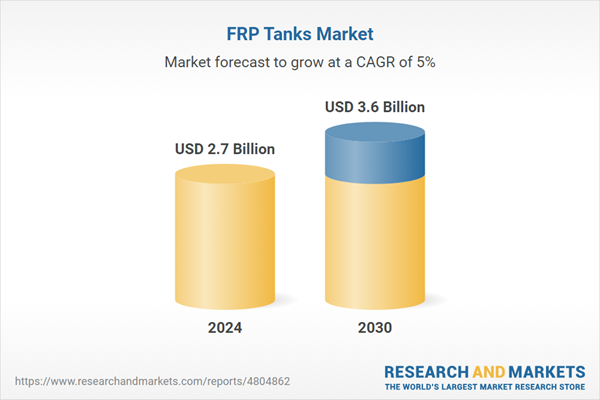

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |