Global Fluoroelastomers Market - Key Trends and Drivers Summarized

Why Are Fluoroelastomers Revolutionizing High-Performance Industries and Applications?

Fluoroelastomers are transforming how industries handle extreme environments and demanding applications, but why are they becoming so essential in modern manufacturing and industrial processes? Fluoroelastomers are synthetic rubbers made from fluorinated polymers, known for their exceptional resistance to chemicals, heat, and aggressive environments. These materials are widely used in industries such as automotive, aerospace, chemical processing, oil and gas, and pharmaceuticals, where durability and resilience in harsh conditions are paramount. Their ability to maintain flexibility, seal integrity, and performance in extreme temperatures and corrosive environments makes them indispensable in applications like seals, gaskets, hoses, and O-rings.One of the key reasons fluoroelastomers are revolutionizing industrial applications is their superior resistance to chemicals and heat. Unlike traditional elastomers, fluoroelastomers can withstand prolonged exposure to high temperatures and aggressive chemicals without degrading. This makes them ideal for sealing and gasket applications in industries like aerospace, where materials must perform reliably in high-pressure, high-temperature environments. Additionally, their durability in the presence of fuels, oils, and solvents has made them critical components in the automotive and chemical processing sectors. As industries continue to push the limits of performance and durability, fluoroelastomers have become a vital solution for ensuring the longevity and safety of equipment and processes.

How Do Fluoroelastomers Work, and What Makes Them So Effective?

Fluoroelastomers possess unique properties that make them highly effective in demanding environments, but how do they work, and what gives them their superior performance? Fluoroelastomers are composed of polymers that contain carbon-fluorine bonds, which are among the strongest in organic chemistry. This bond structure provides fluoroelastomers with their remarkable resistance to heat, chemicals, and oxidation. The material's molecular structure also contributes to its low permeability to gases, making fluoroelastomers highly effective in sealing applications where leakage prevention is critical. Whether used in automotive fuel systems or chemical plant pipelines, fluoroelastomers maintain their integrity even under extreme conditions, ensuring reliable performance over time.What makes fluoroelastomers so effective is their combination of flexibility and durability. Unlike many other high-performance materials, fluoroelastomers retain their elasticity at both high and low temperatures. This flexibility allows them to maintain a tight seal and prevent leaks, even as the material undergoes thermal expansion or contraction. In applications like oil and gas exploration, where equipment is exposed to wide temperature ranges and corrosive fluids, this characteristic is particularly important. Additionally, fluoroelastomers can resist degradation from exposure to UV radiation, ozone, and harsh environmental conditions, making them ideal for outdoor and long-term applications.

Moreover, fluoroelastomers are versatile and can be tailored to meet specific performance requirements. They are available in a range of formulations, each designed to enhance certain properties, such as resistance to specific chemicals or improved performance at extreme temperatures. This allows manufacturers to customize fluoroelastomer components for different industries and applications. From sealing gaskets in aerospace engines to chemical-resistant linings in processing plants, fluoroelastomers offer a versatile solution for industries requiring high-performance materials that can withstand harsh operating conditions.

How Are Fluoroelastomers Shaping the Future of Industrial Applications and Sustainability?

Fluoroelastomers are not only improving current industrial processes - they are shaping the future of manufacturing, technology, and sustainability. One of the most significant ways fluoroelastomers are influencing future industrial applications is through their role in enabling more energy-efficient and durable systems. In industries such as automotive and aerospace, fluoroelastomers are helping to improve fuel efficiency and reduce emissions by providing long-lasting, low-maintenance sealing solutions. Their high-temperature stability and chemical resistance allow engines and machinery to operate more efficiently, minimizing energy loss and maintenance needs. As industries look for ways to enhance performance while reducing environmental impact, fluoroelastomers are playing a key role in supporting this transition.In addition to improving energy efficiency, fluoroelastomers are advancing the development of sustainable technologies. In sectors like renewable energy, fluoroelastomers are used in components that must endure harsh environmental conditions, such as seals and gaskets for solar panels, wind turbines, and geothermal systems. These materials ensure that renewable energy systems can operate reliably for extended periods without frequent maintenance or part replacements. Their durability in these environments contributes to the overall sustainability of renewable energy technologies, supporting the global push toward cleaner energy solutions.

Fluoroelastomers are also contributing to the development of safer and more efficient chemical processing systems. Their superior chemical resistance allows them to be used in equipment that handles aggressive chemicals, acids, and solvents, preventing leaks and ensuring the safety of both workers and the environment. As industries increasingly focus on reducing hazardous chemical exposure and improving workplace safety, fluoroelastomers are becoming an essential material for critical components in chemical processing plants, pharmaceutical production, and other high-risk industries.

What Factors Are Driving the Growth of the Fluoroelastomer Market?

Several key factors are driving the rapid growth of the fluoroelastomer market, reflecting the increasing demand for high-performance materials across multiple industries. One of the primary drivers is the growing need for materials that can withstand extreme temperatures and aggressive chemicals. Industries such as aerospace, automotive, and oil and gas require materials that can operate reliably in extreme conditions without degrading or losing performance. Fluoroelastomers meet these requirements, providing a solution that ensures the longevity and safety of equipment in even the harshest environments. As these industries continue to grow and evolve, the demand for fluoroelastomers is expected to rise in parallel.Another significant factor contributing to the growth of the fluoroelastomer market is the shift toward lightweight, energy-efficient technologies. In the automotive and aerospace sectors, manufacturers are increasingly looking for ways to reduce the weight of vehicles and aircraft to improve fuel efficiency and reduce emissions. Fluoroelastomers offer an ideal solution for reducing the weight of seals and gaskets without compromising on performance. Their ability to withstand high pressures and temperatures makes them a preferred material in applications where both weight and durability are critical.

The increasing focus on environmental regulations and safety standards is also driving the demand for fluoroelastomers. Industries are under pressure to meet strict emissions and safety guidelines, and fluoroelastomers help achieve this by providing reliable sealing and insulation in critical systems. Their use in chemical processing and pharmaceutical industries ensures that hazardous materials are contained and that equipment operates safely. This ability to meet stringent regulatory requirements is a key factor in the continued growth of the fluoroelastomer market.

Finally, advancements in material science and manufacturing technology are expanding the applications for fluoroelastomers. New formulations with enhanced performance characteristics, such as improved low-temperature flexibility or enhanced resistance to specific chemicals, are opening up new opportunities for their use in emerging industries like electronics, renewable energy, and advanced manufacturing. As these industries continue to develop, the demand for high-performance materials like fluoroelastomers will only increase, driving further growth in the market.

Report Scope

The report analyzes the Fluoroelastomers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Fluorocarbon Elastomers, Fluorosilicone Elastomers, Perfluoroelastomers); Application (O-Rings, Seals & Gaskets, Hoses, Other Applications); End-Use (Automotive, Aerospace, Oil & Gas, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the O-Rings Application segment, which is expected to reach US$969 Million by 2030 with a CAGR of 2.6%. The Seals & Gaskets Application segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $452.2 Million in 2024, and China, forecasted to grow at an impressive 4% CAGR to reach $367.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fluoroelastomers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fluoroelastomers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fluoroelastomers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Asahi Glass Co., Ltd., Chenguang Fluoro & Silicone Elastomers Co., Ltd., Clwyd Compounders Ltd., Daikin Industries Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Fluoroelastomers market report include:

- 3M Company

- Asahi Glass Co., Ltd.

- Chenguang Fluoro & Silicone Elastomers Co., Ltd.

- Clwyd Compounders Ltd.

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dynafluon

- Eagle Elastomer Inc.

- Eastcorp International

- Fluoron Chemicals

- Greene, Tweed & Co., Inc.

- Gujarat Fluorochemicals Limited

- HaloPolymer OJSC

- James Walker UK Ltd.

- Marco Rubber & Plastic Products, Inc.

- Polycomp B.V.

- Precision Polymer Engineering Ltd.

- Shanghai 3F New Material Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA

- SUMITOMO ELECTRIC Schrumpf-Produkte GmbH

- The Chemours Company

- TRP Polymer Solutions Ltd.

- Zhonghao Chenguang Research Institute of Chemical Industry

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Asahi Glass Co., Ltd.

- Chenguang Fluoro & Silicone Elastomers Co., Ltd.

- Clwyd Compounders Ltd.

- Daikin Industries Ltd.

- Dongyue Group Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dynafluon

- Eagle Elastomer Inc.

- Eastcorp International

- Fluoron Chemicals

- Greene, Tweed & Co., Inc.

- Gujarat Fluorochemicals Limited

- HaloPolymer OJSC

- James Walker UK Ltd.

- Marco Rubber & Plastic Products, Inc.

- Polycomp B.V.

- Precision Polymer Engineering Ltd.

- Shanghai 3F New Material Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay SA

- SUMITOMO ELECTRIC Schrumpf-Produkte GmbH

- The Chemours Company

- TRP Polymer Solutions Ltd.

- Zhonghao Chenguang Research Institute of Chemical Industry

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

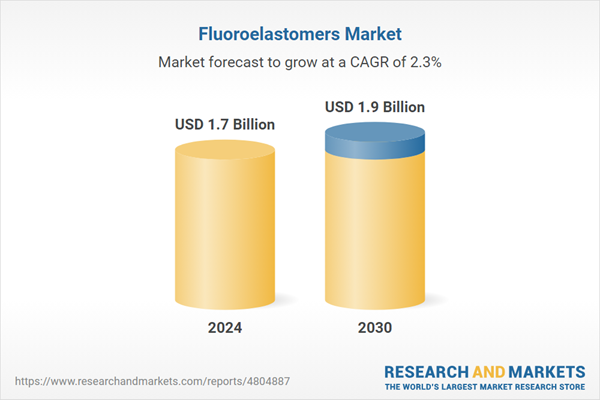

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |