Global Food Certification Market - Key Trends and Drivers Summarized

Why Is Food Certification Revolutionizing Consumer Confidence and Industry Compliance?

Food certification has become a key element in the modern food industry, but why is it so vital in building consumer trust and ensuring compliance with industry standards? Food certification involves third-party verification that food products meet specific safety, quality, and ethical standards. These certifications can cover a range of categories, including organic, non-GMO, fair trade, halal, kosher, and sustainable production practices. The certification process ensures that food manufacturers follow strict guidelines throughout the production, processing, and distribution stages, providing consumers with confidence that the products they purchase meet their expectations in terms of safety, quality, and ethical considerations.One of the primary reasons food certification is revolutionizing the industry is its ability to enhance consumer trust and brand transparency. Consumers today are more informed and concerned about the food they eat, demanding assurance that products are safe, ethically produced, and environmentally sustainable. Certifications offer a clear and reliable way for consumers to verify the claims made on food labels, such as organic or sustainably sourced ingredients. By adhering to certification standards, companies can demonstrate their commitment to quality and transparency, which helps build trust with consumers and differentiate their products in a competitive market.

How Does Food Certification Work, and What Makes It So Effective?

Food certification is critical to maintaining industry standards, but how does it work, and what makes it so effective in ensuring product integrity? The certification process typically involves independent audits and inspections by accredited certifying bodies. These third-party organizations assess a company's adherence to specific guidelines, such as organic farming practices, sustainable fishing methods, or the use of non-GMO ingredients. After verifying compliance with the required standards, the certifying body grants the product a certification label that can be displayed on packaging. This label serves as a mark of authenticity, giving consumers confidence in the product's quality and origin.What makes food certification so effective is its stringent and transparent auditing process. Certifications are not granted lightly; companies must undergo thorough inspections and meet all the necessary criteria before they can claim certification. For example, organic certification requires that products be grown without synthetic pesticides, herbicides, or genetically modified organisms (GMOs), and that farmers adhere to sustainable farming practices. Certifying bodies also perform regular follow-up audits to ensure ongoing compliance. This rigorous approach ensures that only products that truly meet the specified standards can carry the certification label, providing a high level of credibility and trust for consumers.

Additionally, food certification supports global trade and regulatory compliance. Many countries have strict import regulations regarding food safety and quality, and certification helps companies meet these requirements. For example, obtaining Global Food Safety Initiative (GFSI) certification ensures that products comply with international food safety standards, which is crucial for companies looking to export their goods. Certification can also help businesses avoid legal and regulatory issues, as it demonstrates adherence to established safety and quality protocols. This makes certification an essential tool for food manufacturers seeking to expand their market reach while maintaining compliance with global regulations.

How Is Food Certification Shaping the Future of Sustainability and Ethical Sourcing?

Food certification is not only improving current industry practices - it is also shaping the future of sustainability and ethical sourcing in the food industry. One of the most significant trends in food certification is the growing demand for sustainable and ethical certifications. As consumers become more environmentally conscious, they are looking for products that have been produced in a way that minimizes environmental impact and promotes fair labor practices. Certifications such as Fair Trade, Rainforest Alliance, and Marine Stewardship Council (MSC) help ensure that food products are sourced responsibly, protecting ecosystems and supporting the livelihoods of farmers, fishers, and workers around the world.In addition to promoting sustainability, food certification is advancing organic and non-GMO food production. Organic certification is particularly popular among consumers who prefer food grown without synthetic chemicals or genetic modification. These products are viewed as healthier and more environmentally friendly, as they often involve practices that protect soil health and biodiversity. Non-GMO certification, on the other hand, ensures that products do not contain genetically modified organisms, appealing to consumers who are concerned about the impact of GMOs on health and the environment. As demand for organic and non-GMO products grows, certification is helping to ensure that these products meet strict production standards, giving consumers confidence in their choices.

Food certification is also driving transparency in supply chains. Certifications like the Roundtable on Sustainable Palm Oil (RSPO) or the Global Organic Textile Standard (GOTS) trace products back to their origins, providing full visibility into sourcing practices. This level of traceability allows consumers to make informed purchasing decisions, knowing exactly where their food comes from and how it was produced. For businesses, certification creates a transparent, accountable supply chain that meets both ethical and regulatory expectations. As consumer interest in traceability increases, certification will continue to play a central role in ensuring that products are produced responsibly and sustainably.

Furthermore, food certification is playing a crucial role in combating food fraud. As global supply chains become more complex, the risk of mislabeling, adulteration, or misrepresentation increases. Certifications offer an extra layer of protection by verifying the authenticity of claims made about food products, such as organic, non-GMO, or fair trade. This helps prevent deceptive practices and ensures that consumers receive products that align with their values and expectations. By safeguarding the integrity of food labeling, certification enhances consumer confidence and reduces the likelihood of fraudulent products entering the market.

What Factors Are Driving the Growth of the Food Certification Market?

Several key factors are driving the rapid growth of the food certification market, reflecting broader trends in consumer preferences, regulatory compliance, and sustainability efforts. One of the primary drivers is the increasing consumer demand for transparency and ethical products. Modern consumers are more aware of food production processes and are demanding assurance that the food they purchase aligns with their values. Certifications such as organic, non-GMO, and fair trade provide this assurance by verifying that products meet stringent ethical and environmental standards. As the demand for ethically sourced and environmentally responsible products grows, food certification will continue to be a key factor in building consumer trust.Another significant factor contributing to the growth of the food certification market is the rise of food safety regulations. Governments and international bodies are implementing stricter guidelines to ensure food safety and quality, particularly in response to concerns about foodborne illnesses and global trade. Certifications such as the Global Food Safety Initiative (GFSI) and Hazard Analysis and Critical Control Points (HACCP) help companies comply with these regulations by demonstrating that their products meet established safety protocols. As regulatory pressures increase, food manufacturers are turning to certification as a way to ensure compliance and avoid costly recalls or penalties.

The expansion of global trade is also driving the need for food certification. As food supply chains become more international, companies must meet the diverse regulatory and safety requirements of different countries. Certification provides a universal standard that helps businesses navigate these complexities, ensuring that their products are accepted in global markets. Certifications also enhance market access by building trust with international consumers who rely on certification labels to verify product quality, safety, and origin. As global food trade continues to grow, certification will be essential for companies looking to expand their reach and remain competitive.

Finally, technological advancements in certification processes are making it easier for companies to obtain and maintain certifications. Innovations in digital auditing, blockchain for traceability, and real-time data sharing are streamlining certification procedures, reducing the time and cost associated with audits and compliance checks. These technologies also provide greater transparency, allowing consumers and regulators to verify the authenticity of certification claims with more confidence. As the food industry becomes more digitized, these technological advancements will continue to drive the growth and effectiveness of food certification, ensuring that products meet the highest standards of safety, quality, and ethics.

Report Scope

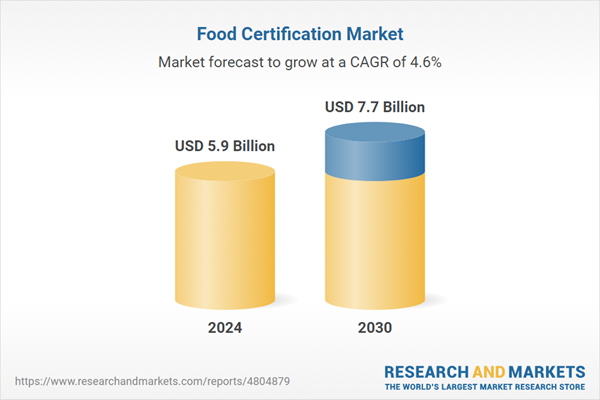

The report analyzes the Food Certification market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (ISO 22000, BRC, SQF, IFS, Free-From Certifications, Halal, Kosher, Other Types); Application (Meat, Poultry & Seafood, Dairy, Bakery & Confectionery, Infant Food, ‘Free-From’ Foods, Beverages, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Meat, Poultry & Seafood Application segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of 5.3%. The ‘Free-From’ Foods Application segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Certification Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Certification Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Certification Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALS Ltd., AsureQuality, Bureau Veritas SA, Dekra SE, DNV GL Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Food Certification market report include:

- ALS Ltd.

- AsureQuality

- Bureau Veritas SA

- Dekra SE

- DNV GL Group

- Intertek Group PLC

- Kiwa Sverige

- Lloyd's Register Group Limited

- SGS SA

- Tuv Sud AG

- UL LLC (Underwriters Laboratories)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALS Ltd.

- AsureQuality

- Bureau Veritas SA

- Dekra SE

- DNV GL Group

- Intertek Group PLC

- Kiwa Sverige

- Lloyd's Register Group Limited

- SGS SA

- Tuv Sud AG

- UL LLC (Underwriters Laboratories)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 323 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.9 Billion |

| Forecasted Market Value ( USD | $ 7.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |