Global Food Robotics Market - Key Trends and Drivers Summarized

How is Food Robotics Revolutionizing Food Production and Efficiency?

Food robotics is transforming how food is produced, processed, and delivered, but why is it becoming so essential in the modern food industry? Food robotics refers to the use of automated machines and robots to perform various tasks in the food production and processing sector. These machines handle everything from food preparation and packaging to quality control and palletizing, reducing the need for human intervention. Food robotics technology increases efficiency, accuracy, and consistency, enabling manufacturers to meet high demand while maintaining strict quality and safety standards.One of the primary reasons food robotics is revolutionizing the industry is its ability to automate repetitive and labor-intensive tasks, increasing productivity and efficiency. Robots can perform tasks such as slicing, sorting, and packaging with incredible speed and precision, far surpassing the capabilities of manual labor. This automation allows food manufacturers to boost production rates, lower labor costs, and minimize human error, leading to a more consistent product. As demand for faster production grows, particularly in areas like processed foods, ready-to-eat meals, and beverages, robotics is becoming indispensable in helping companies scale their operations and remain competitive.

How Do Food Robotics Work, and What Makes Them So Effective?

Food robotics are integral to modern food production, but how do they work, and what makes them so effective in enhancing both speed and precision? Food robots use advanced sensors, cameras, and software to detect, manipulate, and process food items. These machines are equipped with artificial intelligence (AI) and machine learning algorithms that allow them to perform highly specialized tasks such as quality inspection, portion control, and customized food handling. Robotics systems can be programmed to handle delicate tasks, like handling soft fruits or placing decorations on cakes, without damaging the product, ensuring both efficiency and accuracy.What makes food robotics so effective is their ability to operate in demanding environments. Robots can work in extreme conditions, such as cold storage environments or high-heat cooking areas, where human labor might be less efficient or prone to errors. They also maintain the same speed and precision over long periods, eliminating the risk of fatigue, which is a common issue with manual labor. Furthermore, robots can be programmed to switch between tasks quickly, enabling manufacturers to respond to changing production needs with minimal downtime. This flexibility makes food robots ideal for a variety of applications, from large-scale production lines to more specialized tasks in gourmet kitchens and bakeries.

Additionally, food robotics is driving improvements in food safety. Robots minimize human contact with food, reducing the risk of contamination and ensuring that hygiene standards are consistently met. They also enable real-time data collection and monitoring, allowing food processors to track performance, identify potential issues, and make necessary adjustments instantly. By automating processes like sorting and inspection, robotics technology enhances the accuracy of quality control measures, ensuring that only products that meet safety and quality criteria reach the consumer.

How Are Food Robotics Shaping the Future of Precision Cooking, Sustainability, and Labor Solutions?

Food robotics is not only improving efficiency - it is also shaping the future of precision cooking, sustainability, and labor solutions in the food industry. One of the most exciting developments in food robotics is the rise of precision cooking and automated meal preparation systems. Robotic chefs and cooking systems, equipped with AI and machine learning, are being developed to replicate complex recipes with perfect consistency. These robots can measure ingredients, adjust cooking times and temperatures, and assemble dishes with remarkable accuracy, making them ideal for restaurants, fast food chains, and even home kitchens. By automating the cooking process, food robotics ensures that meals are prepared precisely to specifications, reducing waste and improving consistency.In addition to precision cooking, food robotics is advancing sustainability efforts within the industry. Robots are helping to reduce food waste by improving portion control and enhancing food sorting techniques. For example, robotic systems can detect imperfections or foreign materials in fruits and vegetables more effectively than the human eye, ensuring that only high-quality produce moves through the supply chain. In food processing plants, robotics help optimize packaging, reducing material usage and ensuring that products are packaged more efficiently, thus lowering the overall environmental impact. As sustainability becomes a priority for food producers, robotics technology is playing a key role in minimizing waste and resource consumption.

Food robotics is also addressing labor shortages and creating more sustainable labor solutions for the food industry. With many regions experiencing labor shortages in food processing and agriculture, robots are filling critical gaps by performing tasks that are physically demanding or difficult for humans. Automation reduces the need for manual labor in repetitive tasks like sorting, packaging, and cleaning, allowing workers to focus on more complex and value-added tasks. Moreover, robots help manufacturers maintain productivity during labor shortages, ensuring that production lines continue to run smoothly without interruptions. As the labor market evolves, food robotics will play a central role in optimizing workforce allocation and enhancing productivity.

Moreover, food robotics is making strides in personalized food production. Robots are capable of customizing food products based on individual preferences, such as adjusting ingredients for dietary restrictions or flavor profiles. This ability to offer personalized meals at scale is becoming increasingly important in sectors like the meal-kit industry and ready-to-eat meal production, where consumers demand convenience and customization. The combination of robotics and AI is opening new possibilities for on-demand food production, enabling manufacturers and restaurants to offer bespoke meals with high precision.

What Factors Are Driving the Growth of the Food Robotics Market?

Several key factors are driving the rapid growth of the food robotics market, reflecting broader trends in automation, labor optimization, and sustainability. One of the primary drivers is the increasing demand for automation in food production. As food manufacturers face pressure to increase efficiency and reduce costs, robotics provides a scalable solution to meet these challenges. Robots are capable of working around the clock, producing more goods with greater consistency and precision than manual labor. The ability to automate repetitive and labor-intensive tasks, such as packaging, labeling, and sorting, makes robotics an attractive option for manufacturers looking to boost production capacity without compromising quality.Another significant factor contributing to the growth of the food robotics market is the rising consumer demand for precision and customization. With more consumers seeking personalized food experiences, whether through meal delivery services or dietary-specific products, robotics offers the technology needed to produce customized meals and products on a large scale. Robotics systems equipped with AI can easily adapt to different recipes, ingredients, and serving sizes, enabling manufacturers to meet consumer preferences with accuracy and speed. This demand for customized food solutions is expected to drive further investment in robotic systems designed for precision cooking and meal assembly.

The shortage of skilled labor in the food industry is also driving the adoption of food robotics. Many food processing plants and agricultural operations are struggling to find workers to perform labor-intensive tasks. Robots offer a solution by automating these processes, reducing reliance on manual labor and helping manufacturers overcome workforce shortages. In addition, robots provide consistency and reliability in tasks that require precision and repetitive action, such as food packaging and inspection. As labor shortages continue to affect the food industry, the demand for automated solutions will grow, pushing the food robotics market to expand even further.

Finally, technological advancements in robotics, AI, and machine learning are making food robotics more accessible and affordable for a wider range of food producers. Robots are becoming more adaptable, capable of performing delicate tasks such as handling fragile fruits or slicing soft cheeses without damaging them. This flexibility makes robotics technology applicable across various sectors of the food industry, from large-scale industrial processing plants to small artisanal producers. The integration of AI and machine learning also allows robots to learn and improve over time, making them more efficient and cost-effective. As these technologies continue to evolve, the food robotics market is expected to grow significantly, driven by innovations that enhance efficiency, safety, and customization in food production.

Report Scope

The report analyzes the Food Robotics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Payload (Low (Below 10 Kg), Medium (10 - 100 Kg), Heavy (Above 100 Kg)); Function (Palletizing, Packaging & Repackaging, Pick & Place, Processing, Other Functions); End-Use (Beverages, Meat, Poultry & Seafood, Fruits & Vegetables, Confectionery, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Low (Below 10 Kg) Payload segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of 14%. The Medium (10 - 100 Kg) Payload segment is also set to grow at 12% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $805.6 Million in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $915.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Robotics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Robotics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Robotics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

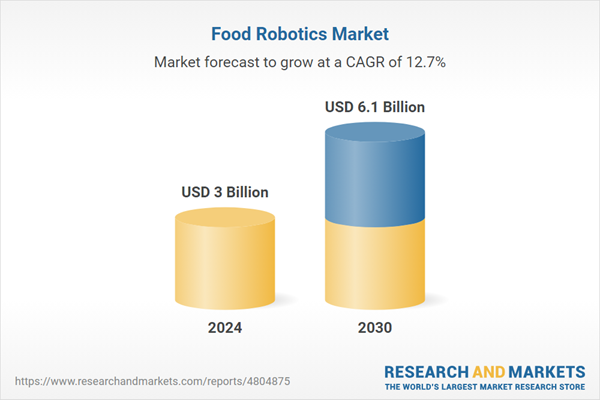

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Bastian Solutions, Inc., FANUC Corporation, Kawasaki Heavy Industries Ltd., KUKA AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Food Robotics market report include:

- ABB Group

- Bastian Solutions, Inc.

- FANUC Corporation

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Seiko Epson Corporation

- Staubli International AG

- Universal Robots A/S

- Yaskawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Bastian Solutions, Inc.

- FANUC Corporation

- Kawasaki Heavy Industries Ltd.

- KUKA AG

- Mayekawa Mfg. Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Seiko Epson Corporation

- Staubli International AG

- Universal Robots A/S

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |