Global Flight Data Monitoring Market - Key Trends and Drivers Summarized

Why Is Flight Data Monitoring (FDM) Revolutionizing Aviation Safety and Efficiency?

Flight Data Monitoring (FDM) has become a cornerstone in modern aviation, but why is it revolutionizing safety and operational efficiency? FDM refers to the process of collecting, analyzing, and interpreting data from an aircraft's flight operations, with the goal of identifying trends, mitigating risks, and enhancing safety. By continuously monitoring parameters such as altitude, airspeed, engine performance, and pilot inputs, FDM allows airlines, regulatory bodies, and safety managers to proactively address potential issues before they lead to accidents or incidents.One of the key reasons FDM is transforming aviation is its ability to improve operational efficiency and enhance safety in real-time. In commercial and military aviation, FDM provides invaluable insights into how aircraft are being operated, identifying deviations from standard procedures or potential hazards that might go unnoticed during regular flight operations. Airlines use this data to develop corrective actions, provide targeted training to pilots, and refine operational procedures, leading to fewer accidents and more efficient flights. With aviation safety regulations becoming more stringent, FDM systems help airlines comply with these standards while simultaneously reducing costs by optimizing fuel usage, maintenance schedules, and route planning. As aviation technology continues to evolve, FDM plays an increasingly vital role in making air travel safer, more efficient, and more reliable.

How Does Flight Data Monitoring Work, and What Makes It So Effective?

Flight Data Monitoring is a complex yet highly effective system, but how exactly does it work, and what makes it such a powerful tool for aviation safety and efficiency? FDM systems collect data from an aircraft's Flight Data Recorder (FDR) and other onboard sensors. These systems monitor a vast array of flight parameters, including altitude, airspeed, pitch, roll, engine settings, and more. The collected data is then analyzed using advanced algorithms and software to identify trends, detect anomalies, and assess overall flight performance. FDM programs can be configured to flag events like hard landings, steep turns, or engine irregularities, providing detailed reports that airlines and safety teams can review to ensure that any deviations from standard operating procedures are corrected.The effectiveness of FDM lies in its proactive approach to safety and maintenance. By continuously monitoring flight data, FDM systems can detect subtle signs of equipment wear or pilot errors long before they escalate into major problems. This allows airlines to schedule preventive maintenance, reduce unscheduled downtime, and avoid costly repairs. For example, if an FDM system identifies that a specific engine is consistently running hotter than normal, maintenance teams can address the issue before it leads to engine failure or more serious mechanical problems. Moreover, FDM can be integrated with a broader Safety Management System (SMS), ensuring that airlines adhere to safety protocols, reduce risks, and improve overall operational standards.

Another critical feature of FDM is its ability to provide valuable feedback for pilot training and performance improvement. Pilots can review data from their flights to identify areas where they can improve, such as reducing fuel consumption or optimizing landing approaches. This feedback loop enhances the effectiveness of training programs, leading to safer, more efficient flight operations. The ability to provide a comprehensive view of both human and mechanical performance is what makes FDM such an effective and indispensable tool in modern aviation.

How Is Flight Data Monitoring Shaping the Future of Aviation Safety and Predictive Maintenance?

Flight Data Monitoring is not only enhancing current aviation practices - it is shaping the future of aviation safety and predictive maintenance, but how is it driving these advancements? One of the most transformative aspects of FDM is its role in predictive maintenance. By analyzing flight data in real-time, FDM systems can identify patterns that suggest impending mechanical issues. This predictive capability allows airlines to perform maintenance before a problem becomes critical, reducing the risk of in-flight failures and minimizing disruptions to flight schedules. In this way, FDM enables a shift from reactive to proactive maintenance strategies, significantly enhancing aircraft reliability and operational uptime.Furthermore, FDM is instrumental in advancing aviation safety by enabling data-driven decision-making. Safety teams can use FDM data to identify trends across entire fleets or specific aircraft types, allowing them to address systemic issues before they lead to incidents. For example, if FDM data reveals that multiple aircraft of the same model are experiencing the same type of engine fluctuation, airlines can work with manufacturers to rectify the issue before it causes operational disruptions or safety concerns. This capability of identifying risks across an entire fleet helps airlines implement broad, data-driven improvements that enhance safety on a large scale.

FDM is also shaping the future of aviation by contributing to the development of autonomous and highly automated aircraft systems. As the aviation industry moves toward greater automation, FDM will play a critical role in monitoring the performance of these systems and ensuring they meet safety standards. By providing real-time data on how automated systems are operating, FDM ensures that any deviations or malfunctions are detected and corrected immediately. Additionally, as unmanned aerial vehicles (UAVs) become more prevalent in commercial applications, FDM will be key to monitoring their performance, ensuring safety, and maintaining regulatory compliance. Overall, FDM is at the forefront of advancing both current and future aviation technologies, making air travel safer and more efficient.

What Factors Are Driving the Growth of the Flight Data Monitoring Market?

The growth of the Flight Data Monitoring market is driven by several key factors, reflecting the increasing demand for enhanced aviation safety, regulatory compliance, and operational efficiency. One of the primary drivers is the global focus on improving aviation safety. As air traffic continues to increase, there is growing pressure from regulatory bodies such as the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA) for airlines to implement robust safety programs. FDM is a key component of these safety management systems, enabling airlines to comply with these regulations while providing data-driven insights that help mitigate risks and prevent accidents.Another major factor contributing to the growth of the FDM market is the expanding adoption of predictive maintenance technologies. As airlines strive to reduce operational costs and maximize aircraft availability, predictive maintenance powered by FDM data is becoming increasingly valuable. FDM enables airlines to perform targeted maintenance based on real-time data rather than following a fixed schedule, which can reduce maintenance costs, prevent mechanical failures, and minimize flight delays. The increasing use of big data analytics and machine learning to process FDM data is further enhancing the predictive capabilities of these systems, making them indispensable for modern fleet management.

The rise of advanced aircraft technologies is also driving demand for FDM solutions. As aircraft become more sophisticated, with advanced avionics, automated systems, and integrated sensors, the volume of data generated during flights has increased exponentially. This has created a need for more comprehensive FDM systems that can process and analyze vast amounts of data in real-time. The development of new technologies such as next-generation air traffic management, electric aircraft, and UAVs is also expected to fuel demand for FDM solutions, as these technologies rely heavily on real-time data monitoring to ensure safety and efficiency.

Lastly, the growing emphasis on environmental sustainability in aviation is contributing to the expansion of the FDM market. Airlines are under pressure to reduce fuel consumption and lower their carbon emissions, and FDM plays a crucial role in achieving these goals. By analyzing flight data, airlines can optimize flight paths, improve fuel efficiency, and reduce unnecessary idling or inefficiencies during takeoff and landing. This not only helps airlines reduce operational costs but also supports their efforts to meet sustainability targets. Together, these factors are driving the rapid growth of the FDM market, positioning it as a critical technology in the future of aviation safety, efficiency, and sustainability.

Report Scope

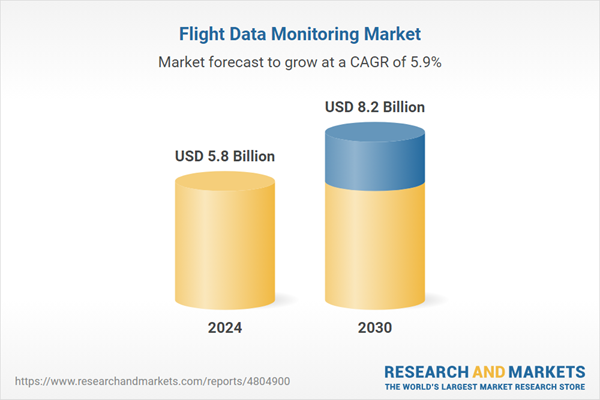

The report analyzes the Flight Data Monitoring market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Hardware, Services, Software); End-Use (Fleet Operators, Investigation Agencies, Drone Operators).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Flight Data Monitoring Hardware segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of 6%. The Flight Data Monitoring Services segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flight Data Monitoring Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flight Data Monitoring Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flight Data Monitoring Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Curtiss-Wright Corporation, Flight Data Services Ltd., Flight Data Systems Inc., Flightdatapeople, FLYHT Aerospace Solutions Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Flight Data Monitoring market report include:

- Curtiss-Wright Corporation

- Flight Data Services Ltd.

- Flight Data Systems Inc.

- Flightdatapeople

- FLYHT Aerospace Solutions Ltd.

- Guardian Mobility

- Safran Electronics & Defense

- Scaled Analytics Inc.

- SKYTRAC Systems Ltd.

- Teledyne Controls LLC.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Curtiss-Wright Corporation

- Flight Data Services Ltd.

- Flight Data Systems Inc.

- Flightdatapeople

- FLYHT Aerospace Solutions Ltd.

- Guardian Mobility

- Safran Electronics & Defense

- Scaled Analytics Inc.

- SKYTRAC Systems Ltd.

- Teledyne Controls LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.8 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |