Global Explosive Detectors Market - Key Trends and Drivers Summarized

How Are Explosive Detectors Revolutionizing Security and Public Safety?

Explosive detectors are transforming the way security and law enforcement agencies approach public safety, especially in high-risk environments like airports, military installations, public events, and border control. These sophisticated devices are designed to detect explosive materials, both in trace amounts and bulk quantities, ensuring that threats are identified before they cause harm. As global security concerns have risen due to the increased frequency of terrorist activities and the use of improvised explosive devices (IEDs), explosive detectors have become indispensable tools for safeguarding critical infrastructure and civilian populations. By using advanced technologies such as ion mobility spectrometry (IMS), mass spectrometry, X-ray imaging, and vapor detection, explosive detectors provide highly accurate, real-time analysis of potential threats, making it possible to prevent attacks and mitigate risks.Modern explosive detection systems have evolved beyond basic chemical detection to integrate advanced AI algorithms and machine learning, allowing for faster and more accurate identification of explosive compounds. These systems are now capable of screening large volumes of people, luggage, and cargo at high throughput rates, which is essential in places like airports where security must be both effective and efficient. Additionally, portable explosive detectors have revolutionized on-the-ground military and law enforcement operations by providing soldiers and officers with tools to detect explosives in real time, even in the most challenging conditions. As the technology behind explosive detectors continues to advance, it is increasingly reshaping how governments and businesses address security threats, making public spaces, transportation hubs, and sensitive locations safer for everyone.

Why Are Explosive Detectors Essential for Modern Security and Counterterrorism Efforts?

Explosive detectors play a pivotal role in modern security and counterterrorism efforts by providing the first line of defense against explosive threats. In high-traffic areas such as airports, train stations, sports arenas, and public events, the risk of explosives being used to carry out large-scale attacks is ever-present. Explosive detectors are designed to quickly and accurately identify dangerous substances, including common explosives such as TNT, RDX, and PETN, as well as homemade explosives (HMEs) that are frequently used by terrorist groups. These devices enable security personnel to detect threats early and respond swiftly, preventing potential disasters before they unfold. With the rise in sophisticated threats, including the use of IEDs in conflict zones and urban settings, the ability of explosive detectors to screen people, baggage, and vehicles has become critical for maintaining public safety.In addition to detecting explosives, these devices play an essential role in enabling security agencies to comply with international safety standards. Regulatory bodies such as the International Civil Aviation Organization (ICAO) and the Transportation Security Administration (TSA) have set stringent guidelines for explosive detection, particularly in air travel, where the risk of concealed explosives in luggage and cargo is a constant concern. Explosive detectors, including full-body scanners, baggage screening systems, and handheld detection devices, ensure that airports and other transportation hubs meet these safety standards while facilitating the smooth flow of passengers and goods. Moreover, in military and border security operations, explosive detectors are vital for uncovering hidden explosives or identifying explosive residues on suspects, vehicles, or packages. Their role in counterterrorism is not just preventative but also forensic, as they can help investigators trace the origins of an explosive device or substance, leading to the capture of criminal networks or terrorist organizations.

What Are the Expanding Applications and Innovations in Explosive Detection Technology Across Various Sectors?

The applications of explosive detectors have expanded significantly beyond traditional security settings like airports and military bases, driven by technological innovations that make these systems more versatile and effective in diverse environments. One of the key sectors benefiting from advancements in explosive detection technology is law enforcement, where portable and handheld explosive detectors are being used in field operations to identify explosive residues during searches, raids, and crime scene investigations. These portable detectors are designed to be highly sensitive and can detect trace amounts of explosives, making them ideal for screening suspects or searching vehicles and buildings in real time. Their portability and ease of use have made them invaluable tools for police and security forces working in high-risk or unstable environments.The use of explosive detectors has also expanded into industries such as shipping, logistics, and critical infrastructure protection. In shipping ports and cargo terminals, explosive detectors are used to screen large volumes of freight and containers for potential explosive threats. These systems often combine X-ray imaging with advanced chemical sensors to ensure that dangerous substances are detected before entering the supply chain. Similarly, critical infrastructure, including power plants, water treatment facilities, and government buildings, relies on explosive detection technology to prevent attacks that could disrupt essential services. In these settings, fixed or mobile explosive detection systems are often integrated into broader security networks, enabling real-time monitoring and response to any detected threats.

Recent innovations in explosive detection technology have led to the development of more sophisticated systems that utilize artificial intelligence (AI) and machine learning to improve detection accuracy and speed. These systems are capable of processing vast amounts of data from multiple sensors, improving the identification of explosive materials while reducing false alarms. AI algorithms can be trained to recognize patterns in chemical signatures, making it possible to detect even low-concentration traces of explosives in crowded or noisy environments. Additionally, new materials and techniques are being used to enhance the sensitivity of sensors, enabling detectors to identify explosives in difficult conditions, such as underwater or through thick materials. Drone-based explosive detection is another emerging innovation, allowing for the remote inspection of potentially dangerous areas without putting human lives at risk. These advancements are expanding the potential applications of explosive detectors, making them more integral to modern security efforts across a range of industries.

What Factors Are Driving the Growth of the Explosive Detector Market?

Several key factors are driving the growth of the explosive detector market, including rising global security concerns, stricter government regulations, and technological advancements in detection methods. One of the most significant drivers is the increase in terrorist activities and geopolitical instability, which has heightened the need for advanced security measures in both public and private sectors. High-profile attacks in urban areas, airports, and public venues have underscored the importance of robust explosive detection systems in preventing mass casualties and ensuring public safety. As governments and security agencies prioritize counterterrorism efforts, the demand for state-of-the-art explosive detectors capable of identifying a wide range of explosive materials in diverse settings is growing.Stricter regulations and international safety standards are also contributing to the growth of the explosive detector market. Airports, seaports, and border crossings are subject to stringent guidelines for the screening of passengers, luggage, and cargo to detect potential threats. Organizations like the ICAO, TSA, and the European Civil Aviation Conference (ECAC) have established regulations that require the use of advanced explosive detection technology in transportation hubs. Compliance with these regulations is mandatory, and non-compliance can result in fines, shutdowns, or reputational damage. As these regulations continue to evolve to address emerging threats, businesses and governments are increasingly investing in upgraded detection systems to remain compliant and secure.

Technological advancements in sensor technology, AI, and machine learning are further fueling the growth of the explosive detector market. The development of more accurate, portable, and faster detection systems is making it easier for security personnel to detect threats in real-time, even in crowded or complex environments. Advances in chemical analysis techniques, such as ion mobility spectrometry (IMS) and mass spectrometry, have increased the sensitivity and specificity of explosive detectors, reducing the occurrence of false positives and improving overall detection reliability. Additionally, innovations like non-invasive vapor detection and drone-mounted sensors are expanding the potential applications of explosive detectors, enabling them to be used in remote or dangerous locations without risking human life.

In conclusion, the explosive detector market is poised for significant growth as global security threats intensify and the demand for advanced safety solutions increases. Driven by the need for improved public safety, regulatory compliance, and technological innovation, explosive detectors are becoming more essential across a wide range of industries, from aviation and transportation to critical infrastructure protection and law enforcement. As technology continues to evolve, explosive detection systems will play an increasingly critical role in preventing attacks, protecting infrastructure, and ensuring the safety of civilians in an ever-changing global security landscape.

Report Scope

The report analyzes the Explosive Detectors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Handheld, Vehicle Mounted, Robotics, Other Product Types); Application (Military & Defense, Public Safety & Law Enforcement, Cargo & Transport, Aviation, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Military & Defense Application segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of 7%. The Public Safety & Law Enforcement Application segment is also set to grow at 8.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 10.5% CAGR to reach $3.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Explosive Detectors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Explosive Detectors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Explosive Detectors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Science and Engineering, Inc. (AS&E), Analogic Corporation, Chemring Group PLC, FLIR Systems, Inc., Implant Sciences Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Explosive Detectors market report include:

- American Science and Engineering, Inc. (AS&E)

- Analogic Corporation

- Chemring Group PLC

- FLIR Systems, Inc.

- Implant Sciences Corporation

- L-3 Communications Holdings, Inc.

- Leidos Holdings, Inc.

- Nuctech Co., Ltd.

- OSI Systems, Inc.

- Safran Group

- Smiths Group PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Science and Engineering, Inc. (AS&E)

- Analogic Corporation

- Chemring Group PLC

- FLIR Systems, Inc.

- Implant Sciences Corporation

- L-3 Communications Holdings, Inc.

- Leidos Holdings, Inc.

- Nuctech Co., Ltd.

- OSI Systems, Inc.

- Safran Group

- Smiths Group PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

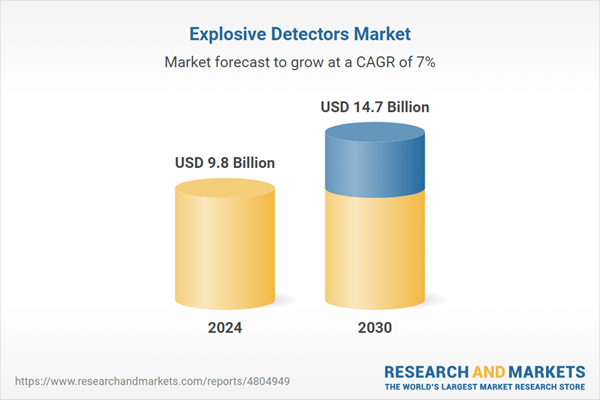

| Estimated Market Value ( USD | $ 9.8 Billion |

| Forecasted Market Value ( USD | $ 14.7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |