Global Flexible Pipes Market - Key Trends and Drivers Summarized

Why Are Flexible Pipes Revolutionizing the Oil, Gas, and Industrial Sectors?

Flexible pipes are transforming the way industries manage fluid transportation, but why are they becoming so essential in the oil, gas, and industrial sectors? Flexible pipes are engineered structures made from layers of polymer, steel, and other materials that provide flexibility while maintaining strength, durability, and corrosion resistance. Unlike rigid pipes, flexible pipes can bend and adapt to dynamic environments without cracking or breaking, making them ideal for transporting fluids in challenging conditions such as offshore oil fields, deep-sea exploration, and complex industrial settings.One of the main reasons for the growing importance of flexible pipes is their versatility and adaptability to extreme environments. They are widely used in the oil and gas industry, where they handle high-pressure, high-temperature fluids in deep-sea drilling and production. These pipes can withstand the harsh environmental conditions found in deep-water and offshore operations, including strong currents, pressure variations, and chemical exposure. Their ability to flex, rather than break, under these conditions makes them vital for ensuring the safe and efficient extraction and transportation of oil, gas, and other materials. As the demand for energy grows and drilling operations move to more remote and challenging areas, flexible pipes are increasingly seen as a critical solution for modern energy infrastructure.

How Are Flexible Pipes Manufactured, and What Makes Them So Versatile?

Flexible pipes are engineering marvels, but how are they manufactured, and what gives them such versatility across different industries? Flexible pipes are typically made from multiple layers of materials, each designed to serve a specific function. The inner layers, usually made of polymers or high-density polyethylene (HDPE), provide a smooth pathway for fluid flow while resisting corrosion and chemical degradation. Surrounding this is a reinforcement layer, often made from steel or composite materials, which gives the pipe its strength and pressure-handling capabilities. The outer layers protect the pipe from environmental factors like UV radiation, seawater, and physical wear.This multi-layered structure allows flexible pipes to perform well in extreme conditions. Their ability to bend and flex without breaking enables them to handle dynamic loads, such as those experienced during offshore drilling, where waves and currents create constant motion. Additionally, flexible pipes can be tailored for specific uses, with variations in materials, thickness, and reinforcement to suit different applications. For example, flexible pipes used in subsea oil and gas fields need to withstand high pressure and chemical exposure, while those used in industrial plants must handle high temperatures and abrasive materials.

Another key feature of flexible pipes is their ease of installation. Flexible pipes are lighter and more maneuverable than rigid pipes, which reduces the time and cost associated with transporting and laying them in place. This is particularly beneficial in offshore operations, where deploying and maintaining pipelines can be complex and expensive. The ability to coil and transport these pipes in long continuous lengths makes installation faster and more efficient, reducing downtime and improving productivity. The versatility and adaptability of flexible pipes make them a preferred solution in industries that demand durability, reliability, and flexibility in fluid transportation systems.

How Are Flexible Pipes Shaping the Future of Energy Infrastructure and Industrial Applications?

Flexible pipes are not just improving fluid transport - they are reshaping energy infrastructure and industrial applications, but how are they driving these changes? One of the most significant ways flexible pipes are impacting the future is by enabling more efficient and safer offshore oil and gas production. As oil and gas fields are discovered in deeper and more remote locations, flexible pipes provide a reliable solution for subsea flowlines, risers, and umbilicals. These pipes are able to withstand the extreme pressures and temperatures found in deep-water environments, as well as the movements caused by ocean currents and shifting seabeds. This flexibility allows operators to maintain the integrity of their pipelines, reducing the risk of leaks and spills that could lead to environmental disasters.Flexible pipes are also playing a crucial role in the transition to renewable energy and cleaner technologies. For example, in the wind energy sector, flexible pipes are used in offshore wind farms to transport fluids for cooling and lubrication systems. Additionally, they are being utilized in geothermal energy projects, where hot water or steam is transported from deep underground to the surface for energy production. These new applications demonstrate how flexible pipes are supporting the shift toward more sustainable energy systems while maintaining their traditional role in oil and gas.

In industrial applications, flexible pipes are being adopted for chemical processing, water treatment, and mining, where their corrosion resistance and ability to handle aggressive chemicals and high temperatures make them ideal for demanding environments. Their adaptability also allows for quick installation in complex industrial systems, reducing downtime and operational costs. As industries continue to evolve and demand more resilient, flexible, and efficient infrastructure, flexible pipes are increasingly seen as a key solution that bridges traditional energy systems with modern, sustainable technologies.

What Factors Are Driving the Growth of the Flexible Pipes Market?

Several key factors are driving the rapid growth of the flexible pipes market, reflecting the increasing demand for energy infrastructure, advancements in technology, and the shift toward sustainability. One of the primary drivers is the expanding offshore oil and gas exploration and production sector. As energy companies venture into deeper and more remote areas, the need for durable, reliable pipes that can handle extreme pressures, temperatures, and environmental conditions has become critical. Flexible pipes, with their ability to withstand these challenges while offering ease of installation and maintenance, have become the preferred choice for subsea flowlines, risers, and umbilicals in offshore operations.Another significant factor contributing to the growth of the flexible pipes market is the rise of renewable energy projects. Flexible pipes are increasingly being used in offshore wind farms, geothermal energy plants, and other renewable energy infrastructure due to their ability to transport fluids efficiently in harsh environments. The transition to clean energy sources has accelerated the need for flexible, durable piping systems that can support these new technologies. As governments and industries invest more heavily in renewable energy, the demand for flexible pipes in these sectors is expected to rise.

Technological advancements in materials science are also playing a major role in expanding the capabilities and applications of flexible pipes. Innovations in polymer and composite materials have led to the development of more resilient, corrosion-resistant, and high-temperature-tolerant pipes. These advancements are enabling flexible pipes to perform better in extreme conditions, making them more suitable for a wider range of industrial applications, including chemical processing, mining, and wastewater treatment. Additionally, the ability to incorporate monitoring technologies, such as sensors and data collection systems, into flexible pipes is improving their safety and performance, further driving their adoption in critical industries.

Lastly, the growing focus on reducing operational costs and improving efficiency in the oil, gas, and industrial sectors is boosting demand for flexible pipes. Their lightweight and flexible design reduces transportation and installation costs, while their durability lowers the need for frequent repairs or replacements. This combination of cost savings and performance improvements makes flexible pipes an attractive option for companies looking to optimize their infrastructure. Together, these factors are driving the expansion of the flexible pipes market, positioning it as a key technology for modern energy systems and industrial applications.

Report Scope

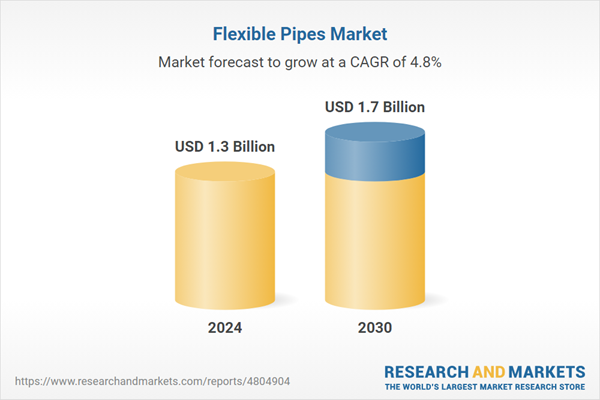

The report analyzes the Flexible Pipes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Raw Material (High-Density Polyethylene (HDPE), Polyamide, Polyvinylidene Fluoride, Other Raw Materials); Application (Off-Shore, On-Shore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Off-Shore Application segment, which is expected to reach US$1 Billion by 2030 with a CAGR of 5%. The On-Shore Application segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $328.5 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $369.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flexible Pipes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flexible Pipes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flexible Pipes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airborne Oil & Gas B.V., ContiTech AG, FlexSteel Pipeline Technologies, Inc., GE Oil & Gas, Magma Global Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Flexible Pipes market report include:

- Airborne Oil & Gas B.V.

- ContiTech AG

- FlexSteel Pipeline Technologies, Inc.

- GE Oil & Gas

- Magma Global Limited

- National Oilwell Varco, Inc.

- Pipelife Nederland B.V.

- Prysmian Group

- Shawcor Ltd.

- TechnipFMC PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airborne Oil & Gas B.V.

- ContiTech AG

- FlexSteel Pipeline Technologies, Inc.

- GE Oil & Gas

- Magma Global Limited

- National Oilwell Varco, Inc.

- Pipelife Nederland B.V.

- Prysmian Group

- Shawcor Ltd.

- TechnipFMC PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |