Global Failure Analysis Market - Key Trends and Drivers Summarized

How Is Failure Analysis Revolutionizing Engineering and Product Development?

Failure analysis is transforming the way industries approach engineering and product development by providing in-depth insights into why and how components, systems, or processes fail. This interdisciplinary practice involves investigating the root causes of failures in materials, electronics, structures, and machinery to prevent future occurrences, improve safety, and enhance product design. By using advanced techniques such as scanning electron microscopy (SEM), X-ray diffraction, and mechanical stress testing, engineers and scientists can identify the underlying factors - whether mechanical, thermal, chemical, or electrical - that led to a product's or system's failure.In industries like aerospace, automotive, electronics, and construction, failure analysis is essential for ensuring the reliability and safety of products and structures. For example, a failure in a critical aerospace component could have catastrophic consequences, making it vital to understand the failure mechanism to prevent recurrences. The insights gained from failure analysis not only help to fix immediate issues but also play a critical role in advancing product design, materials selection, and manufacturing processes. By identifying weaknesses early in the product lifecycle, companies can enhance quality control, improve product performance, and reduce costly recalls or repairs, making failure analysis an indispensable tool in modern engineering.

Why Is Failure Analysis Critical for Improving Product Reliability and Preventing Catastrophic Failures?

Failure analysis is critical for improving product reliability and preventing catastrophic failures because it provides a systematic approach to understanding the root causes of failures, allowing engineers to develop more durable and reliable designs. In industries where safety is paramount - such as aerospace, automotive, and nuclear energy - a single failure can lead to significant financial loss, environmental damage, or even loss of life. Failure analysis helps engineers pinpoint the exact failure mode, whether it's fatigue, corrosion, thermal degradation, or stress fracture, and offers solutions to prevent similar incidents in the future. By examining factors such as material defects, design flaws, improper usage, or manufacturing inconsistencies, failure analysis helps prevent recurring problems, ensuring the long-term performance and safety of products.Furthermore, failure analysis improves product reliability by enabling manufacturers to refine their materials and processes. For example, in electronics manufacturing, failure analysis can reveal why certain components fail due to thermal stress, electrical overload, or improper soldering techniques. By identifying these issues, manufacturers can adjust design parameters, select more suitable materials, or improve assembly processes to enhance the reliability of their products. In this way, failure analysis is a proactive strategy that helps companies avoid costly product recalls, reduce warranty claims, and build consumer trust by consistently delivering high-quality, dependable products. It also plays a crucial role in risk management by helping industries comply with regulatory standards and safety certifications, minimizing the likelihood of unforeseen accidents or failures.

What Are the Expanding Applications and Innovations in Failure Analysis Across Industries?

The applications of failure analysis are expanding across a wide range of industries as advancements in technology and materials science continue to develop. In the aerospace and defense sectors, failure analysis is used extensively to investigate the failure of critical components such as engines, landing gear, and avionics systems. Aircraft parts are subjected to extreme conditions, and even the smallest failure can result in significant safety risks. Failure analysis in aerospace often involves methods such as fractography, metallurgy, and non-destructive testing (NDT) to detect fractures, fatigue, or corrosion that may compromise a component's integrity. Additionally, failure analysis plays a key role in understanding material fatigue in spacecraft components, contributing to the development of safer and more reliable space exploration technologies.In the automotive industry, failure analysis is critical for ensuring the safety and durability of vehicles, especially as electric vehicles (EVs) and autonomous driving technologies become more prevalent. Engineers use failure analysis to investigate issues related to battery degradation, motor failures, or sensor malfunctions. As EV batteries are subjected to thermal cycling and repeated charge-discharge cycles, failure analysis can help identify the causes of battery degradation and suggest improvements in materials or cooling systems to extend battery life. Moreover, with the rise of autonomous driving technologies, failure analysis is increasingly used to ensure that sensors, processors, and other electronics function reliably in real-world conditions, helping to enhance vehicle safety and performance.

Innovations in failure analysis are driving the development of more sophisticated tools and techniques for examining and predicting failures. For example, advancements in scanning electron microscopy (SEM) and transmission electron microscopy (TEM) allow engineers to analyze materials at the atomic level, identifying defects or microstructural changes that may have contributed to failure. This level of precision is particularly important in industries such as semiconductors and nanotechnology, where even microscopic defects can lead to significant product failures. Additionally, artificial intelligence (AI) and machine learning are being integrated into failure analysis processes, enabling the rapid identification of failure patterns in large datasets. AI algorithms can detect subtle correlations between different variables, such as temperature, stress, and material properties, providing deeper insights into the causes of failure and enabling more accurate failure prediction.

In the energy sector, failure analysis is crucial for maintaining the safety and reliability of power generation equipment, such as turbines, generators, and transmission lines. As the global demand for energy continues to grow, and renewable energy systems such as wind turbines and solar panels become more widespread, failure analysis helps identify the root causes of mechanical wear, corrosion, and electrical failures in these systems. For example, in wind turbines, failure analysis is used to understand blade fatigue, gearbox malfunctions, and generator breakdowns, helping operators extend the lifespan of equipment and improve overall energy efficiency. With the increasing reliance on sustainable energy, the role of failure analysis in ensuring the long-term reliability of renewable energy infrastructure is becoming more important than ever.

What Factors Are Driving the Growth of the Failure Analysis Market?

The growth of the failure analysis market is driven by several key factors, including the increasing complexity of modern technologies, rising demand for product reliability and safety, and advancements in analytical tools and techniques. One of the primary drivers is the growing complexity of products and systems in industries such as electronics, aerospace, automotive, and energy. As devices become more sophisticated - incorporating advanced materials, miniaturized components, and intricate designs - the likelihood of failures due to design flaws, material defects, or manufacturing errors increases. Failure analysis is essential for diagnosing these issues, helping manufacturers maintain product quality and reliability in an increasingly competitive market.Another significant factor driving the growth of the failure analysis market is the rising emphasis on safety, particularly in regulated industries such as aerospace, healthcare, and automotive. Governments and regulatory bodies worldwide have established stringent safety standards and certifications that companies must meet to ensure their products and processes are safe and reliable. Failure analysis helps companies comply with these standards by identifying potential safety hazards and preventing failures that could lead to accidents, product recalls, or regulatory penalties. The automotive industry, for example, must meet strict safety standards for critical components like brakes, airbags, and batteries, and failure analysis is a key tool for verifying that these components function correctly under real-world conditions.

The increasing demand for reliability in high-tech industries, such as semiconductor manufacturing, telecommunications, and renewable energy, is another factor driving the growth of failure analysis. As the global economy becomes more reliant on advanced technology, companies cannot afford system failures that could disrupt operations or cause financial losses. Failure analysis plays a vital role in the semiconductor industry, where tiny defects in integrated circuits can lead to significant performance issues. Additionally, with the expansion of 5G networks and the Internet of Things (IoT), ensuring the reliability of electronic components and systems is more critical than ever. Failure analysis helps manufacturers detect potential vulnerabilities early in the production process, ensuring that products meet the rigorous performance requirements demanded by these high-tech sectors.

Advancements in analytical tools and techniques, including non-destructive testing (NDT), scanning electron microscopy (SEM), and X-ray tomography, are further fueling the growth of the failure analysis market. These tools allow engineers to examine materials and components with unprecedented precision, helping to identify defects, fractures, and other signs of wear or damage that may not be visible to the naked eye. The integration of artificial intelligence (AI) and machine learning into failure analysis processes is also enhancing the ability to predict failures and optimize maintenance schedules, further driving the adoption of failure analysis in industries that require high reliability and performance.

In conclusion, the failure analysis market is poised for significant growth as industries continue to demand higher levels of product reliability, safety, and performance. As technology becomes more complex and the need for failure prevention becomes more critical, failure analysis will play an increasingly central role in ensuring the long-term success of products and systems across industries. With ongoing advancements in analytical techniques and the integration of AI, failure analysis will continue to evolve, providing companies with powerful tools to enhance quality control, improve safety, and optimize product development.

Report Scope

The report analyzes the Failure Analysis market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Equipment (Scanning Electron Microscope (SEM), Focused Ion Beam System (FIB), Dual-Beam System (FIB-SEM), Transmission Electron Microscope (TEM), Other Equipment); Application (Electronics & Semiconductor, Material Science, Industrial Science, Bio-Science).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Electronics & Semiconductor Application segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of 7.5%. The Material Science Application segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Failure Analysis Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Failure Analysis Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Failure Analysis Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&D Company Ltd., Carl Zeiss Smt GmbH, FEI Company, Hitachi High-Technologies Corporation, Intertek Group PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Failure Analysis market report include:

- A&D Company Ltd.

- Carl Zeiss Smt GmbH

- FEI Company

- Hitachi High-Technologies Corporation

- Intertek Group PLC

- JEOL Ltd.

- Motion X Corporation

- Tescan Orsay Holding, a. s.

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A&D Company Ltd.

- Carl Zeiss Smt GmbH

- FEI Company

- Hitachi High-Technologies Corporation

- Intertek Group PLC

- JEOL Ltd.

- Motion X Corporation

- Tescan Orsay Holding, a. s.

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

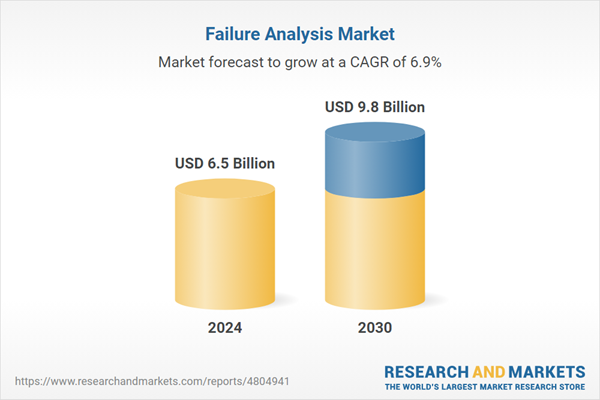

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 9.8 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |