Global Flight Inspection (FI) Market - Key Trends and Drivers Summarized

Why Is Flight Inspection (FI) Critical to Aviation Safety and Airspace Management?

Flight Inspection (FI) plays a fundamental role in ensuring the safety and efficiency of airspace, but why is it so critical in modern aviation? Flight inspection involves the evaluation and calibration of navigational aids (navaids), radar systems, and communication equipment to verify their accuracy and reliability. These systems are essential for guiding aircraft during takeoff, en route navigation, approach, and landing. Any discrepancies or malfunctions can jeopardize safety, especially in challenging weather or low-visibility conditions. Therefore, FI ensures that these systems are performing at optimal levels, reducing the risk of accidents and improving air traffic management.One of the key reasons FI is crucial to aviation is its role in validating the precision of ground-based and satellite navigation systems, such as Instrument Landing Systems (ILS), Very High Frequency Omnidirectional Range (VOR), and Global Navigation Satellite Systems (GNSS). These systems are used by pilots to guide their aircraft accurately along flight paths, especially when visual cues are limited. By conducting routine and specialized inspections, FI teams ensure these systems meet international safety standards, minimizing the risk of equipment failure or data inaccuracies that could lead to navigation errors. As aviation continues to expand and airspace becomes more congested, flight inspection is indispensable for maintaining safety and operational efficiency across global airspace.

How Does Flight Inspection Work, and What Makes It So Effective?

Flight inspection is a specialized process, but how does it work, and what makes it so effective in maintaining air safety? FI is typically conducted using specially equipped aircraft fitted with advanced avionics, sensors, and receivers. These aircraft fly precise patterns around airports and along flight routes to test the performance of navigational aids and other critical infrastructure. The onboard systems measure various parameters, such as signal strength, accuracy, and alignment of ground-based navaids like ILS and VOR. The data collected is analyzed in real-time or post-flight, and if discrepancies are detected, maintenance crews can make adjustments to ensure the navaids are functioning properly.What makes flight inspection so effective is its rigorous and systematic approach to testing the safety-critical infrastructure that supports aviation. FI covers a broad range of systems and procedures, including radio navigational aids, radar systems, lighting, and even the alignment of runways. By conducting regular inspections, FI ensures that all equipment meets the exacting standards set by international aviation authorities, such as the International Civil Aviation Organization (ICAO). This proactive maintenance helps prevent system failures that could compromise flight safety or disrupt air traffic control operations.

In addition, FI is not limited to just airports or traditional flight routes. It also plays a vital role in testing new airspace designs, particularly as satellite-based navigation systems like GNSS become more prevalent. These new technologies require precise calibration to function correctly, and FI ensures that the systems work seamlessly in various environments. This level of attention to detail ensures that every element of airspace management - from airport runways to high-altitude flight paths - is safe, reliable, and efficient for air traffic.

How Is Flight Inspection Shaping the Future of Air Navigation and Emerging Aviation Technologies?

Flight Inspection is not just maintaining current air navigation systems - it is shaping the future of aviation technologies and air traffic management, but how is it driving these advancements? One of the most significant ways FI is influencing the future of aviation is through the transition from ground-based navaids to satellite-based systems, such as GNSS. These satellite systems are becoming increasingly important as aviation moves towards more precise and flexible navigation solutions. FI plays a crucial role in verifying the accuracy and reliability of these satellite-based systems, ensuring that they provide the required performance for safe and efficient air navigation.Additionally, FI is essential in the integration of Performance-Based Navigation (PBN), which allows aircraft to fly more direct, fuel-efficient routes. By inspecting and calibrating the systems that enable PBN, FI helps reduce aircraft fuel consumption and lower greenhouse gas emissions while improving airspace capacity. This is especially important as the aviation industry continues to grow and as environmental sustainability becomes a key focus area for airlines and regulators. FI's ability to validate the safety and accuracy of these advanced systems is helping pave the way for a greener, more efficient future in aviation.

Emerging aviation technologies, such as Unmanned Aerial Vehicles (UAVs) and urban air mobility solutions, also depend on reliable air navigation systems that will need regular inspection and calibration. As these technologies become more integrated into controlled airspace, FI will play an essential role in ensuring that the navigational and communication systems that guide these new aircraft are operating safely and efficiently. Moreover, as air traffic management evolves to accommodate more diverse aircraft, including drones and electric vertical takeoff and landing (eVTOL) aircraft, FI will be crucial in validating new air traffic control procedures and ensuring seamless operations.

What Factors Are Driving the Growth of the Flight Inspection Market?

Several key factors are driving the growth of the flight inspection market, reflecting the increasing complexity of airspace management and the rapid advancements in aviation technology. One of the primary drivers is the continued expansion of global air traffic. As more flights take to the skies and new airports are developed, the demand for accurate, reliable navigational systems increases. Flight inspection ensures that the navaids supporting this growing air traffic operate with the highest precision, helping to prevent accidents and improve the overall efficiency of air travel. The rise in new airport developments, especially in emerging markets, is further boosting the demand for flight inspection services.Another significant factor contributing to the growth of the FI market is the transition to satellite-based navigation systems. As aviation shifts away from traditional ground-based navaids, there is a growing need for FI services to ensure that these new technologies meet the rigorous standards required for aviation safety. The ongoing implementation of GNSS and PBN systems, which allow for more direct and efficient flight routes, relies heavily on regular inspection and calibration to ensure they deliver accurate and reliable navigation. As these advanced systems are adopted across more regions and airports, the demand for flight inspection services is expected to increase.

Technological advancements in flight inspection equipment and processes are also driving growth. Modern FI aircraft are equipped with cutting-edge avionics and sensor systems capable of capturing and analyzing a wide range of data in real-time. These advancements allow for faster and more accurate inspections, reducing downtime and improving the efficiency of air traffic operations. Additionally, remote sensing technologies and automated inspection solutions are emerging, further enhancing the ability of FI teams to monitor and maintain navaids across vast regions, including remote or difficult-to-reach locations.

Lastly, the increasing focus on safety regulations and air traffic modernization initiatives is driving the demand for FI services. Aviation authorities like ICAO and the Federal Aviation Administration (FAA) mandate regular flight inspections to ensure compliance with global safety standards. As air traffic systems are modernized to handle more complex airspace and integrate new technologies like UAVs and urban air mobility, the need for robust flight inspection services becomes even more crucial. Together, these factors are fueling the growth of the flight inspection market, positioning it as a key component of the future of safe, efficient, and technologically advanced airspace management.

Report Scope

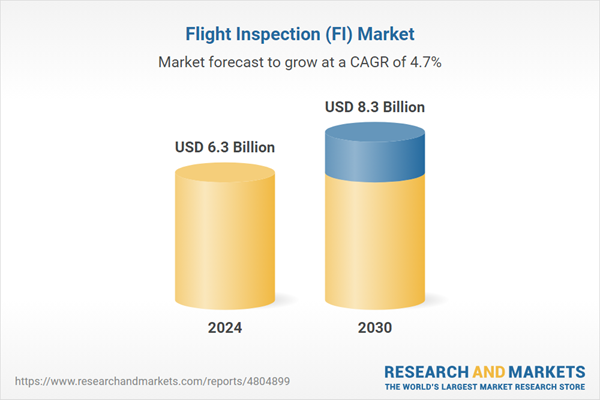

The report analyzes the Flight Inspection (FI) market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Solution (Systems, Services); End-Use (Defense Airports, Commercial Airports).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Defense Airports End-Use segment, which is expected to reach US$5 Billion by 2030 with a CAGR of 4.6%. The Commercial Airports End-Use segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flight Inspection (FI) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flight Inspection (FI) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flight Inspection (FI) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerodata AG, Airfield Technology, Inc., Bombardier, Inc., Cobham PLC, Enav S.P.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 68 companies featured in this Flight Inspection (FI) market report include:

- Aerodata AG

- Airfield Technology, Inc.

- Bombardier, Inc.

- Cobham PLC

- Enav S.P.A.

- Norwegian Special Mission AS

- Radiola Aerospace Limited

- SAAB AB

- Safran

- Textron Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerodata AG

- Airfield Technology, Inc.

- Bombardier, Inc.

- Cobham PLC

- Enav S.P.A.

- Norwegian Special Mission AS

- Radiola Aerospace Limited

- SAAB AB

- Safran

- Textron Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 257 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.3 Billion |

| Forecasted Market Value ( USD | $ 8.3 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |