Global Food Anti-caking Agents Market - Key Trends and Drivers Summarized

Why Are Food Anti-Caking Agents Revolutionizing Food Production and Quality Control?

Food anti-caking agents have become a fundamental component in food production, but why are they so critical to ensuring product quality and consistency? Anti-caking agents are additives that prevent powdered and granulated food products from clumping together due to moisture absorption or changes in temperature. These agents help maintain the free-flowing nature of food products such as salt, sugar, flour, spices, and coffee creamers. By ensuring that powders and granules do not stick together, anti-caking agents improve the texture, appearance, and usability of food products, making them easier to process, package, and consume.One of the primary reasons food anti-caking agents are revolutionizing the industry is their ability to enhance product stability and shelf life. In many powdered or granulated foods, moisture absorption can cause clumping, leading to inconsistent texture and difficulty in measuring and using the product. Anti-caking agents prevent this by coating particles with a moisture-repellent barrier, ensuring that the product remains free-flowing even in humid conditions. This improves the overall quality and appearance of the food, making it more appealing to consumers. As the food industry continues to expand, the importance of ensuring product stability through anti-caking agents is becoming more crucial for manufacturers.

How Do Food Anti-Caking Agents Work, and What Makes Them So Effective?

Food anti-caking agents play a vital role in ensuring the quality of powdered products, but how do they work, and what makes them so effective in preventing clumping? Anti-caking agents are typically added in small amounts to powdered or granulated foods to reduce moisture absorption, prevent lump formation, and improve the product's flow properties. These agents work by creating a barrier around individual particles, preventing them from sticking together when exposed to moisture. Some anti-caking agents absorb excess moisture, while others act as lubricants, reducing friction between particles.What makes food anti-caking agents so effective is their versatility and adaptability to different food products. There are various types of anti-caking agents, such as calcium silicate, silicon dioxide, magnesium stearate, and tricalcium phosphate, each suited to different applications based on the product's characteristics and the specific challenges of moisture control. For example, silicon dioxide is widely used in products like powdered spices, sugar, and salt due to its excellent ability to absorb moisture without affecting the taste or color of the product. These agents are chosen based on their compatibility with the food's ingredients, ensuring that they do not alter the flavor, appearance, or nutritional profile.

In addition to preventing clumping, anti-caking agents help maintain product consistency during manufacturing, packaging, and transportation. In large-scale food production, powders and granules are processed in high volumes, and clumping can cause blockages or uneven distribution in automated machinery. By keeping powders free-flowing, anti-caking agents ensure that production lines run smoothly and efficiently, reducing downtime and ensuring consistent product quality. This ability to maintain product integrity throughout the supply chain is key to their effectiveness in large-scale food manufacturing.

How Are Food Anti-Caking Agents Shaping the Future of Food Processing and Product Innovation?

Food anti-caking agents are not only improving current production methods - they are also shaping the future of food processing and product innovation. One of the most significant trends in anti-caking agent development is the move toward natural and clean-label alternatives. As consumers demand more transparency in food ingredients, manufacturers are seeking natural anti-caking agents that align with clean-label standards. Natural compounds like rice starch, calcium carbonate, and cellulose are increasingly being used in place of synthetic agents, offering the same benefits of moisture control and flowability while catering to consumer preferences for minimally processed, recognizable ingredients.In addition to supporting clean-label products, anti-caking agents are driving innovation in food packaging and storage. By ensuring that powders and granules remain free-flowing over long periods, anti-caking agents help extend the shelf life of products, reducing food waste and improving packaging efficiency. This is particularly important in industries like spices, baking products, and dietary supplements, where prolonged exposure to air and moisture can cause product degradation. With the rise of e-commerce and global distribution, ensuring that food products retain their quality during long-distance shipping is critical, and anti-caking agents are playing an important role in making that possible.

Food anti-caking agents are also supporting advances in food texture and functionality. In products like grated cheese, dry soup mixes, and seasoning blends, anti-caking agents help maintain the desired texture and prevent clumping during preparation. This allows consumers to easily use and measure the product without frustration, improving the overall culinary experience. Furthermore, as the demand for convenience foods and instant mixes grows, anti-caking agents are being used to develop innovative new products that cater to busy lifestyles while ensuring high-quality and consistent performance in the kitchen.

Moreover, food anti-caking agents are contributing to sustainability efforts within the food industry. By reducing the likelihood of clumping, spoilage, or other product defects, these agents help manufacturers minimize waste and improve resource efficiency. Products that remain stable and usable for longer periods require less frequent replacement, which reduces the overall environmental impact of food production. This focus on sustainability is driving further innovation in anti-caking agents, as manufacturers explore eco-friendly and biodegradable alternatives to synthetic additives.

What Factors Are Driving the Growth of the Food Anti-Caking Agent Market?

Several key factors are driving the rapid growth of the food anti-caking agent market, reflecting broader trends in food production, convenience, and consumer preferences. One of the primary drivers is the increasing demand for processed and packaged foods. As consumers seek convenient, ready-to-use products like instant mixes, seasonings, and baking ingredients, there is a growing need for anti-caking agents that can maintain product quality and usability. Processed foods often involve complex formulations that require anti-caking agents to ensure the product remains stable and free-flowing during storage and use, making these agents essential in modern food manufacturing.Another significant factor contributing to the growth of the anti-caking agent market is the globalization of food supply chains. As food products are transported over longer distances and stored for extended periods, the risk of moisture absorption and clumping increases. Anti-caking agents are crucial in maintaining product integrity throughout these extended supply chains, ensuring that products reach consumers in optimal condition. This is particularly important for global food brands that distribute products across diverse climates, where humidity and temperature changes can affect product quality.

The rise of clean-label and natural products is also driving demand for innovative anti-caking agents. As consumers become more health-conscious and prefer fewer synthetic additives in their food, manufacturers are turning to natural anti-caking agents that meet these preferences. This shift toward natural ingredients is encouraging research and development in plant-based and mineral-derived anti-caking agents, which offer the same functional benefits as synthetic additives while aligning with consumer demands for transparency and simplicity in food labeling.

Finally, technological advancements in food production are expanding the applications of anti-caking agents. Innovations in ingredient processing and packaging technologies are allowing manufacturers to develop new food products that require more precise control of texture, moisture, and stability. As food companies continue to create novel products that meet the evolving tastes and preferences of consumers, the need for advanced anti-caking agents will continue to grow, driving further expansion in the market and positioning these agents as an indispensable tool in modern food production.

Report Scope

The report analyzes the Food Anti-caking Agents market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Calcium Compounds, Sodium Compounds, Silicon Dioxide, Magnesium Compounds, Microcrystalline Cellulose, Other Types); End-Use (Seasonings & Condiments, Bakery, Dairy Products, Soups & Sauces, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Calcium Compounds segment, which is expected to reach US$490.6 Million by 2030 with a CAGR of 6.4%. The Sodium Compounds segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $278.4 Million in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $356 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Food Anti-caking Agents Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Food Anti-caking Agents Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Food Anti-caking Agents Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agropur Ingredients, Brenntag AG, Evonik Industries AG, Huber Engineered Materials, International Media and Cultures, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Food Anti-caking Agents market report include:

- Agropur Ingredients

- Brenntag AG

- Evonik Industries AG

- Huber Engineered Materials

- International Media and Cultures, Inc.

- PPG Industries, Inc.

- PQ Corporation

- Solvay SA

- Sweetener Supply Corporation

- Univar, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agropur Ingredients

- Brenntag AG

- Evonik Industries AG

- Huber Engineered Materials

- International Media and Cultures, Inc.

- PPG Industries, Inc.

- PQ Corporation

- Solvay SA

- Sweetener Supply Corporation

- Univar, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 326 |

| Published | February 2026 |

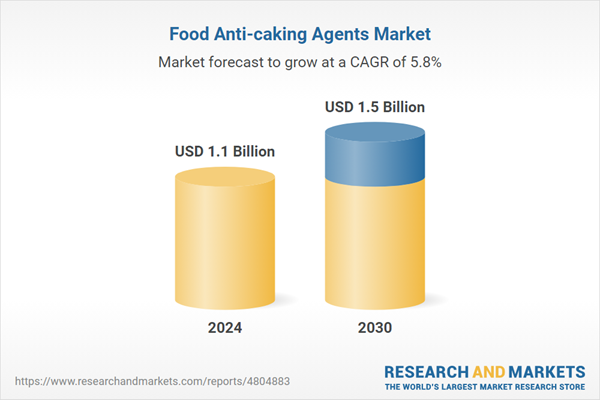

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.5 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |