Global Food Antioxidants Market - Key Trends and Drivers Summarized

Why Are Food Antioxidants Revolutionizing Shelf Life and Nutritional Value in the Food Industry?

Food antioxidants are transforming how food products are preserved and fortified, but why are they so crucial in modern food production? Food antioxidants are additives that prevent oxidation in food, a process that can lead to spoilage, rancidity, and loss of nutritional value. Oxidation occurs when food is exposed to oxygen, causing degradation of fats, oils, and certain vitamins. By slowing down or preventing this reaction, antioxidants help maintain the freshness, taste, color, and nutritional integrity of food products. These substances are widely used in processed foods, oils, snacks, and beverages, making them essential for maintaining product quality.One of the primary reasons food antioxidants are revolutionizing the industry is their ability to extend the shelf life of food products. Antioxidants such as ascorbic acid (vitamin C), tocopherols (vitamin E), and synthetic compounds like butylated hydroxyanisole (BHA) and butylated hydroxytoluene (BHT) play a critical role in preserving perishable goods by inhibiting the oxidative degradation of lipids and fats. This helps food manufacturers reduce waste and ensure that products remain fresh and palatable for longer periods, even in challenging storage conditions. As global food distribution networks grow and consumer demand for high-quality products increases, the use of antioxidants in food preservation is becoming more important than ever.

How Do Food Antioxidants Work, and What Makes Them So Effective?

Food antioxidants are essential in maintaining the quality and nutritional value of food, but how do they work, and what makes them so effective in preventing spoilage? Antioxidants work by neutralizing free radicals, which are unstable molecules that can cause oxidative damage to food. When food is exposed to air, light, or heat, free radicals are formed, leading to the breakdown of fats, proteins, and vitamins. Antioxidants prevent this process by donating electrons to free radicals, stabilizing them and stopping the chain reaction that leads to oxidation. This helps preserve the flavor, color, and nutritional content of food.What makes food antioxidants so effective is their versatility and ability to protect various types of food products. For example, natural antioxidants like ascorbic acid are commonly used in fruit juices and canned fruits to prevent browning and loss of vitamin C. Tocopherols are widely used in oils, margarine, and snack foods to prevent the rancidity of fats. Synthetic antioxidants like BHT and BHA are often used in processed foods, cereals, and snacks to provide long-lasting protection against oxidation. These antioxidants are carefully selected based on the type of food and the specific challenges associated with maintaining its freshness and quality.

In addition to preventing spoilage, food antioxidants play a key role in maintaining the nutritional value of foods. Certain antioxidants, such as vitamin C and vitamin E, not only preserve the freshness of food but also contribute to its nutritional content, making them a valuable addition to health-conscious consumers. For instance, vitamin C is a powerful antioxidant that helps maintain the color and flavor of fruits while boosting the immune system when consumed. This dual role of food antioxidants - preserving both quality and nutrition - makes them an indispensable component in the modern food industry.

How Are Food Antioxidants Shaping the Future of Clean-Label Products and Functional Foods?

Food antioxidants are not only improving the longevity and quality of products - they are also shaping the future of clean-label products and functional foods. One of the most significant trends in food antioxidants is the shift toward natural antioxidants as consumers demand cleaner, more transparent labels. Natural sources of antioxidants, such as rosemary extract, green tea extract, and mixed tocopherols, are gaining popularity as alternatives to synthetic antioxidants. These natural compounds offer the same preservative benefits while appealing to consumers who prefer fewer artificial ingredients in their food. As the clean-label trend grows, natural antioxidants are becoming key players in delivering both food preservation and consumer trust.In addition to supporting clean-label products, food antioxidants are driving innovation in functional foods. Functional foods are products that offer health benefits beyond basic nutrition, and antioxidants are often added to these foods to enhance their health-promoting properties. For example, antioxidants like polyphenols and flavonoids, found in foods such as berries, dark chocolate, and green tea, are known for their ability to reduce oxidative stress and support heart health. Food manufacturers are increasingly incorporating these antioxidant-rich ingredients into snacks, beverages, and supplements to cater to health-conscious consumers looking for added value in their diet.

Food antioxidants are also advancing sustainability efforts in the food industry by helping to reduce food waste. By preventing oxidation and spoilage, antioxidants enable longer shelf lives, which reduces the amount of food that is discarded due to spoilage or loss of quality. This is particularly important in industries such as snack foods, oils, and processed meats, where rancidity and oxidation can render products inedible. By extending shelf life, antioxidants help manufacturers reduce waste, lower costs, and contribute to more sustainable production practices, aligning with growing consumer concerns about food waste and environmental impact.

Moreover, food antioxidants are being used to support innovations in packaging and food processing. Advanced packaging solutions, such as active packaging, incorporate antioxidants directly into packaging materials to protect food from oxidation throughout its shelf life. This innovation not only extends freshness but also reduces the need for additional preservatives in the food itself. As food manufacturers continue to explore new ways to improve product longevity and quality, antioxidants will play a central role in driving these advancements.

What Factors Are Driving the Growth of the Food Antioxidant Market?

Several key factors are driving the rapid growth of the food antioxidant market, reflecting broader trends in health-conscious eating, natural ingredients, and food preservation technologies. One of the primary drivers is the increasing demand for processed and packaged foods. As consumers seek convenient, ready-to-eat products, there is a growing need for preservatives that can extend the shelf life of these foods while maintaining their quality. Antioxidants are widely used in packaged snacks, baked goods, oils, and beverages to prevent spoilage and ensure that products remain fresh and appealing to consumers for longer periods.Another significant factor contributing to the growth of the food antioxidant market is the rise in consumer awareness of health and wellness. As people become more informed about the role of antioxidants in preventing oxidative damage and supporting overall health, there is an increasing demand for foods and beverages that are fortified with antioxidants. Consumers are seeking out antioxidant-rich products like superfoods, supplements, and beverages that promote health benefits such as reduced inflammation, improved skin health, and enhanced immune function. This health-conscious mindset is fueling demand for both natural and synthetic antioxidants in food products.

The shift toward natural ingredients is also driving the adoption of food antioxidants. As consumers move away from artificial preservatives, food manufacturers are turning to natural antioxidants like tocopherols, rosemary extract, and ascorbic acid to maintain product quality while meeting consumer preferences for clean labels. This trend is encouraging innovation in sourcing and developing natural antioxidants that can effectively preserve food without compromising on taste, texture, or nutritional value. The growing popularity of organic and natural food products is expected to continue driving demand for these types of antioxidants.

Finally, technological advancements in food processing and preservation are expanding the applications of food antioxidants. Innovations in food formulation and packaging technologies are enabling the more efficient use of antioxidants to protect food from oxidation and extend shelf life. For example, the development of microencapsulation techniques allows antioxidants to be evenly distributed throughout a product, enhancing their effectiveness in preventing oxidation. As the food industry continues to evolve and adapt to consumer preferences, the demand for innovative antioxidant solutions is expected to grow, positioning antioxidants as a crucial tool in the future of food preservation and quality control.

Report Scope

The report analyzes the Food Antioxidants market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Synthetic, Natural); Form (Dry, Liquid); Application (Prepared Meat & Poultry, Prepared Foods, Beverages, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Form segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 3.5%. The Liquid Form segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $388.3 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $360.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Antioxidants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Antioxidants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Antioxidants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company, Barentz, BASF SE, Camlin Fine Sciences, Ltd., Dow, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Food Antioxidants market report include:

- Archer Daniels Midland Company

- Barentz

- BASF SE

- Camlin Fine Sciences, Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Frutarom Industries Ltd.

- Kalsec, Inc.

- Kemin Industries, Inc.

- Koninklijke DSM NV

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company

- Barentz

- BASF SE

- Camlin Fine Sciences, Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Frutarom Industries Ltd.

- Kalsec, Inc.

- Kemin Industries, Inc.

- Koninklijke DSM NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 323 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

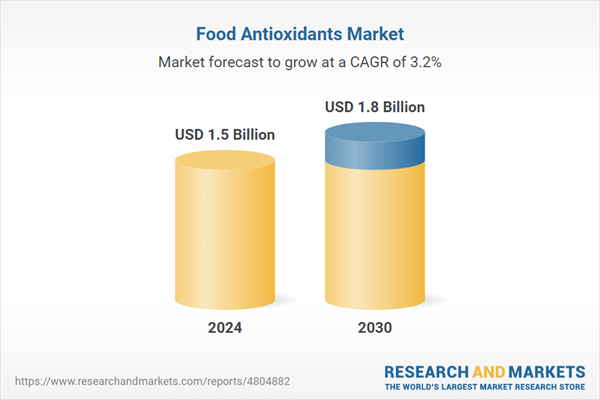

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |