Global Fiberglass Fabric Market - Key Trends and Drivers Summarized

How Is Fiberglass Fabric Revolutionizing Industrial and Commercial Applications with Durability and Flexibility?

Fiberglass fabric is transforming industries by offering a strong, lightweight, and heat-resistant material that is used in a wide variety of applications, from construction and marine to aerospace and automotive. Made by weaving fine strands of glass into a flexible fabric, fiberglass fabric provides exceptional tensile strength, resistance to high temperatures, and electrical insulation, making it ideal for environments where durability and safety are paramount. Its versatility allows it to be used in multiple forms, including reinforcement for composite materials, insulation, and protective barriers.In construction, fiberglass fabric is widely used for reinforcing concrete, roofing membranes, and waterproofing systems, ensuring structures can withstand extreme environmental conditions without degrading. The marine industry utilizes fiberglass fabric to create strong, corrosion-resistant hulls for boats and ships. In the automotive and aerospace sectors, fiberglass fabric is applied to create lightweight but durable components, improving fuel efficiency and reducing emissions. As industries continue to prioritize performance and sustainability, fiberglass fabric is becoming an essential material, providing solutions that meet modern demands for strength, resilience, and efficiency.

Why Is Fiberglass Fabric Critical for Enhancing Strength and Heat Resistance in Key Industries?

Fiberglass fabric is critical for enhancing strength and heat resistance in industries such as construction, aerospace, and marine because it combines lightweight flexibility with extraordinary durability. Unlike traditional materials like steel or wood, fiberglass fabric can withstand high temperatures, chemical exposure, and moisture without losing its structural integrity. This makes it ideal for applications where safety and reliability are paramount. For example, in fireproofing, fiberglass fabric is used to insulate structures and protect them from extreme heat, ensuring that key components remain functional in emergencies. Similarly, its electrical insulation properties make it a vital material in industries where electrical safety is critical, such as in power generation or electronics.In aerospace and automotive industries, where reducing weight is critical for improving fuel efficiency, fiberglass fabric is used to reinforce composite materials that are lighter and stronger than traditional materials. By incorporating fiberglass fabric into components like panels, structural elements, and insulation layers, manufacturers can reduce vehicle weight without compromising strength or performance. This results in better fuel economy and lower emissions, contributing to the global push for more sustainable transportation solutions. Additionally, fiberglass fabric's resistance to corrosion and environmental degradation makes it indispensable in the marine industry, where it is used for hull reinforcement, decks, and protective coverings. By protecting vessels from the harsh effects of saltwater, UV radiation, and extreme weather conditions, fiberglass fabric significantly extends the lifespan of boats and ships.

What Are the Expanding Applications and Innovations in Fiberglass Fabric Across Various Industries?

The applications of fiberglass fabric are rapidly expanding across multiple industries due to its adaptability, durability, and growing innovations in material science. In the construction industry, fiberglass fabric is being used in everything from wall coverings and insulation to waterproofing and reinforcement in concrete structures. Its ability to resist cracking, thermal expansion, and corrosion makes it an essential component in strengthening modern buildings. Additionally, fiberglass fabric is now being used in the production of architectural elements like domes, roofs, and other structures that require both aesthetic appeal and structural reliability. Architects and engineers are increasingly turning to fiberglass fabric for creating complex and lightweight architectural designs, particularly in sustainable construction projects where long-lasting materials are critical.In the energy sector, fiberglass fabric is gaining traction for its use in the production of wind turbine blades and solar panel support structures. Wind turbines, in particular, benefit from the strength-to-weight ratio that fiberglass fabric provides, as the material enables the production of long, durable blades capable of withstanding strong winds and other harsh environmental factors. These characteristics improve the efficiency and longevity of renewable energy infrastructure, driving down costs and promoting the expansion of sustainable energy solutions. Innovations in the manufacturing of fiberglass fabric have also led to the development of hybrid fabrics, combining fiberglass with other advanced materials like carbon fiber to create even stronger and lighter composites for wind turbines and other energy-related structures.

In aerospace and automotive industries, where weight reduction is critical for performance and fuel efficiency, fiberglass fabric is being used to manufacture lightweight components that provide high strength without adding excessive weight. For example, the use of fiberglass fabric in aircraft fuselages, wings, and interior panels reduces the overall weight of the plane, which improves fuel economy and lowers operating costs. Similarly, in automotive applications, fiberglass fabric is used in body panels, seat structures, and interior components, contributing to the design of more fuel-efficient vehicles. The flexibility of fiberglass fabric also allows for the creation of complex shapes and forms that are essential for modern aerodynamic designs.

The marine industry continues to see innovations in fiberglass fabric, particularly in boat hull construction and protective coatings. Fiberglass fabric is highly valued for its corrosion resistance, especially in saltwater environments, where traditional materials like steel are prone to rust and degradation. By incorporating fiberglass fabric into hulls, decks, and other structural elements, marine vessels are able to achieve greater durability, reduced maintenance costs, and improved performance. Additionally, innovations in fiberglass fabric coatings are making marine vessels even more resistant to UV radiation, impact damage, and moisture absorption, further extending their operational lifespan.

In industrial applications, fiberglass fabric is being used in insulation products, fireproofing, and chemical-resistant barriers. Its non-flammable properties and high thermal resistance make it a preferred choice for protecting equipment, pipelines, and machinery from extreme heat and fire risks. Fiberglass fabric is also used in the construction of containment areas for hazardous materials, ensuring that chemicals or pollutants are safely stored or transported without the risk of corrosion or leakage. As industries increasingly prioritize safety, efficiency, and environmental protection, fiberglass fabric is being adopted for a wide range of critical infrastructure and safety applications.

What Factors Are Driving the Growth of the Fiberglass Fabric Market?

Several key factors are driving the growth of the fiberglass fabric market, including the increasing demand for lightweight and durable materials in industries like aerospace, automotive, and construction, as well as the growing focus on fire safety, insulation, and environmental protection. One of the primary drivers is the need for materials that can enhance the strength and performance of structures while also reducing weight, particularly in sectors where fuel efficiency and emissions reductions are top priorities. As aerospace manufacturers and automakers seek to design more fuel-efficient and sustainable vehicles, fiberglass fabric offers a solution that reduces weight without sacrificing strength or safety.The construction industry's ongoing demand for durable and low-maintenance materials is another significant factor contributing to the growth of the fiberglass fabric market. With its ability to resist moisture, corrosion, and thermal expansion, fiberglass fabric is increasingly being used in applications like insulation, wall coverings, and roofing. As sustainable construction practices gain traction, fiberglass fabric is becoming a go-to material for builders looking to enhance the energy efficiency and lifespan of buildings. In particular, its use in green building certifications such as LEED (Leadership in Energy and Environmental Design) is driving its adoption as a key component in environmentally responsible construction projects.

Increased awareness of fire safety and insulation requirements is also propelling the growth of the fiberglass fabric market. As building codes and regulations become more stringent regarding fireproofing and thermal insulation, fiberglass fabric's non-combustible and heat-resistant properties are making it an essential material for protecting structures from fire risks. The demand for fireproof blankets, curtains, and protective coverings made from fiberglass fabric is rising across both residential and industrial sectors, further boosting the market. In the energy sector, fiberglass fabric is being used to insulate pipelines, equipment, and storage tanks, helping industries meet safety standards while improving the energy efficiency of their operations.

The marine and renewable energy industries are also contributing to the expansion of the fiberglass fabric market. In marine applications, fiberglass fabric's corrosion resistance and durability are essential for maintaining the integrity of boats, ships, and offshore platforms exposed to harsh saltwater environments. In the renewable energy sector, particularly in wind energy, fiberglass fabric is playing a critical role in the production of wind turbine blades, which need to be strong, lightweight, and capable of withstanding severe weather conditions. As global investment in renewable energy infrastructure continues to grow, the demand for fiberglass fabric in these applications is expected to rise.

Technological advancements in the manufacturing and design of fiberglass fabrics are further driving market growth. Innovations in weaving techniques, resin formulations, and surface coatings are enhancing the strength, flexibility, and resistance of fiberglass fabrics, making them more adaptable to a broader range of applications. These advancements are expanding the use of fiberglass fabric beyond traditional industries like construction and automotive to emerging sectors like electronics, where fiberglass is used for printed circuit boards and electronic insulation. Additionally, the increasing adoption of hybrid fabrics - combining fiberglass with materials like carbon fiber - is opening new possibilities for lightweight, high-strength composites in advanced engineering and design.

In conclusion, the fiberglass fabric market is poised for significant growth as industries across the globe continue to seek durable, lightweight, and heat-resistant materials that enhance performance and sustainability. With its versatility, adaptability, and resistance to environmental stressors, fiberglass fabric is becoming a preferred material in sectors ranging from construction and automotive to marine and renewable energy. As technological advancements continue to improve the properties and applications of fiberglass fabric, its role in shaping the future of manufacturing, construction, and industrial processes will only expand.

Report Scope

The report analyzes the Fiberglass Fabric market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Fiber Type (E-Glass, Other Fiber Types); Fabric Type (Woven, Non-woven); Application (Construction, Transportation, Electrical & Electronics, Marine, Wind Energy, Aerospace & Defense, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Woven Fabric segment, which is expected to reach US$7.4 Billion by 2030 with a CAGR of 6%. The Non-woven Fabric segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fiberglass Fabric Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fiberglass Fabric Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fiberglass Fabric Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amatex Corporation, Asahi Kasei Corporation, Atlanta Fiberglass, Auburn Manufacturing, Inc., BGF Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Fiberglass Fabric market report include:

- Amatex Corporation

- Asahi Kasei Corporation

- Atlanta Fiberglass

- Auburn Manufacturing, Inc.

- BGF Industries, Inc.

- Central Glass Co., Ltd.

- China Jushi Co., Ltd.

- Chomarat Group

- Devold AMT AS

- Fothergill Group

- Fulltech Fiber Glass Corp.

- Gurit Holding AG

- Hexcel Corporation

- iLLStreet Composite Materials and Parts

- Jps Composites Materials

- Nitto Boseki Co., Ltd.

- Owens Corning

- Parabeam B.V.

- Porcher Industries

- Rock West Composites

- SAERTEX GmbH & Co.KG

- Saint-Gobain Performance Plastics Corporation

- Tah Tong Textile Co., Ltd.

- Taiwan Electric Insulator Co., Ltd.

- Valutex Reinforcements Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amatex Corporation

- Asahi Kasei Corporation

- Atlanta Fiberglass

- Auburn Manufacturing, Inc.

- BGF Industries, Inc.

- Central Glass Co., Ltd.

- China Jushi Co., Ltd.

- Chomarat Group

- Devold AMT AS

- Fothergill Group

- Fulltech Fiber Glass Corp.

- Gurit Holding AG

- Hexcel Corporation

- iLLStreet Composite Materials and Parts

- Jps Composites Materials

- Nitto Boseki Co., Ltd.

- Owens Corning

- Parabeam B.V.

- Porcher Industries

- Rock West Composites

- SAERTEX GmbH & Co.KG

- Saint-Gobain Performance Plastics Corporation

- Tah Tong Textile Co., Ltd.

- Taiwan Electric Insulator Co., Ltd.

- Valutex Reinforcements Inc.

Table Information

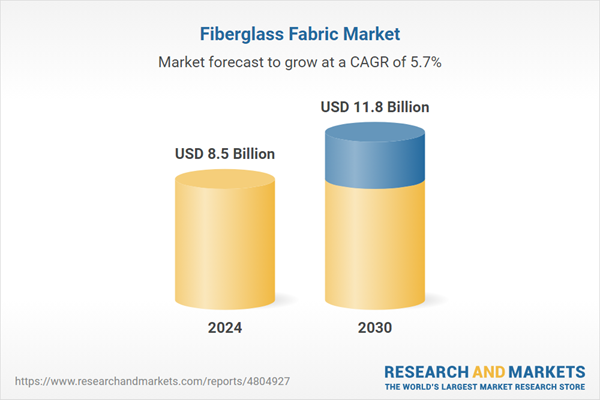

| Report Attribute | Details |

|---|---|

| No. of Pages | 242 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.5 Billion |

| Forecasted Market Value ( USD | $ 11.8 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |