Global Fiberglass Pipes Market - Key Trends and Drivers Summarized

How Are Fiberglass Pipes Revolutionizing the Industrial and Infrastructure Sectors?

Fiberglass pipes are transforming industrial and infrastructure sectors by providing a highly durable, corrosion-resistant, and lightweight alternative to traditional materials such as steel, concrete, or PVC. Made from a combination of fiberglass reinforcement and resin, these pipes offer a unique blend of strength and flexibility, making them ideal for a wide variety of applications, including chemical processing, oil and gas transportation, water distribution, wastewater management, and industrial piping systems. Fiberglass pipes are especially valued in environments where traditional metal pipes would corrode or degrade due to exposure to chemicals, saltwater, or extreme temperatures.The adoption of fiberglass pipes is revolutionizing industries that require reliable, long-lasting piping solutions. In the oil and gas sector, for instance, fiberglass pipes are used for transporting corrosive substances like crude oil, natural gas, and produced water, reducing maintenance costs and extending the lifespan of pipelines. In water treatment and distribution, fiberglass pipes ensure leak-free, efficient transport of water, offering greater longevity compared to other materials. As industries demand more sustainable, cost-effective, and low-maintenance solutions, fiberglass pipes are becoming a crucial component in modern infrastructure projects, ensuring the resilience and efficiency of critical systems.

Why Are Fiberglass Pipes Critical for Enhancing Durability and Efficiency in Industrial Piping Systems?

Fiberglass pipes are critical for enhancing durability and efficiency in industrial piping systems due to their superior resistance to corrosion, low weight, and high strength-to-weight ratio. In environments where traditional metal pipes are prone to rust, corrosion, or chemical degradation, fiberglass pipes stand out for their ability to withstand exposure to a wide range of chemicals, high salinity, and aggressive environmental conditions. This makes them particularly useful in industries such as oil and gas, wastewater treatment, and chemical processing, where pipe failure can result in costly repairs, downtime, and environmental hazards. The long-lasting nature of fiberglass pipes reduces the need for frequent maintenance and replacement, lowering overall lifecycle costs and improving system reliability.In addition to their corrosion resistance, fiberglass pipes are much lighter than metal or concrete alternatives, which significantly reduces installation time and costs. Their lightweight properties make them easier to transport, handle, and install, especially in challenging or remote locations. In large infrastructure projects, such as water treatment plants, desalination facilities, or underground piping networks, the use of fiberglass pipes can result in considerable savings on labor and installation expenses. Furthermore, their flexibility allows fiberglass pipes to absorb shock and stress from external forces, such as ground movement or thermal expansion, without cracking or rupturing, thereby improving the long-term performance and safety of industrial systems.

Fiberglass pipes are also critical for their energy efficiency. The smooth internal surface of these pipes reduces friction and minimizes energy losses during fluid transport, making them more efficient than rough-surfaced materials like steel or concrete. This improved flow capacity leads to energy savings, especially in systems that transport large volumes of fluids over long distances. The combination of durability, low maintenance, and energy efficiency positions fiberglass pipes as an essential material for modern industrial and infrastructure applications.

What Are the Expanding Applications and Innovations in Fiberglass Pipes Across Various Industries?

The applications of fiberglass pipes are expanding across a wide range of industries, driven by the need for corrosion-resistant, lightweight, and durable piping solutions. In the oil and gas industry, fiberglass pipes are increasingly being used in both onshore and offshore operations, particularly for transporting crude oil, natural gas, and other hydrocarbons that are highly corrosive to metal pipes. Fiberglass pipes are also favored for their ability to handle the harsh conditions found in offshore platforms, such as saltwater exposure, high pressure, and temperature fluctuations. Innovations in resin formulations and pipe construction are further enhancing the performance of fiberglass pipes in these demanding environments, enabling them to withstand higher temperatures and pressures, making them suitable for a broader range of oil and gas applications.In water and wastewater treatment, fiberglass pipes are used for everything from potable water distribution to sewer systems and stormwater management. Their resistance to corrosion, even in the presence of chemicals commonly found in wastewater, ensures that fiberglass pipes remain leak-free and maintain their structural integrity over long periods of time. These qualities make them ideal for municipal water systems, which require long-lasting and low-maintenance infrastructure. Fiberglass pipes are also used in desalination plants, where their ability to resist saltwater corrosion is essential for reliable operation. As global demand for clean water grows, especially in arid regions, fiberglass pipes are playing a crucial role in expanding and maintaining water infrastructure.

The industrial sector is also increasingly adopting fiberglass pipes for use in chemical processing plants, where exposure to acids, solvents, and other corrosive materials is common. Traditional metal pipes are often inadequate in these environments, as they quickly corrode and fail. Fiberglass pipes, on the other hand, are designed to withstand these harsh chemicals, reducing the risk of leaks and the need for constant repairs. Additionally, fiberglass pipes can be custom-made to handle specific chemicals and conditions, offering tailored solutions for industries with unique requirements. Innovations in pipe coatings and resin technology are improving the chemical resistance and durability of fiberglass pipes, further expanding their use in industrial applications.

In the renewable energy sector, fiberglass pipes are being used in geothermal plants, where they transport hot fluids from underground reservoirs to the surface for power generation. The high temperature and corrosive nature of these fluids make fiberglass pipes an ideal choice, as they can withstand the extreme conditions found in geothermal environments. In addition, fiberglass pipes are being integrated into the infrastructure for hydrogen production and storage, where their non-corrosive properties make them suitable for handling hydrogen, which can cause embrittlement in traditional metal pipes.

Innovations in fiberglass pipe technology are also driving new applications in infrastructure projects. For example, trenchless technology, which involves installing or repairing pipes without the need for extensive excavation, has benefited from the use of fiberglass pipes due to their flexibility and strength. This approach reduces disruption to the surrounding environment and lowers installation costs, making it an attractive option for urban infrastructure projects. Additionally, the development of reinforced fiberglass pipes (RFP) and advanced composite materials is enabling these pipes to handle higher pressures and more demanding applications, such as in high-pressure water transmission and industrial fluid handling systems.

What Factors Are Driving the Growth of the Fiberglass Pipe Market?

Several key factors are driving the growth of the fiberglass pipe market, including the increasing demand for corrosion-resistant materials, the expansion of oil and gas exploration, and the need for durable and low-maintenance infrastructure solutions. One of the primary drivers is the need for pipes that can withstand harsh environmental and chemical conditions without corroding or degrading. In industries such as oil and gas, chemical processing, and wastewater treatment, traditional metal pipes are often prone to corrosion, leading to leaks, costly repairs, and environmental hazards. Fiberglass pipes, with their excellent resistance to corrosion and chemicals, offer a long-lasting solution that reduces maintenance and replacement costs, making them highly attractive to industries looking for more reliable infrastructure.The ongoing expansion of the oil and gas sector, particularly in regions like the Middle East, North America, and offshore fields, is another significant factor contributing to the growth of the fiberglass pipe market. As exploration activities move into more challenging environments, such as deep-water drilling and high-temperature reservoirs, the demand for pipes that can withstand these extreme conditions is increasing. Fiberglass pipes, with their ability to handle high pressures, temperatures, and corrosive substances, are becoming a preferred choice for oil and gas companies looking to extend the lifespan and reliability of their infrastructure.

The growing need for efficient and durable water and wastewater management systems is also driving demand for fiberglass pipes. Municipalities and utility companies are increasingly adopting fiberglass pipes for potable water distribution, stormwater management, and sewer systems due to their long lifespan, resistance to corrosion, and ability to handle high flow rates. As aging infrastructure in many countries requires upgrading or replacement, fiberglass pipes offer a cost-effective solution that reduces the need for frequent repairs and extends the service life of water systems. Additionally, as the global population grows and urbanization increases, the demand for reliable water infrastructure is expected to rise, further boosting the fiberglass pipe market.

Technological advancements in the manufacturing of fiberglass pipes are also contributing to market growth. Innovations in resin formulations, pipe construction techniques, and composite materials are enhancing the performance of fiberglass pipes, allowing them to be used in more demanding applications and environments. These advancements are improving the strength, flexibility, and pressure-handling capabilities of fiberglass pipes, making them suitable for a wider range of industrial, commercial, and infrastructure applications. Additionally, the development of environmentally friendly resins and sustainable manufacturing processes is making fiberglass pipes a more attractive option for industries looking to reduce their environmental impact.

The growing focus on sustainability and energy efficiency is another factor driving the adoption of fiberglass pipes. Compared to traditional materials like steel or concrete, fiberglass pipes are lighter, which reduces transportation costs and energy consumption during installation. Their smooth internal surface also improves flow efficiency, reducing energy losses during fluid transport. This makes fiberglass pipes an ideal choice for industries and municipalities looking to improve the efficiency of their infrastructure and reduce operational costs.

Report Scope

The report analyzes the Fiberglass Pipes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (GRE, GRP, Other Types); Application (Oil & Gas, Chemicals, Sewage, Irrigation, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil & Gas Application segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of 2.7%. The Chemicals Application segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fiberglass Pipes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fiberglass Pipes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fiberglass Pipes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abu Dhabi Pipe Factory LLC, Balaji Fiber Reinforced Pvt. Ltd., Chemical Process Piping Pvt. Ltd., Enduro Composites, Inc., Future Pipe Industries LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Fiberglass Pipes market report include:

- Abu Dhabi Pipe Factory LLC

- Balaji Fiber Reinforced Pvt. Ltd.

- Chemical Process Piping Pvt. Ltd.

- Enduro Composites, Inc.

- Future Pipe Industries LLC

- Graphite India Ltd.

- Hengrun Group Co., Ltd.

- Hobas GRP Pipe Systems

- Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

- National Oilwell Varco, Inc.

- Saudi Arabian AMIANTIT Company

- ZCL Composites Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abu Dhabi Pipe Factory LLC

- Balaji Fiber Reinforced Pvt. Ltd.

- Chemical Process Piping Pvt. Ltd.

- Enduro Composites, Inc.

- Future Pipe Industries LLC

- Graphite India Ltd.

- Hengrun Group Co., Ltd.

- Hobas GRP Pipe Systems

- Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

- National Oilwell Varco, Inc.

- Saudi Arabian AMIANTIT Company

- ZCL Composites Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

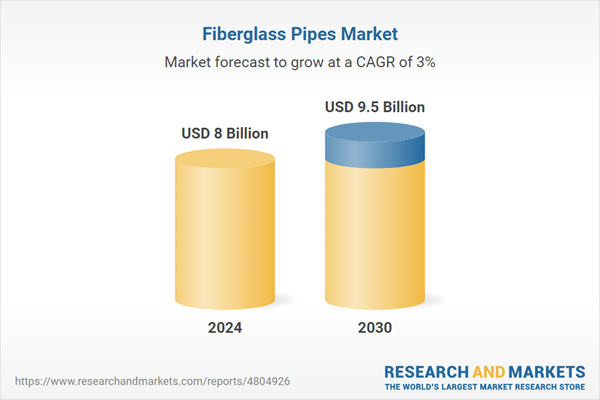

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |